The real estate sector is raising eyebrows

Today, A-shares opened high. The Shanghai Index rose 0.7% and finally reached a phased high of 3100. The Shenzhen Index, the GEM Index, and the Science and Technology Innovation 100 Index rose 1.86%, 3.21%, and 2.88% respectively.

On the sector side, the real estate sector of Hong Kong A-shares continued its recent strength. Huaxia Happiness, Rongsheng Development, Jingneng Real Estate, and Fuxing shares rose and stopped, while Vanke A rose and stopped in mid-morning trading.

In terms of ETFs, China Southern Fund Real Estate ETF and Yinhua Fund Real Estate ETF rose 7.24% and 6.68% respectively, while Real Estate ETF Huaxia rose 6.68%.

According to the news, the housing purchase restriction policy is gradually being withdrawn from the market. Chengdu City of Sichuan Province issued a notice to further optimize the real estate market policy. The notice will be officially implemented on April 29, 2024. This also means that after Chengdu became a hot provincial capital city such as Wuhan, Hefei, Nanjing, and Changsha, it was another city that fully liberalized housing purchase restrictions.

Up to now, with the exception of Hainan Province, only the four major first-tier cities of Beijing, Shanghai, Guangzhou, and Shenzhen, as well as core areas such as Hangzhou (new housing), Tianjin, and Xi'an, have maintained purchase restriction policies among core cities.

It is worth noting that on April 24, there was a market rumor that after “May 1st,” Shenzhen will abolish the purchase restriction policy for regions other than Futian and Nanshan, and at the same time abolish the 5-year value-added tax, which can be exempted after 3 years. In response, staff at the Shenzhen Real Estate Registration Center said that no relevant policy notices have been received so far. In addition, relevant staff of the Shenzhen Municipal Taxation Bureau also responded that they have not received the relevant notice, and that they are currently exempt from VAT after 3 years; it is still 5 years.

On April 26, John LaMJ, an analyst in charge of real estate research at UBS Greater China, said in a recent interview: “After three years of bearishness, we are more optimistic about the Chinese real estate industry for the first time due to government aid.”

He anticipates that domestic housing demand and supply will return to historical averages sometime next year, and stocks of major Chinese real estate developers may rebound. John Lam predicts that sales volume and prices in China's real estate industry will not rise this year, but the decline will ease somewhat. In terms of area, he believes domestic residential sales may fall 7% this year, down from the 27% drop recorded in 2022. The rate of new housing starts is likely to drop by 7%, which is narrower than the 39% drop in 2022.

Influenced by this news, the Hong Kong A-share real estate sector experienced a sudden strong market last Friday. Judging from the top 10 ETF share growth list, the top 9 are broad-based ETFs. The only industry-themed ETF is the Southern Fund Real Estate ETF. The ETF share increased by 451 million shares last week, of which 345 million shares were purchased by OTC funds on Friday.

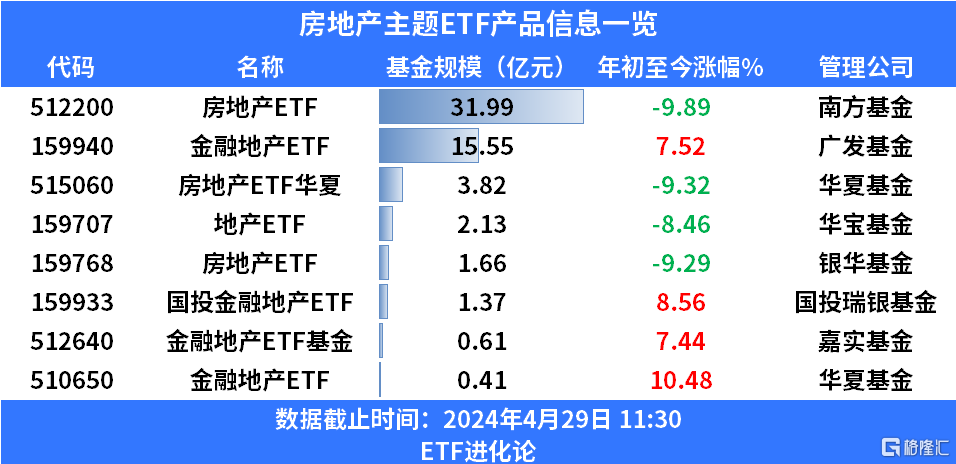

Currently, A-shares have four real estate-themed ETFs and four financial real estate ETFs. The largest of these is the Southern Fund Real Estate ETF. The latest scale is 3.199 billion yuan.

Western Securities believes that core second-tier cities are actively promoting the implementation of supportive policies for the property market and sending a signal of relaxation. If Chengdu completely abolishes the purchase restriction policy, you can settle in if you buy a house in Nanjing. Supply and demand are working together on the policy side, and trading volume is expected to pick up moderately. It is recommended to standardize the industry. Guojin Securities believes that Chengdu has introduced a series of measures to stabilize the real estate market, and Shenzhen supports “trade-in”. The current policy coverage and support is stronger than before. It is expected that more core cities will introduce additional policies after May. The first key layout is a central state-owned enterprise that continues to cultivate first-tier and core second-tier cities, focuses on improving products, and has experience and strength in urban village renovation.