Declining Stock and Solid Fundamentals: Is The Market Wrong About Jinan High-tech Development Co., Ltd. (SHSE:600807)?

Declining Stock and Solid Fundamentals: Is The Market Wrong About Jinan High-tech Development Co., Ltd. (SHSE:600807)?

With its stock down 17% over the past week, it is easy to disregard Jinan High-tech Development (SHSE:600807). But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. Specifically, we decided to study Jinan High-tech Development's ROE in this article.

由於其股票在過去一週下跌了17%,很容易忽視濟南高新技術開發有限公司(SHSE:600807)。但是,如果你密切關注,你可能會發現,鑑於市場通常會獎勵財務狀況良好的公司,其強勁的財務狀況可能意味着該股的長期價值可能會增加。具體而言,我們決定在本文中研究濟南高新開發的投資回報率。

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

股本回報率或投資回報率是股東需要考慮的重要因素,因爲它可以告訴他們資本再投資的有效性。簡而言之,它用於評估公司相對於其股權資本的盈利能力。

How Is ROE Calculated?

ROE 是如何計算的?

The formula for ROE is:

ROE 的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

股本回報率 = 淨利潤(來自持續經營業務)÷ 股東權益

So, based on the above formula, the ROE for Jinan High-tech Development is:

因此,根據上述公式,濟南高新開發的投資回報率爲:

34% = CN¥263m ÷ CN¥778m (Based on the trailing twelve months to September 2023).

34% = 2.63億元人民幣 ÷ 7.78億元人民幣(基於截至2023年9月的過去十二個月)。

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.34 in profit.

“回報” 是指公司去年的收益。對此進行概念化的一種方法是,該公司每擁有1元人民幣的股本即可獲得0.34元人民幣的利潤。

What Is The Relationship Between ROE And Earnings Growth?

投資回報率與收益增長之間有什麼關係?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don't share these attributes.

到目前爲止,我們已經了解到,投資回報率是衡量公司盈利能力的指標。現在,我們需要評估公司再投資或 “保留” 了多少利潤以用於未來的增長,從而使我們對公司的增長潛力有所了解。一般而言,在其他條件相同的情況下,股本回報率和利潤留存率高的公司的增長率要高於不具有這些屬性的公司。

Jinan High-tech Development's Earnings Growth And 34% ROE

濟南高新開發的收益增長和34%的投資回報率

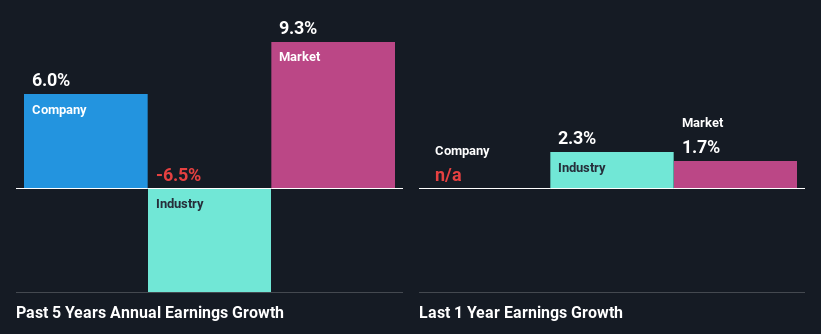

First thing first, we like that Jinan High-tech Development has an impressive ROE. Second, a comparison with the average ROE reported by the industry of 4.8% also doesn't go unnoticed by us. This likely paved the way for the modest 6.0% net income growth seen by Jinan High-tech Development over the past five years.

首先,我們喜歡濟南高新開發的投資回報率令人印象深刻。其次,與該行業報告的平均投資回報率4.8%的比較也不會被我們忽視。這可能爲濟南高新技術開發在過去五年中實現6.0%的溫和淨收入增長鋪平了道路。

Given that the industry shrunk its earnings at a rate of 6.5% over the last few years, the net income growth of the company is quite impressive.

鑑於該行業在過去幾年中將收益縮減了6.5%,該公司的淨收入增長令人印象深刻。

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Jinan High-tech Development's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

收益增長是股票估值的重要因素。無論如何,投資者應設法確定預期的收益增長或下降是否已計入其中。然後,這可以幫助他們確定股票是爲光明還是暗淡的未來而佈局。如果你想知道濟南高新開發的估值,可以看看這個衡量其市盈率與行業相比的指標。

Is Jinan High-tech Development Using Its Retained Earnings Effectively?

濟南高新技術開發是否在有效使用其留存收益?

Jinan High-tech Development doesn't pay any regular dividends currently which essentially means that it has been reinvesting all of its profits into the business. This definitely contributes to the decent earnings growth number that we discussed above.

濟南高新技術開發目前不支付任何定期分紅,這實質上意味着它一直在將所有利潤再投資於該業務。這無疑有助於實現我們上面討論的可觀的收入增長數字。

Conclusion

結論

In total, we are pretty happy with Jinan High-tech Development's performance. In particular, it's great to see that the company is investing heavily into its business and along with a high rate of return, that has resulted in a sizeable growth in its earnings. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. Our risks dashboard would have the 2 risks we have identified for Jinan High-tech Development.

總的來說,我們對濟南高新開發的表現非常滿意。特別是,很高興看到該公司正在對其業務進行大量投資,再加上高回報率,這爲其收益帶來了可觀的增長。考慮到每股收益如何影響長期股價,如果該公司繼續以現有方式增長收益,這可能會對其股價產生積極影響。請記住,股票的價格還取決於感知的風險。因此,在投資任何公司之前,投資者必須隨時了解所涉及的風險。我們的風險儀表板將包含我們爲濟南高新開發區確定的兩種風險。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。