Bert Dohmen, an analyst at Dohmen Capital Research, saidThe recent sharp increase in M2 money supply means that the Federal Reserve will not be able to deliver on expected interest rate cuts this year.

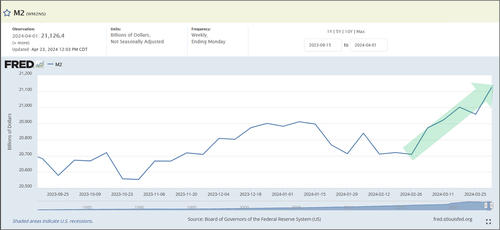

Dohmen wrote in a recent report: “We have always believed that the growth in M2 (money supply) is one of the factors indicating that the Federal Reserve is not fighting inflation. Below is an updated weekly chart of the money supply M2, which continues to soar. This data is 'not seasonally adjusted' and therefore does not include the usual 'seasonally adjustment' fabrications (chart from the St. Louis Federal Reserve).”

Dohmen said the Federal Reserve is “in a dilemma” because they are forced to finance record fiscal deficits while continuing to struggle with high inflation. He believes, “The huge amount of treasury bonds sold on the market every week to finance huge deficits will eventually lead to 'indigestion, 'that is, a buyers' strike.”

He asked, “Is it possible that they want to blame the weakness in the bond market (i.e. rising interest rates) on inflation? The US Treasury cannot let the market start worrying about insufficient market demand for US Treasury bonds. Therefore, inflationary pressure is best blamed for the weakness in the bond market.”

To support his views, DohMen shared the iShares Barclays 20+ Year Treasury Bond ETF (TLT) long-term monthly performance chart. “It plummeted 53% at the end of 2023, then rebounded, and should now return to its 2023 low (red horizon),” he wrote.

He concluded: “The Federal Reserve is being forced to accelerate in order to finance the US Treasury's record deficit. They knew it would cause inflation, but they had no choice.”

Because of this, Dohmen said, all discussions about how many times the Federal Reserve might cut interest rates this year are meaningless. “They know they probably won't be able to cut interest rates at all, which will only add more impetus to the market, especially in major industries and US stocks that are driving the recent rise,” he said.

Furthermore, according to a recent foreign media report, the IMF warned in the latest “Fiscal Monitor” (Fiscal Monitor) report released in April that the US Treasury is planning to issue more bonds while continuing to implement quantitative austerity policies, which may exacerbate the recent increase in bond market volatility.