Switch leader Arista mentioned at the earnings conference that its AI cluster data in collaboration with Broadcom showed that Arista's Ethernet products were completed at least 10% faster than Nvidia's InfiniBand.

Author of this article: Zhang Yifan

Source: Hard AI

1. Arista: The Ethernet computing power cluster network exceeded expectations and surged 6.45%

InfiniBand and Ethernet are two communication protocols. Because of its fast transmission speed and good performance, InfiniBand was widely used in cloud vendor data centers after being acquired by Nvidia. On the other hand, Ethernet has never been able to serve AI data centers due to problems such as slow speed and data loss. Therefore, the market once believed that InfiniBand was the only AI field.

However, switch leader Arista denied this claim during yesterday's meeting.

Just yesterday at Arista's earnings conference, the company said that of the two large-scale computing power clusters Meta launched in March of this year, one uses Arista's Ethernet products.

The network is connected to 2w4 H100 GPUs, and the performance is not inferior to Infiniband. Referring to 8,000 H cards, you can train an GPT-4 model. The cluster scale of 2w4 H100 GPUs can be applied to various scenarios, which means that the performance of the Ethernet network can fully meet the requirements of AI computing power clusters.

The company expects 10,000 to 100,000 GPUs to be connected by 2025.

Additionally, the company said that its cluster data in collaboration with Broadcom shows that Arista's Ethernet products have increased the job completion speed by at least 10% compared to traditional InfiniBand. This is the complete opposite of what the market previously believed that the Ethernet network was less capable than InfiniBand.

24Q1 Earnings Conference Financial Data:

FY24Q2 revenue guidance of US$16.2-1.65 billion (agreed forecast of 1.62 billion), non-GAAP gross margin of about 64% (agreed estimate of 62.5%), non-GAAP operating margin of about 44% (agreed estimate of 42.9%);

The guideline is that the revenue growth rate for the whole of 2024 will be higher than the 10-12% rate previously exchanged;

2. ARM: Similar to Meta, the FY25 guidance fell short of expectations and plummeted 9% after the market

Against the backdrop of high AI growth, the market gave strong expectations for ARM. Referring to Meta's sharp decline a while ago, as it did not guide expectations, Arm must provide performance and forecasts that exceeded expectations in order to avoid this situation.

However, the FY25 guidance given by ARM at this week's earnings conference fell short of expectations, causing a 9% drop after the market.

Because ARM ——

A new agreement of up to 20 years was signed with Nvidia to authorize Grace CPUs (shipped with Nvidia's computing power cards);

Cooperate with Amazon, Microsoft, Google and other cloud vendors to develop self-developed data center CPU chips and supply AI servers for cloud giants;

As a result, ARM's share in AI data centers is gradually increasing. Combined with recent capital expenses of Meta, Google, and Microsoft, the market expects ARM to maintain a high growth rate. However, the FY25 guidance fell short of expectations, leading to a sharp decline after the market.

24Q1 Earnings Conference Financial Data:

FY25Q1: Revenue of US$875-925 million, yoy +29.6% - 37.0% (agreed forecast of US$870 million);

FY25: Revenue of US$38.0-4.10 billion, yoy +17.5% to 26.8% (agreed forecast of US$4,025 million);

3. Citi: Intel's microprocessor market share is being squeezed out by AMD and ARM

Intel launched a “four-year five-node” strategy in 2023, which aims to take back the leading position in its processors. However, the latest data shows that the implementation of the strategy has not been very smooth.

According to the Citi report, the latest 24Q1 data shows that Intel is being squeezed out by AMD and ARM in various fields such as servers, desktops, and laptops:

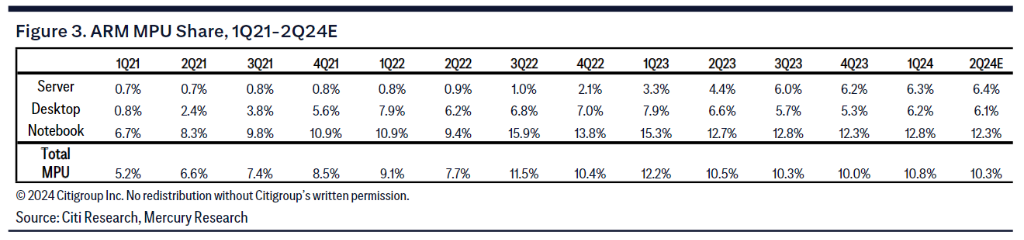

ARM: The market share in all fields (including laptops, desktops, and servers) is growing steadily, mainly due to the high performance+low power consumption characteristics of ARM CPUs, which have won market recognition;

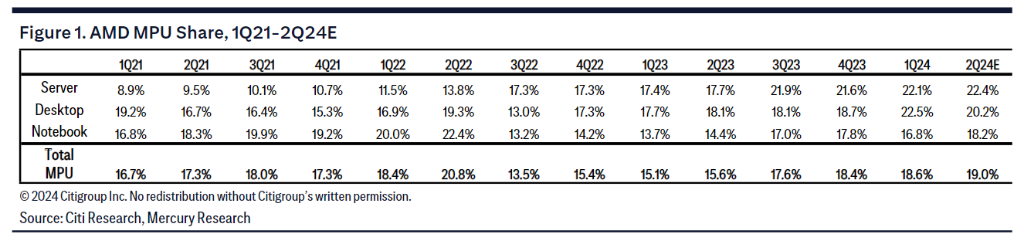

AMD: Increased market share, particularly in the server and desktop CPU markets, where laptop market share declined slightly, mainly due to the success of its strategy to enter “high-end chips”;

Intel: Overall, the market share in all fields is declining, and it can be seen that Intel has not yet emerged from the shadow of the wrong implementation of the previous strategy;

As a result, despite a loud slogan and aggressive corporate strategy last year, Intel also launched the 7nm Ultra Series processor and the Lake Series processor for AI PCs. However, according to the latest data, the company has yet to usher in a turning point.

ARM ——

AMD ——

Intel ——

4. Bank of America: Competition for AI PC processors is becoming more intense

The report predicts AI PC market growth, which is expected to grow from the current 50 million units to 167 million units by 2027. Global PC shipments in 2023 will be about 247 million units, which is equivalent to nearly 67.6% of computer shipments in 2027 being AI PCs.

Additionally, Bank of America ranked the performance of AI PC processors currently released on the market:

As can be seen from the chart, the performance of the M4 chip released by Apple this time is second only to Qualcomm Snapdragon X, but ahead of the Lake series recently released by Intel.

Finally, the report emphasizes the importance of embedded presence in the advancement of AI, arguing that larger AI models require larger, faster, and more energy-efficient memory, which will benefit companies such as Micron.