Money market funds are beginning to adjust their holdings in the $6 trillion US money market as a series of new regulations are about to be implemented, which may increase demand for government securities, while demand for riskier assets will be adversely affected.

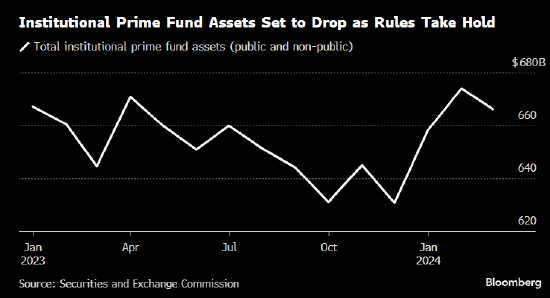

As of mid-April, about five such funds — including the two largest — have announced plans to switch to holding only government securities, or simply shut down to avoid the Securities and Exchange Commission (SEC) taking effect later this year. Beginning in October, adjustments to SEC rules mean that during periods of heightened financial pressure, it will become more expensive to withdraw funds from certain funds.

This change in asset holdings means an increase in demand for government-backed debt instruments such as treasury notes, institutional discount notes, and repurchase agreements, while demand for commercial papers and certificates of deposit has decreased.

Demand for government debt instruments is likely to push down short-term interest rates, and as cash flows through the financial system to find places to invest, one of the Federal Reserve's key overnight instruments will become more attractive.

Barclays strategist Joseph Abate wrote in a report to clients on Tuesday that when this reshuffle will happen depends on two factors: when the planned conversion takes place and how long institutional investors are willing to stay in the funds that are about to be converted. “So far, there are only a few signs that money is shifting from credit products to government assets or outflows of funds.”