Financial giants have made a conspicuous bullish move on Carnival. Our analysis of options history for Carnival (NYSE:CCL) revealed 9 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $98,724, and 7 were calls, valued at $500,958.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $12.0 to $35.0 for Carnival over the recent three months.

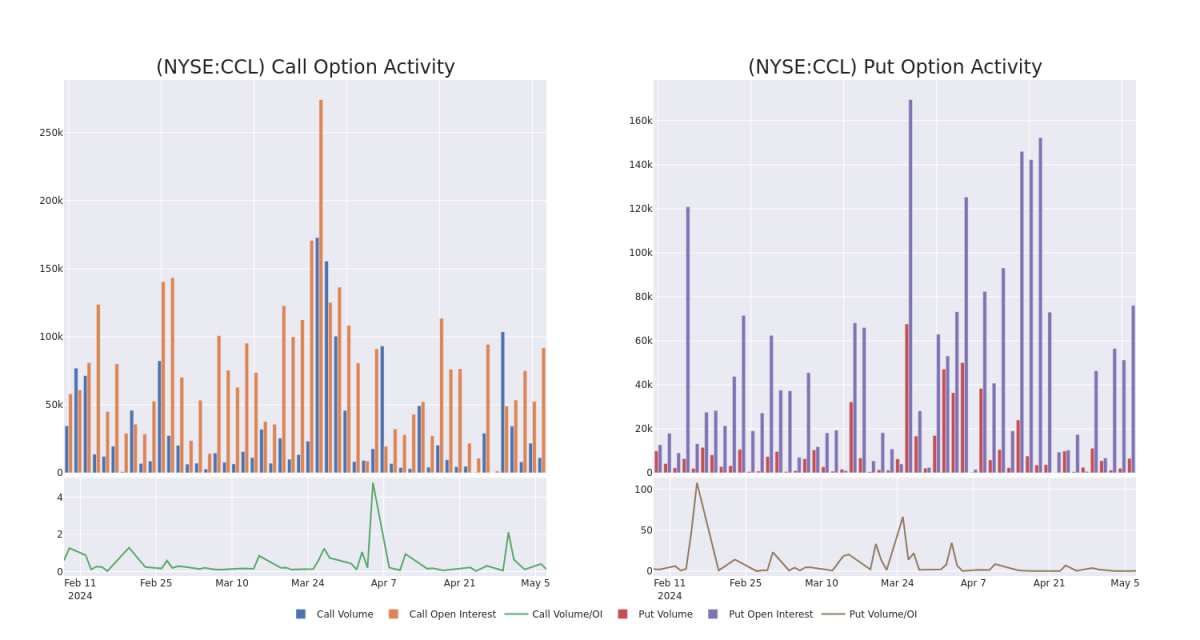

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Carnival's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Carnival's whale activity within a strike price range from $12.0 to $35.0 in the last 30 days.

Carnival Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | CALL | TRADE | BULLISH | 06/21/24 | $0.58 | $0.56 | $0.58 | $15.00 | $290.0K | 30.4K | 7.2K |

| CCL | CALL | TRADE | BEARISH | 01/16/26 | $0.67 | $0.62 | $0.62 | $30.00 | $62.0K | 10.6K | 1.9K |

| CCL | PUT | SWEEP | BEARISH | 05/17/24 | $0.27 | $0.26 | $0.27 | $14.00 | $54.3K | 14.0K | 2.7K |

| CCL | PUT | SWEEP | BULLISH | 06/21/24 | $0.18 | $0.15 | $0.16 | $12.50 | $44.4K | 61.9K | 3.8K |

| CCL | CALL | SWEEP | BEARISH | 06/21/24 | $0.58 | $0.56 | $0.57 | $15.00 | $37.8K | 30.4K | 1.5K |

About Carnival

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe; and P&O Cruises in Australia. Carnival also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

In light of the recent options history for Carnival, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Carnival's Current Market Status

- Trading volume stands at 18,490,006, with CCL's price down by -2.84%, positioned at $14.19.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 48 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.