For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Enovis Corporation (NYSE:ENOV) shareholders, since the share price is down 60% in the last three years, falling well short of the market return of around 17%. Even worse, it's down 15% in about a month, which isn't fun at all. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

After losing 8.3% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Enovis isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Enovis saw its revenue shrink by 9.3% per year. That is not a good result. The share price decline of 17% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

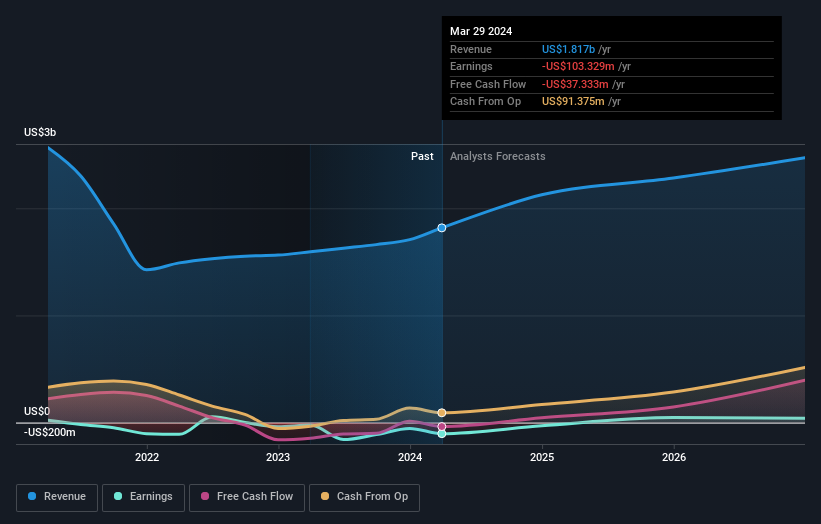

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Enovis is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Enovis will earn in the future (free analyst consensus estimates)

What About The Total Shareholder Return (TSR)?

We've already covered Enovis' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Enovis' TSR, at -30% is higher than its share price return of -60%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market gained around 26% in the last year, Enovis shareholders lost 9.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You could get a better understanding of Enovis' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like Enovis better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.