The gross margin is more than ten points higher than that of peers, so you really don't need a paper when you go overseas?

When it comes to Jiayi Co., Ltd., you may be unfamiliar with it, but its OEM product, the Stanley thermos mug, has long been an influencer item around the world.

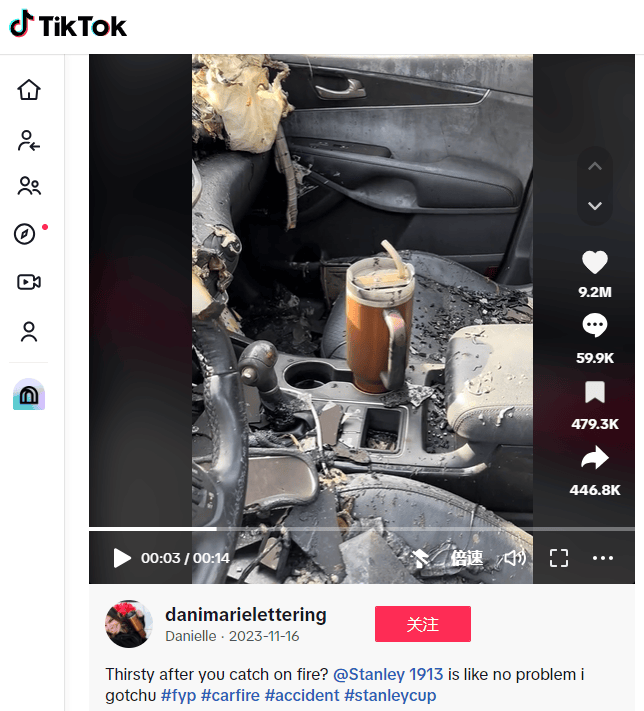

In November of last year, Stanley's popularity rose rapidly: a woman's car unfortunately caught fire, but the Stanley straw cup inside her car was miraculously undamaged, and even the ice in the cup hadn't melted...

Stanley also became popular “in disguise” overnight. According to Sorftime data, Stanley sold 1.17 million units in all categories in December 2023, up 135% month-on-month and 64% year-on-year; year-on-year sales volume was 5.81 million units, up 125% year on year.

As the main foundry of the Stanley brand, Jiayi Co., Ltd.'s performance and market performance are closely related to the continued popularity of Stanley thermos mugs in the North American market.

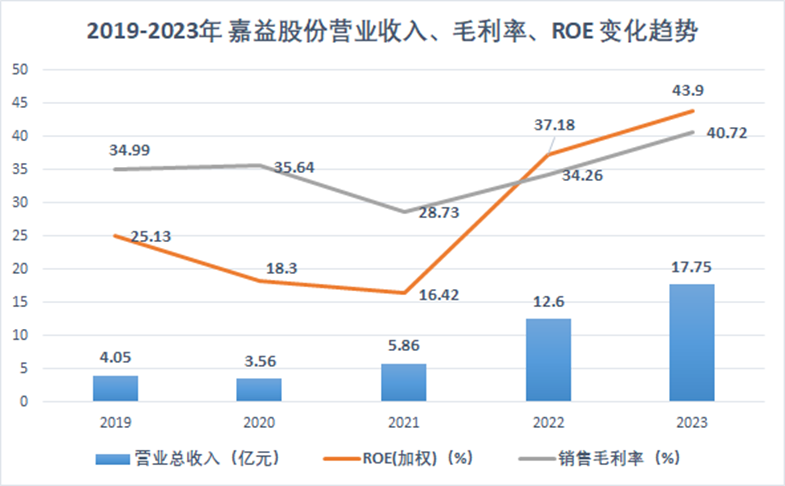

According to the 2023 annual report released by the company on March 29, the company achieved annual revenue of 1.78 billion yuan, an increase of 41% over the previous year; net profit attributable to the parent company reached 470 million yuan, an increase of 74% over the previous year. Looking at quarterly data, revenue for the fourth quarter was $547 million, up 29.2% year on year; net profit attributable to the parent company was 158 million, up 51.6% year on year.

(Insight into intellectual research and cartography)

What is particularly noteworthy is that Pacific Market Internationl (Stanley's parent company) brought in 1.51 billion dollars in sales, accounting for 85% of total revenue, an increase of 75% over the previous year, and the proportion that increased year by year has become the most important source of the company's performance.

(Insight into intellectual research and cartography)

Major customers, accounting for 85%, have a “global viral explosion”

In recent years, domestic companies have gone overseas one after another to seek a second growth curve in terms of performance.

The light industry segment relies on China's strong manufacturing supply chain and rapid response mechanism, and is an important category with the highest sales volume on cross-border e-commerce platforms such as Amazon and Temu. According to Amazon data, in the past year, the number of products sold by Chinese sellers to consumers and business customers through Amazon's global site increased by more than 20% year over year; the number of Chinese sellers with sales exceeding 10 million US dollars increased nearly 30% year over year.

Jiayi shares are a typical beneficiary of this trend. The company focuses on the OEM thermos business and sells products to overseas markets through exports. According to financial reports, developed countries such as Europe, America, Japan and South Korea are its main sales regions, and overseas revenue accounts for 95.07% of revenue.

Last year, the “viral” spread of Stanley, the largest customer in North America, on social media, encouraged Jiayi Co., Ltd. to take off together.

An unexpected car fire unexpectedly became the starting point of the Stanley Straw Cup saga. In this accident, the Stanley sippy cup inside the car actually survived. This miraculous incident quickly sparked a buzz on social networks, and CEO Stanley immediately picked up traffic and gave away a new car and a new cup to the person concerned.

Subsequently, through viral marketing by KOLs and influencers on TIKTOK, the Stanley sippy cup quickly became a top fashion item among white American women, successfully breaking the circle from the professional outdoor market to the mass consumer market. Its fashion attributes and strong social attributes have significantly increased the customer unit price and repurchase rate of the product, and brought continuous growth impetus to the brand.

(Stanley traffic only began to rise in '23, and rose sharply at the end of the year due to car delivery incidents. Source: TuBong Creative)

According to Amazon data, in November and December 2023, the sales volume of Stanley thermos mugs reached 712,000 and 1.168,000, respectively, with year-on-year increases of 125.8% and 135%, respectively. By mid-January 2024, Stanley thermos mugs still ranked first in sales in the category, with a share as high as 40%.

With the release of Stanley's popular high-capacity water cup Quencher series, its average sales price also increased from around $30 to over $50, far exceeding the average price of other brands around $20-30.

Take Stanley's best-selling Quencher H2.0 FlowState 40 oz capacity as an example, which sells for $45 to $50; while its competitor's RAMBLER series, which has the most reviews on the YETI website, is priced at $35 to $38.

As the main foundry of the Quencher cup type, Jiayi Co., Ltd. also enjoys higher premium rights and profit margins, and its gross margin far exceeds that of its peers. Looking at the split price, in 2023, the company sold 38.13 million thermos cups, up 17.6% year on year; production volume was 388.85 million, up 19.8% year on year; average factory price was 46.6 yuan, up 19.8% year on year.

(The gross profit of Jiayi Co., Ltd. far exceeds that of peers; insight into research and mapping)

Driven by huge demand, the company's capacity utilization rate reached an unprecedented high, and the production and sales rate for the first three quarters of 2023 even exceeded 140%. According to information on the Amazon platform on March 3, the current Quencher thermos mug series is still limited to two, and some colors of small-capacity (14 oz and 20 oz) cups are still out of stock, and production and sales are still tight.

In response, the company plans to raise 398 million dollars to expand production by issuing convertible bonds for the production and construction project of 13.5 million stainless steel vacuum thermos cups per year in Vietnam. Domestic production capacity is expected to be released within 2024, and the Vietnamese plant will start contributing to the increase in production capacity in 2025. As production capacity expands, the company's ability to take orders will be further enhanced, further unlocking performance potential.

The fragility of foundry

However, the market is still concerned about the fragility of foreign trade foundries and the continuation of Stanley's growth.

According to some market opinions, the business model of foreign trade foundries is inherently weak. For example, Lixun Precision's business model is inherently weak. For example, if Apple loses such a big customer, it will disrupt the enterprise.

(PMI accounts for nearly 85% of Jiayi's revenue. Source: Jiayi Shares 2013 Annual Report)

Currently, the competitive pattern of the domestic thermos mug manufacturing industry is characterized by fragmentation and fierce competition. Although the company is a leader in the foundry industry, its success does not only depend on foundry capabilities, but also thanks to the popularity of its OEM products, the Stanley Quencher series, in the market. However, Hals, which is also a PMI OEM (its largest customer is YETI, and the second largest customer is PMI), has fallen into a different fate of OEM manufacturing different production lines for the same brand.

Due to its high dependency on Stanley, the company's prosperity is also largely constrained by Stanley's market dynamics.

Drawing on YETI's development path, since the first iconic cup product was launched in 2014, it has continued to launch different cup types; at the same time, since 2017, it has actively expanded overseas markets. The non-US market revenue CAGR reached 101% in 2017-2023, and YETI's non-US market revenue share reached 15.5% in 2023.

Similarly, Stanley has strengthened the marketing of the new IceFlow series since 2023. According to data from Amazon's US site, the monthly sales volume of this series of products continued to increase month-on-month. By February 2024, the IceFlow series had reached 20% of sales, an increase of 16 percentage points over the previous year.

However, the market is also concerned about a possible decline in sales after high growth. According to Amazon's US TOP100 product data, in February 2024, the Stanley brand sold 570,000 units, up 70% year on year; while the YETI brand sold 230,000 units, down 18% year on year. Of the cumulative sales volume from January to February, Stanley reached 1.36 million units, up 115% year on year; YETI was 530,000 units, down 1% year on year.

The business model of deeply binding a single major customer makes Jiayi Co., Ltd. closely linked to the fate of the Stanley brand. However, compared to the domestic market, going overseas is definitely more profitable.