The domestic and overseas market landscape has been turned upside down

Before 2021, robot sweepers were viewed by the capital market as an investment gold mine, giving a very high valuation premium. Leading company Covos surged 1,300% in just one and a half years, and at one point its valuation increased 290 times.

Then the super-valuation bubble burst. The current price of Covos is still 80% lower than its historical peak, and the market value has evaporated by more than 110 billion yuan. Competitor Stone Technology has climbed out of the quagmire, and the current price has risen sharply by 150% from the low in October 2022. Currently, Stone has a market value of 55.9 billion dollars, which is double that of Covos, and has achieved a Jedi counterkill.

How do you view the current capital performance of Covos? Will the future reverse the predicament?

01

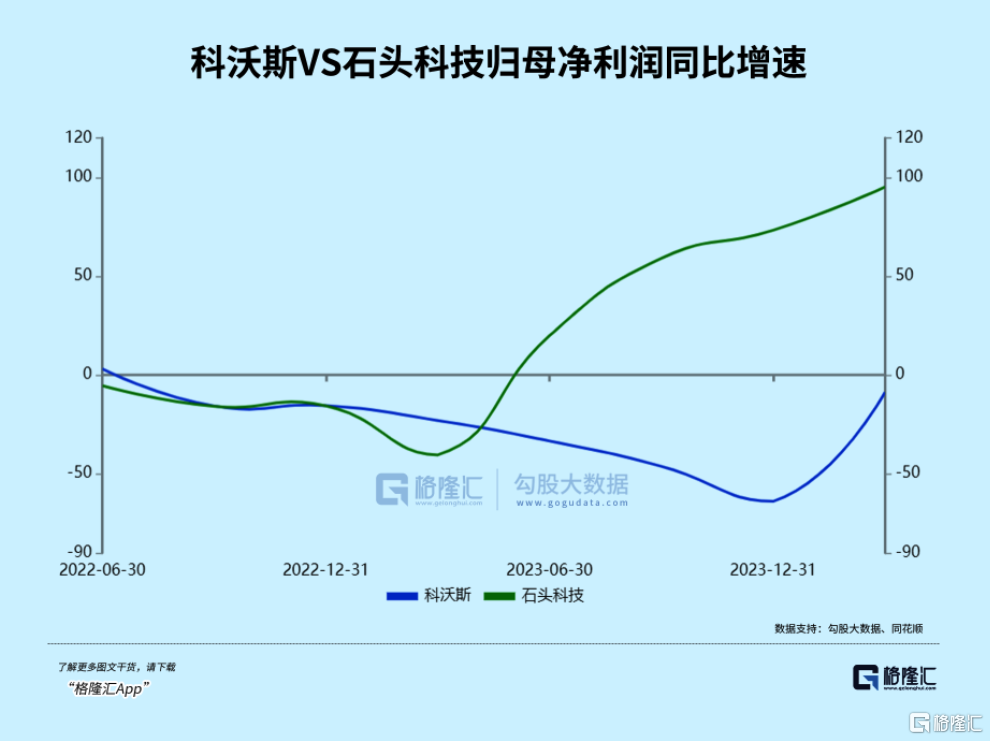

Recently, Covos released the latest report card. In 2023, revenue was 15.5 billion yuan, an increase of only 1.2% over the previous year, and its scale reached a record high. The net profit returned to mother was only 600 million yuan, a sharp drop of 64% over the previous year, a sharp decrease of 1.4 billion yuan from the peak of 2 billion yuan in 2021. In the first quarter of this year, revenue increased slightly, and net profit to mother declined again.

Looking at Stone Technology, revenue surged by more than 30% in 2023, and net profit to mother surged 73%. Growth accelerated in the first quarter of this year, and net profit to mother nearly doubled. Comparatively speaking, the sharp decline in Covos' performance is not entirely due to the poor macroeconomic environment at home and abroad; it is more that there are quite a few problems with its own business strategy.

Specifically, the domestic sales market of the Covos brand experienced a “price increase and decrease”. Total sales fell sharply by 10% year on year, while overseas markets performed well, increasing 26% year on year. Furthermore, the Tianke brand, which was highly anticipated by the market, achieved “price for volume”, with domestic sales falling 11% and export sales increasing by 41%. Stone Technology, on the other hand, is progressing hand in hand in domestic and overseas markets. Among them, the domestic sales market surged 41%, achieved double-digit growth in terms of volume and price, and the export market also surged by more than 20%.

Let's look at profitability again. By the end of the first quarter of this year, Covos's gross sales margin was 41.17%, down 4.44% from the end of 2022. On the other hand, Stone Technology's gross margin continued to rise. The latest figure was 56.5%, and it continued to rise 7.23% from 2022.

The former's profitability declined, mainly due to the decline in average product prices due to fierce competition in the industry. Stone, on the other hand, bucked the trend. New high-margin products and increased overseas share brought about structural improvements, driving gross margins to continue to rise.

In terms of net interest rates, Covos fell sharply to 4% in 2023, rebounded to 8.6% in the first quarter of this year, and reached 15.4% in 2021. Overall, the company's total sales expenses rate continued to rise, reaching 43% at the end of last year, more than double that of 2013. As a result, the net interest rate did not perform well and remained low.

Looking at Stone Technology, although the overall sales expense ratio has increased, gross margin continued to rise, keeping the net interest rate relatively high, at 21.66% at the end of the first quarter of 2024.

Judging from the above core financial data performance and comparison, it is generally explained why the capital market gave the two robot sweeper giants very different stock price performance.

02

In 2020 and before, the market penetration rate of sweeping robots in China was very low. The average price of each unit remained below 1,500 yuan. Mainly, machines with sweeping and mopping functions were less effective, and rags required manual cleaning, and the consumer experience was poor.

In 2020, breakthroughs were made in technologies such as mopping and self-cleaning of rags, and technology iterations continued to be carried out in navigation systems, cleaning systems, battery life systems, interactive systems, etc., to increasingly meet the core demands of consumers. The penetration rate increased significantly — 3.6% in 2019 to 9% in 2023.

In terms of price, robot vacuum products sell more and more expensive due to increased functionality or optimized experience. According to data from Aowei Cloud Network, in 2020-2022, the average retail price of sweeping robots in China was 1,687 yuan, 2,424 yuan, and 3,175 yuan respectively. Among them, the average online prices of base station sweepers with self-cleaning functions were 3,992 yuan, 4,021 yuan, and 3,964 yuan, respectively.

The price of robot vacuum cleaners is rising year by year, gradually exceeding the expectations that consumers can bear. According to QuestMobile data, only 9.3% of young users have the ability to spend more than 3,000 yuan online. Also, according to the “2021 White Paper on the Robotic Vacuum Market”, 93% of consumers can accept a sweeping robot for less than 3,000 yuan.

In the second half of 2022, Covos took the lead in cutting prices and launched an internal volume model. In December of that year, the price of the main selling product T10 OMNI fell 20% compared to the June unit price, and the unit price of the X1 OMNI decreased by about 15%. In the first half of 2023, the average price of Covos robot vacuum cleaners online was 3,788 yuan, down 8.4% year on year. The average offline retail price was 4,457 yuan, a year-on-year decrease of 15.7%, and some high-end products were even reduced by more than 20%.

Covos' move has prompted rivals to follow suit, and a price war is unavoidable.

In terms of sales, the number of robot vacuum cleaners in China in 2020 was 6.54 million, a cumulative increase of 139% over 2018, and sales have declined since then. In 2023, there were 4.58 million units, down 30% from the peak in 2020, and back to the level in 2017.

The decline in sales was mainly due to two major factors. First, the impact of the epidemic has caused the macroeconomic growth rate to drop to a level. The good consumption upgrade trend shown in the past few years has been interrupted, but the phenomenon of consumption downgrade is becoming more and more obvious. This is reflected in many consumer fields, including casual snacks, mustard, marinated products, functional drinks, etc.

Second, the average unit price of sweeping robots has risen too fast, exceeding the affordability of ordinary consumers, and not in line with the general environment of consumption downgrading, which has affected sales performance.

In this context, the industrial pattern of sweeping robots in China has also entered a stage of reshaping. In 2019-2023, the TOP5 market share further increased from 70% to 93%, presenting an oligopoly situation.

In 2018 and before, Covos's share in the domestic market remained at 50%-60% for a long time, and then entered a downward channel. According to statistics from the JD platform from Guanyan Research Network, Covos's market sales share in 2023 was 36%. Stone ranked second, accounting for about 25%. In addition, the market shares of Chase, Mijia, and Cloud Whale were 14%, 10%, and 10%, respectively.

Overall, sales of robot vacuum cleaners in China have been poor in the last three years, but the overall sales scale has continued to grow (growth rate is slowing), mainly driven by price increases. However, price increases are unsustainable. Currently, the domestic market has switched from price increases driven by technological iteration to a price-for-volume model, and the future is likely to be even more internal.

03

Overseas markets are an important potential growth point for Chinese robot vacuum cleaners. Among them, Shitou Technology's overseas revenue in 2019 was only 580 million yuan, and in 2023 it has expanded to 4.23 billion yuan, and its share of total revenue has increased from 13.8% to 48.87%. In addition, Chase Tech's 2023 international performance surged by more than 120% year on year, with a market share of over 37% in Italy and Germany, ranking first. In the Southeast Asian market, it also ranked first in market share for the fourth quarter of 2023.

Covos overseas markets developed earlier. Overseas revenue of 6.5 billion yuan in 2023, accounting for 42%, compared with revenue of 1.25 billion yuan in 2015, accounting for 46.4%.

Currently, Chinese robot vacuum companies are conquering overseas markets, showing strong competitive strength. In 2022, China's own brands will account for around 50% of the global market. Of these, 68% are in Southeast Asia and 55% in Europe.

Domestic brands are leading in technology research and development, and their product strength is at least 3-5 years ahead of overseas companies. For example, the flagship aircraft of Covos and Stone have long incorporated all-purpose sweepers with self-cleaning and self-collecting functions. However, iRobot, an established giant that is deeply involved in the industry, only included self-dust collection performance in March of last year.

With leading technology, domestic brands focus on the middle and high-end fields in overseas markets. Take the US Amazon platform as an example. Covos's explosive price range is 800 US dollars, and Covos even reached 1,400 US dollars, which is significantly higher than iRobot.

Currently, the product structure of overseas markets is gradually shifting from a single product to a base station type intelligent navigation system, so there is still a lot of room for price growth, which is similar to the development period of the Chinese market in 2017-2022.

In short, whoever seizes more market share in overseas markets, especially in the high-end sector, has better growth expectations, and the valuation given by the capital market is likely to be higher.

In 2022, Stone Technology launched the S7 Max V series in overseas markets. Its all-purpose base station product sold for 1,399 US dollars, making it the company's first overseas product priced at over 1,000 US dollars. In 2023, the S8 product was launched again, and its North American revenue in the first half of the year increased by nearly 60% year over year.

Covos also attaches great importance to overseas markets, and its products have covered 145 countries and regions around the world. According to market-related data, Covos Dibao has a market share of over 40% in Australia and Southeast Asia. Covos Window Treasure accounts for 84% of the German market.

The rise of domestic brands such as Stone, Covos, and Pursuit had a huge impact on iRobot. Revenue began to decline sharply, and market share continued to shrink. The gross margin level fell sharply from over 60% to less than 30%, or even lower than gross sales margin. As the financial situation worsened, the market reported that it would sell to Amazon at a price of 1.4 billion US dollars.

04

Local robot vacuum companies in China are facing an internal “volume for price” environment in the domestic environment, and the growth ceiling is not high. However, the overall penetration rate of overseas markets is low, and they are still in the “sharp rise in volume and price” stage, so there are good market prospects.

Stone's stock price has emerged from a different style from domestic and foreign companies. It is mainly due to the good implementation of overseas strategies, which has raised the capital market's expectations for its growth. However, Covos has encountered obvious bottlenecks in the domestic market, and although progress has been made in overseas markets, the pace of development is not fast; it is not enough to make up for the weakness in the domestic sales market, and the valuation level is very low.

Overall, Covos has yet to overcome its growth dilemma and still needs more time to watch. However, as the general environment in the capital market recovers, there is also a potential driving force for restoration in valuation levels. The determining factor for how high the future rebound will be is still the extent to which fundamentals improve.