Shenzhen SNC Opto ElectronicLtd's (SZSE:001326) Solid Earnings May Rest On Weak Foundations

Shenzhen SNC Opto ElectronicLtd's (SZSE:001326) Solid Earnings May Rest On Weak Foundations

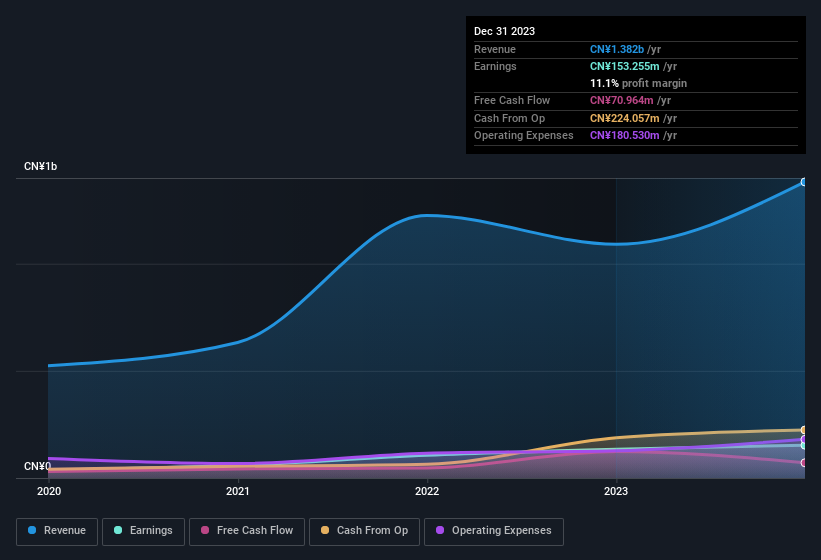

The market for Shenzhen SNC Opto Electronic Co.,Ltd's (SZSE:001326) stock was strong after it released a healthy earnings report last week. While the profit numbers were good, our analysis has found some concerning factors that shareholders should be aware of.

深圳信諾光電有限公司的市場,Ltd(深圳證券交易所:001326)的股票在上週發佈了健康的收益報告後表現強勁。儘管利潤數字不錯,但我們的分析發現了一些股東應該注意的令人擔憂的因素。

A Closer Look At Shenzhen SNC Opto ElectronicLtd's Earnings

仔細看看深圳信諾光電有限公司的收益

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

用於衡量公司將其利潤轉換爲自由現金流(FCF)的情況的一個關鍵財務比率是應計比率。應計比率從給定時期的利潤中減去FCF,然後將結果除以該時間內公司的平均運營資產。該比率向我們顯示了公司的利潤超過其FCF的程度。

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

因此,當公司的應計比率爲負時,這實際上被認爲是一件好事,但如果其應計比率爲正,則是一件壞事。雖然正應計比率表明非現金利潤達到一定水平不是問題,但高應計比率可以說是一件壞事,因爲它表明紙面利潤與現金流不匹配。引用Lewellen和Resutek在2014年發表的一篇論文,“應計額較高的公司將來的利潤往往會降低”。

Shenzhen SNC Opto ElectronicLtd has an accrual ratio of 0.43 for the year to December 2023. That means it didn't generate anywhere near enough free cash flow to match its profit. As a general rule, that bodes poorly for future profitability. In fact, it had free cash flow of CN¥71m in the last year, which was a lot less than its statutory profit of CN¥153.3m. Shenzhen SNC Opto ElectronicLtd shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months.

截至2023年12月的一年中,深圳信諾光電有限公司的應計比率爲0.43。這意味着它產生的自由現金流不足以與其利潤相提並論。通常,這對未來的盈利能力來說是個壞兆頭。實際上,它去年的自由現金流爲7100萬元人民幣,遠低於其1.533億元的法定利潤。毫無疑問,深圳SNC光電有限公司的股東們將希望其自由現金流能夠在明年反彈,因爲在過去的十二個月中一直處於下降狀態。

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Shenzhen SNC Opto ElectronicLtd.

注意:我們始終建議投資者檢查資產負債表的實力。點擊此處查看我們對深圳信諾光電有限公司的資產負債表分析

Our Take On Shenzhen SNC Opto ElectronicLtd's Profit Performance

我們對深圳信諾光電有限公司盈利表現的看法

As we discussed above, we think Shenzhen SNC Opto ElectronicLtd's earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that Shenzhen SNC Opto ElectronicLtd's underlying earnings power is lower than its statutory profit. The good news is that, its earnings per share increased by 11% in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. At Simply Wall St, we found 1 warning sign for Shenzhen SNC Opto ElectronicLtd and we think they deserve your attention.

正如我們上面討論的那樣,我們認爲深圳SNC光電有限公司的收益沒有得到自由現金流的支持,這可能會讓一些投資者感到擔憂。因此,我們認爲深圳信諾光電有限公司的潛在盈利能力很可能低於其法定利潤。好消息是,其每股收益在去年增長了11%。本文的目標是評估我們在多大程度上可以依靠法定收益來反映公司的潛力,但還有很多需要考慮的地方。因此,如果你想更深入地研究這隻股票,那麼考慮它所面臨的任何風險至關重要。在Simply Wall St,我們發現了深圳信諾光電有限公司的1個警告標誌,我們認爲它們值得你關注。

Today we've zoomed in on a single data point to better understand the nature of Shenzhen SNC Opto ElectronicLtd's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

今天,我們放大了單一數據點,以更好地了解深圳信諾光電有限公司利潤的性質。但是,還有很多其他方法可以讓你對公司的看法。例如,許多人認爲高股本回報率是有利的商業經濟的標誌,而另一些人則喜歡 “關注資金”,尋找內部人士正在買入的股票。雖然可能需要你進行一些研究,但你可能會發現這份免費收集的擁有高股本回報率的公司,或者這份內部人士正在購買的股票清單很有用。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。