Whales with a lot of money to spend have taken a noticeably bearish stance on T-Mobile US.

Looking at options history for T-Mobile US (NASDAQ:TMUS) we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 12% of the investors opened trades with bullish expectations and 62% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $499,820 and 6, calls, for a total amount of $685,504.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $150.0 to $190.0 for T-Mobile US during the past quarter.

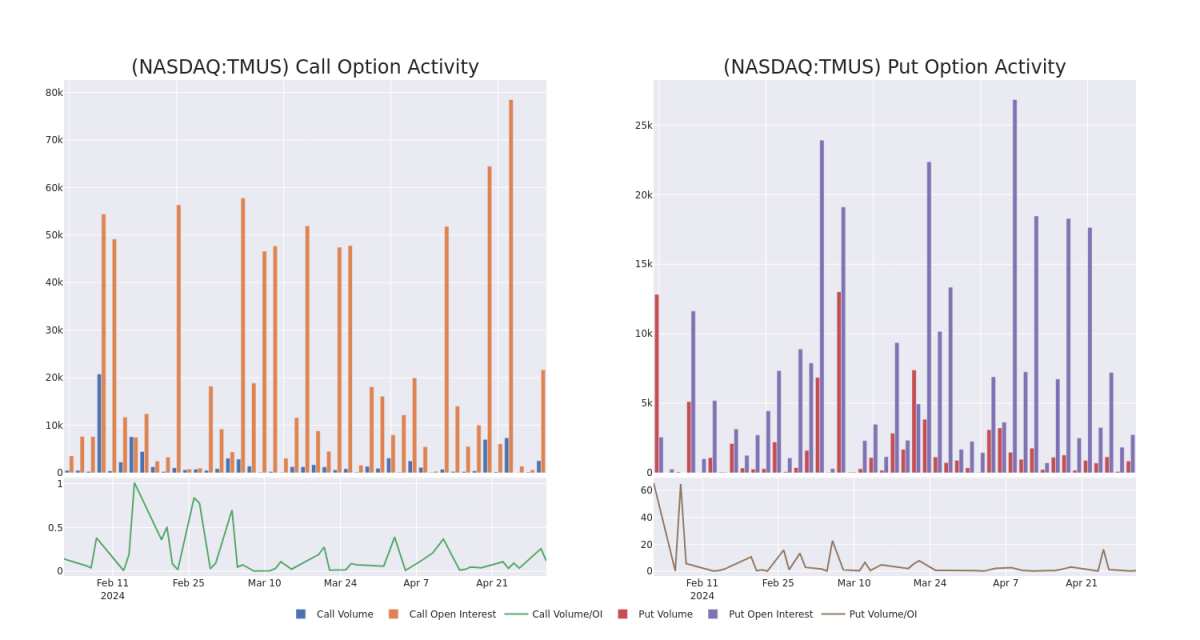

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in T-Mobile US's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to T-Mobile US's substantial trades, within a strike price spectrum from $150.0 to $190.0 over the preceding 30 days.

T-Mobile US Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TMUS | PUT | TRADE | NEUTRAL | 06/20/25 | $5.8 | $5.2 | $5.5 | $150.00 | $467.5K | 2.2K | 850 |

| TMUS | CALL | TRADE | BULLISH | 06/20/25 | $6.95 | $5.3 | $6.5 | $190.00 | $364.0K | 1.5K | 560 |

| TMUS | CALL | SWEEP | BEARISH | 05/17/24 | $2.77 | $2.71 | $2.71 | $165.00 | $157.7K | 14.4K | 1.1K |

| TMUS | CALL | SWEEP | NEUTRAL | 01/17/25 | $3.0 | $2.73 | $2.98 | $190.00 | $61.5K | 2.6K | 408 |

| TMUS | CALL | SWEEP | BEARISH | 05/17/24 | $2.83 | $2.78 | $2.78 | $165.00 | $48.1K | 14.4K | 186 |

About T-Mobile US

Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, and that firm merged with Sprint in 2020, creating the second-largest wireless carrier in the U.S. T-Mobile now serves 76 million postpaid and 22 million prepaid phone customers, equal to around 30% of the U.S. retail wireless market. The firm entered the fixed-wireless broadband market aggressively in 2021 and now serves nearly 5 million residential and business customers. In addition, T-Mobile provides wholesale services to resellers.

Following our analysis of the options activities associated with T-Mobile US, we pivot to a closer look at the company's own performance.

Where Is T-Mobile US Standing Right Now?

- Currently trading with a volume of 1,400,217, the TMUS's price is up by 1.13%, now at $166.02.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 85 days.

Professional Analyst Ratings for T-Mobile US

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $191.25.

- An analyst from TD Cowen persists with their Buy rating on T-Mobile US, maintaining a target price of $202.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on T-Mobile US with a target price of $188.

- Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on T-Mobile US with a target price of $185.

- Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for T-Mobile US, targeting a price of $190.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest T-Mobile US options trades with real-time alerts from Benzinga Pro.