Dell Technologies's Options: A Look at What the Big Money Is Thinking

Dell Technologies's Options: A Look at What the Big Money Is Thinking

Financial giants have made a conspicuous bullish move on Dell Technologies. Our analysis of options history for Dell Technologies (NYSE:DELL) revealed 23 unusual trades.

金融巨頭對戴爾科技採取了明顯的看漲舉動。我們對戴爾科技(紐約證券交易所代碼:DELL)期權歷史的分析顯示了23筆不尋常的交易。

Delving into the details, we found 47% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $540,300, and 13 were calls, valued at $1,301,083.

深入研究細節,我們發現47%的交易者看漲,而43%的交易者表現出看跌傾向。在我們發現的所有交易中,有10筆是看跌期權,價值爲540,300美元,13筆是看漲期權,價值1,301,083美元。

Predicted Price Range

預測的價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $140.0 for Dell Technologies during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注戴爾科技在過去一個季度的價格範圍從105.0美元到140.0美元不等。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

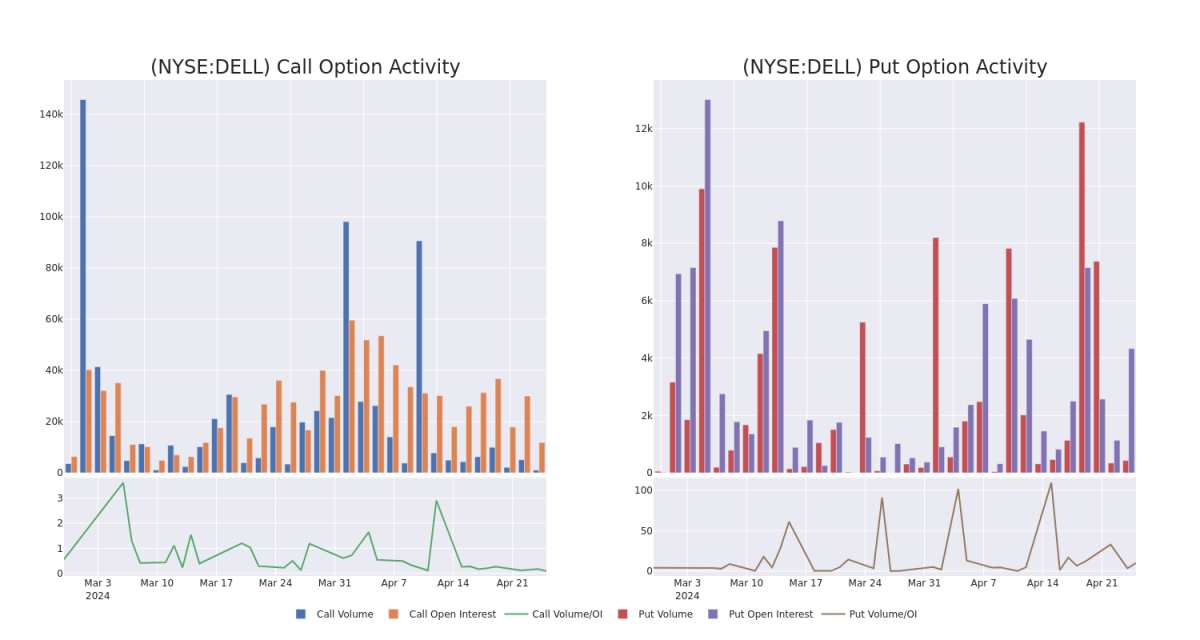

In terms of liquidity and interest, the mean open interest for Dell Technologies options trades today is 807.65 with a total volume of 1,473.00.

就流動性和利息而言,當今戴爾科技期權交易的平均未平倉合約爲807.65,總交易量爲1,473.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dell Technologies's big money trades within a strike price range of $105.0 to $140.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天內戴爾科技在105.0美元至140.0美元行使價區間內的大額資金交易的看漲和看跌期權交易量和未平倉合約的變化。

Dell Technologies 30-Day Option Volume & Interest Snapshot

戴爾科技 30 天期權交易量和利息快照

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | TRADE | BEARISH | 06/21/24 | $13.3 | $13.1 | $13.1 | $120.00 | $327.5K | 3.2K | 54 |

| DELL | CALL | SWEEP | BULLISH | 06/20/25 | $25.2 | $24.8 | $25.2 | $125.00 | $216.7K | 37 | 86 |

| DELL | PUT | SWEEP | BEARISH | 01/17/25 | $28.3 | $25.5 | $26.9 | $135.00 | $172.1K | 150 | 0 |

| DELL | CALL | TRADE | BULLISH | 01/17/25 | $11.9 | $11.3 | $11.9 | $140.00 | $119.0K | 433 | 0 |

| DELL | CALL | TRADE | BULLISH | 06/20/25 | $21.0 | $19.6 | $20.55 | $130.00 | $113.0K | 118 | 0 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 戴爾 | 打電話 | 貿易 | 粗魯的 | 06/21/24 | 13.3 美元 | 13.1 美元 | 13.1 美元 | 120.00 美元 | 327.5 萬美元 | 3.2K | 54 |

| 戴爾 | 打電話 | 掃 | 看漲 | 06/20/25 | 25.2 美元 | 24.8 美元 | 25.2 美元 | 125.00 美元 | 21.67 萬美元 | 37 | 86 |

| 戴爾 | 放 | 掃 | 粗魯的 | 01/17/25 | 28.3 美元 | 25.5 美元 | 26.9 美元 | 135.00 美元 | 172.1 萬美元 | 150 | 0 |

| 戴爾 | 打電話 | 貿易 | 看漲 | 01/17/25 | 11.9 美元 | 11.3 美元 | 11.9 美元 | 140.00 美元 | 119.0 萬美元 | 433 | 0 |

| 戴爾 | 打電話 | 貿易 | 看漲 | 06/20/25 | 21.0 美元 | 19.6 美元 | 20.55 美元 | 130.00 美元 | 113.0 萬美元 | 118 | 0 |

About Dell Technologies

關於戴爾科技

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium personal computers and enterprise on-premises data center hardware. It holds top-three shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell is vertically integrated but has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

戴爾科技是一家廣泛的信息技術供應商,主要爲企業提供硬件。它專注於高級個人計算機和企業本地數據中心硬件。它在個人計算機、外圍顯示器、主流服務器和外部存儲等核心市場中佔有前三的份額。戴爾是垂直整合的,但擁有強大的組件和裝配合作夥伴生態系統,還嚴重依賴渠道合作伙伴來完成銷售。

Following our analysis of the options activities associated with Dell Technologies, we pivot to a closer look at the company's own performance.

在分析了與戴爾科技相關的期權活動之後,我們轉而仔細研究公司自身的業績。

Where Is Dell Technologies Standing Right Now?

戴爾科技目前的立場如何?

- With a trading volume of 3,309,816, the price of DELL is up by 3.24%, reaching $124.1.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 35 days from now.

- 戴爾的價格上漲了3.24%,達到124.1美元,交易量爲3,309,816美元。

- 當前的RSI值表明該股可能已接近超買。

- 下一份收益報告定於35天后發佈。

Expert Opinions on Dell Technologies

關於戴爾技術的專家觀點

1 market experts have recently issued ratings for this stock, with a consensus target price of $141.0.

1位市場專家最近發佈了該股的評級,共識目標價爲141.0美元。

- An analyst from UBS has decided to maintain their Buy rating on Dell Technologies, which currently sits at a price target of $141.

- 瑞銀的一位分析師已決定維持對戴爾科技的買入評級,目前的目標股價爲141美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。