Financial giants have made a conspicuous bearish move on $Goldman Sachs (GS.US)$. Our analysis of options history for Goldman revealed 33 unusual trades.

Delving into the details, we found 48% of traders were bullish, while 51% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $1,080,375, and 23 were calls, valued at $1,068,999.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $290.0 to $435.0 for Goldman Sachs Gr over the last 3 months.

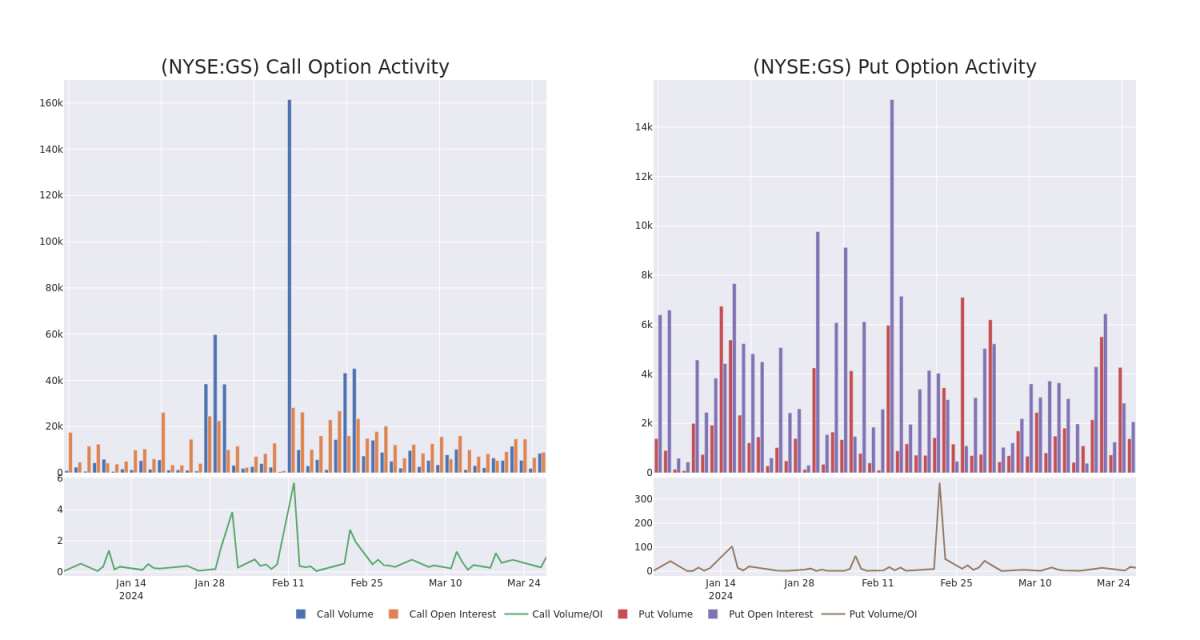

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Goldman Sachs Gr's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Goldman Sachs Gr's substantial trades, within a strike price spectrum from $290.0 to $435.0 over the preceding 30 days.

Goldman Sachs Gr Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

GS | PUT | TRADE | BULLISH | 11/15/24 | $24.5 | $24.25 | $24.35 | $410.00 | $487.0K | 147 | 202 |

GS | PUT | TRADE | BULLISH | 01/17/25 | $21.85 | $21.55 | $21.58 | $390.00 | $129.4K | 1.2K | 60 |

GS | PUT | SWEEP | BEARISH | 05/17/24 | $9.85 | $9.65 | $9.75 | $410.00 | $115.0K | 265 | 271 |

GS | PUT | SWEEP | BEARISH | 05/17/24 | $9.55 | $9.5 | $9.55 | $410.00 | $95.5K | 265 | 613 |

GS | CALL | SWEEP | BULLISH | 04/19/24 | $4.7 | $4.55 | $4.66 | $430.00 | $93.9K | 1.3K | 442 |

About Goldman Sachs

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

Having examined the options trading patterns of Goldman Sachs Gr, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Goldman Sachs

With a trading volume of 1,089,354, the price of GS is up by 0.36%, reaching $416.75.

Current RSI values indicate that the stock is may be approaching overbought.

Next earnings report is scheduled for 18 days from now.

Professional Analyst Ratings for Goldman Sachs Gr

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $430.0.

Showing optimism, an analyst from Daiwa Capital upgrades its rating to Outperform with a revised price target of $430.

An analyst from JP Morgan has decided to maintain their Overweight rating on Goldman Sachs Gr, which currently sits at a price target of $424.

In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $390.

Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Goldman Sachs Gr, targeting a price of $446.

An analyst from HSBC persists with their Buy rating on Goldman Sachs Gr, maintaining a target price of $460.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.