On the evening of January 30, a number of A-share listed companies announced their 2023 annual results forecasts.

A few companies are happy and a few are sad. The Ningde Era expects net profit to increase by more than 30% over the same period last year, reaching 42.5 billion yuan to 45.5 billion yuan, with daily earnings exceeding 116 million yuan; China Shenhua's profit in 2023 will drop 9.9% to 14%, and the drop in coal prices will affect performance.

Sluggish pig prices have caused most listed pig companies to report losses in 2023, and industry differentiation has intensified. Among them, Muyuan Co., Ltd. expects a net loss of 3.9 billion to 4.7 billion yuan in 2023, and a profit of over 13.2 billion yuan in 2022.

The price of lithium carbonate fell sharply, with an annual drop of more than 80%, putting pressure on the performance of many lithium mining companies. Ganfeng Lithium's net profit in 2023 fell 69.76%-79.52% year on year; Tianqi Lithium's performance dived, and annual profit is expected to shrink from 24.1 billion yuan in the same period last year to less than 9 billion yuan, a pre-drop of more than 60%.

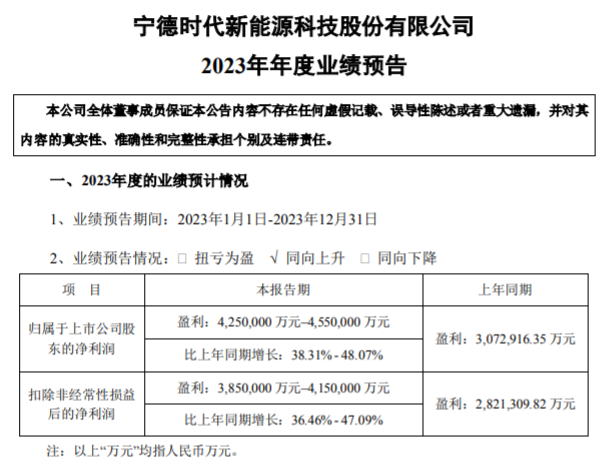

Ningde Times: Expected net profit of 42.5 billion yuan to 45.5 billion yuan in 2023, a year-on-year increase of 38.31%-48.07%

On January 30, Ningde Times released a performance forecast. Net profit attributable to shareholders of listed companies is expected to be 42.5 billion yuan to 45.5 billion yuan in 2023, an increase of 38.31%-48.07% over the previous year.

The main reasons for the increase in performance in the reporting period compared to the same period last year are: the domestic and foreign energy industry maintained a relatively rapid growth rate, the power battery and energy storage industry market continued to grow, and the trend of shifting towards clean energy from the “dual carbon” target was clear.

During the reporting period, the company's new technologies and products were launched one after another, overseas market expansion accelerated, customer partnerships were further deepened, and while production and sales grew rapidly, it also achieved good economic benefits.

According to Ningde Times Quarterly Report, in the third quarter, revenue was 105.431 billion yuan, up 8.28% year on year; net profit to mother was 10.428 billion yuan, up 10.66% year on year. Based on this calculation, Ningde Era's net profit for the fourth quarter of 2023 is expected to be 11.355 billion yuan to 14.355 billion yuan, an increase of 8.89% to 37.66% over the previous month.

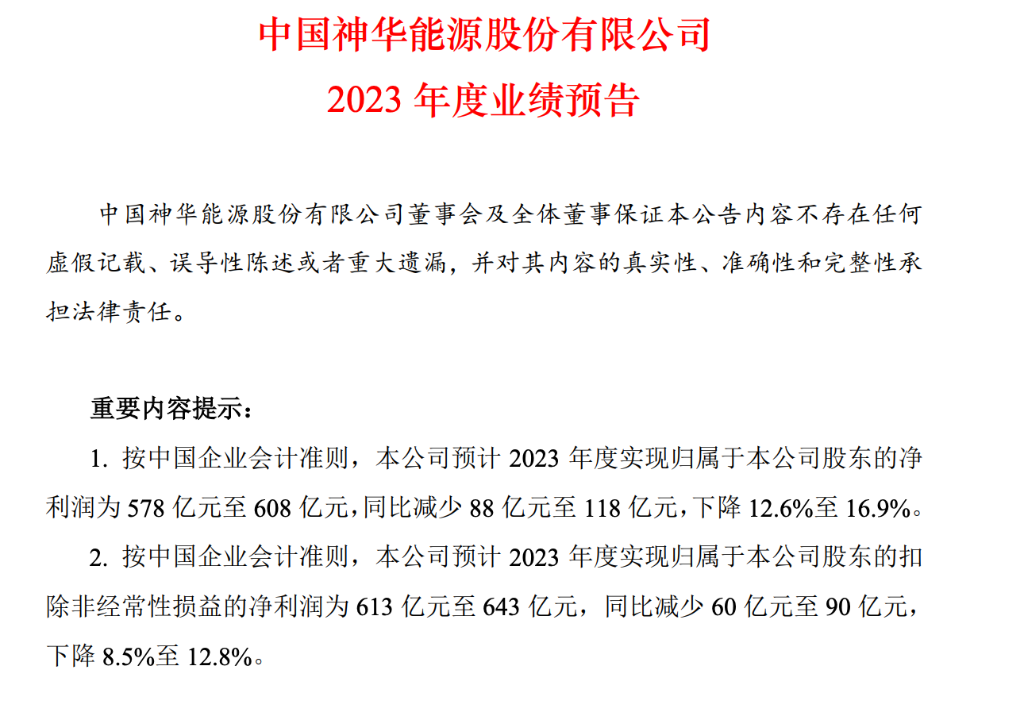

China Shenhua: Expected net profit of 62.7 billion yuan to 65.7 billion yuan in 2023, a year-on-year decrease of 9.9%-14.0%

On January 30, China's Shenhua issued an announcement. According to Chinese corporate accounting standards, the Company expects to achieve net profit attributable to the Company's shareholders of 57.8 billion yuan to 60.8 billion yuan in 2023, a year-on-year decrease of 8.8 billion yuan to 11.8 billion yuan, a decrease of 12.6% to 16.9%.

The Company expects to achieve net profit of 61.3 billion yuan to 64.3 billion yuan after deducting non-recurring profit and loss attributable to shareholders of the Company in 2023, a year-on-year decrease of 6 billion yuan to 9 billion yuan, a decrease of 8.5% to 12.8%.

Furthermore, China Shenhua released a performance forecast on the Hong Kong Stock Exchange, stating that net profit is expected to be 62.7 billion yuan to 65.7 billion yuan in 2023, a year-on-year decrease of 9.9% to 14.0%.

Regarding the decline in net profit, China's Shenhua pointed out that, first, due to factors such as a drop in the average sales price of coal, the coal division's profit declined year on year; second, due to factors such as heavy railway maintenance, railway division costs increased year on year; third, non-operating expenses increased year on year; fourth, when some coal subsidiaries of the Group settled and paid corporate income tax during the same period of the previous year, the current income tax was deducted. Income tax expenses increased year on year.

Muyuan Co., Ltd.: The net profit for 2023 is expected to be a loss of 3.8 billion yuan to 4.6 billion yuan, compared to a profit of 14.933 billion yuan for the same period last year

On January 30, Muyuan Co., Ltd. announced its 2023 annual results forecast. The net profit for 2023 is expected to be a loss of 3.8 billion yuan to 4.6 billion yuan, compared to a profit of 14.933 billion yuan for the same period last year.

There was a loss in the company's operating performance in 2023, mainly due to a sharp drop in pig prices during the reporting period compared to last year. At the same time, after performing impairment tests on expendable biological assets in accordance with the requirements of accounting standards, the company plans to calculate impairment preparations for some expendable biological assets. The specific data is subject to the audit results.

Muyuan Co., Ltd. previously announced that it sold a total of 63.816 million pigs in 2023. According to this estimate, the average loss amount in the past year may have been around 50 yuan, and the average head loss was lower than the industry level.

According to pig industry data previously released by the Ministry of Agriculture and Rural Affairs, from January to December 2023, the highest monthly net profit loss per head of free-range pigs reached 420 yuan/head, and the highest monthly net profit per head of large-scale breeding pigs also reached 243 yuan/head. Some analysts point out that assuming the same monthly sales volume, the average loss of free-range pig heads in 2023 is roughly estimated to be about 239 yuan, and the average loss for large-scale farming heads will also reach about 92 yuan.

New Hope: Expected net profit of 300 million yuan in 2023, after deducting non-net loss of 4.5 billion yuan

New Hope's net profit is expected to be 300 million yuan in 2023 and a loss of 1.46 billion yuan in 2022. This is also the first time that New Hope's performance has been corrected since 2021 was deeply entrenched in the cycle.

During the reporting period, the introduction of strategic investment in the company's white feather meat, poultry and food deep processing business affected the net profit of the mother. The impact amount was about 5.1 billion yuan to 5.2 billion yuan. This project was an unrecurring profit and loss; due to the decline in pig sales prices, losses in the pig industry were the main reason for deducting non-net profit losses in the current period.

Aonong Biotech: Expected net loss of 3 billion yuan to 3.6 billion yuan in 2023

Aonong Biotech announced that it expects a net loss of 3 billion yuan to 3.6 billion yuan in 2023. Compared with the same period last year, it will continue to lose money.

According to the announcement, pig prices continued to be low in 2023. The average sales price of commercial pigs was 14.38 yuan/kg, down 22.44% from 18.66 yuan/kg in the same period last year, which had a significant impact on the company's operating capital.

In order to ease financial pressure, the company began releasing pigs early in the second half of the year. Fat pigs were underweight, and fat pigs weighed 97.97 kilograms throughout the year; at the same time, they actively shut down some inefficient pig farms, causing some shutdown losses, leading to huge losses in the pig breeding business.

Ganfeng Lithium: Expected net profit of 4.2 billion yuan to 6.2 billion yuan in 2023, a year-on-year decrease of 79.52% to 69.76%

Ganfeng Lithium pointed out that during the reporting period, due to the cyclical impact of the lithium industry, the growth rate of terminal demand slowed, the price of lithium salt products dropped sharply, and the price drop in lithium ore raw materials was less than that of lithium salt and downstream products, leading to a decline in the company's gross margin. Furthermore, the company calculated asset impairment preparations for related assets in accordance with accounting standards, so the company's performance declined sharply year on year.

Since the end of 2022, the price of lithium carbonate has been falling all the way, from a high of 600,000 yuan/ton to less than 100,000 yuan/ton today, putting pressure on the performance of many lithium mining companies.

Wall Street heard about this, and Ganfeng Lithium bucked the trend and bought lithium mines. According to Australian mining manufacturer Pilbara's announcement on January 15, 2024, it signed an amendment to the underwriting agreement with Ganfeng Lithium. Ganfeng Lithium will increase the purchase volume of spodumene concentrate from Pirbala, from 160,000 tons per year until now to a maximum of 310,000 tons per year for the next three years.

Tianqi Lithium: Expected net profit of 6.62 billion yuan to 8.95 billion yuan in 2023, a year-on-year decrease of 62.90%-72.56%

According to the 2023 performance forecast released by Tianqi Lithium, net profit has been reduced by more than 60%. The company expects to achieve net profit of 6.62 billion yuan to 8.95 billion yuan during the reporting period, a decrease of 62.9%-72.56% over the same period last year.

Tianqi Lithium said that in 2023, due to fluctuations in the lithium chemical product market, the sales price of the company's lithium chemical products fell compared to the previous year, and the gross profit of lithium chemical products declined; in addition, the increase in the sales price of lithium concentrate compared to the previous year led to an increase in the net profit of the company's holding subsidiary Windfield Holdings Pty Ltd., an increase in income tax expenses, and an increase in profit and loss for minority shareholders.

Shengxin Lithium Energy: Net profit is expected to drop 85.59%-87.39% year-on-year in 2023

According to the 2023 performance forecast released by Shengxin Lithium Energy, net profit for 2023 is expected to be 700 million yuan to 800 million yuan, a year-on-year decrease of 85.59%-87.39%. During the reporting period, due to the market environment in the lithium battery new energy industry, lithium salt prices dropped sharply, costs increased year-on-year, and the profit margin of lithium salt products was compressed.

360: Expected net loss of 370 million yuan to 550 million yuan in 2023, compared to -2204 billion yuan in the same period last year

360 announced that in 2023, the company expects to achieve net profit attributable to owners of the parent company of about -550 million yuan to -370 million yuan, compared to -2204 billion yuan for the same period last year. During the reporting period, the company's revenue declined slightly compared to the same period last year, and overall gross profit was basically the same as the same period last year. The expected losses for the 2023 fiscal year are mainly due to investment gains and losses and large losses of some joint ventures.

At the AI business level, 360 actively lays out the big model business, launched the “360 Smart Brain”, a cognitive general-purpose model with 100 billion parameters, and has introduced the “360 Family Bucket” product to the public. In addition, 360 has actively promoted the implementation of big models in the enterprise market, launched big model industry alliances, developed its own “Qiyuan” big model for B-side users, etc., and has now completed the complete layout of the C-side and B-side markets.

At the security business level, 360 has broken the traditional cybersecurity “sales” model, fully “cloud-based” its security capabilities to serve the country, and launched a next-generation security product, 360 Security Cloud, with the concept of “security as a service”, which has been recognized by the market. It has already had more than a thousand benchmark customers, and the second security growth curve has been further strengthened.

Trina Solar: Net profit is expected to increase by 43.27% to 58.36% year-on-year in 2023

Tianhe Solar: Net profit is expected to be 5.27 billion yuan to 5.83 billion yuan in 2023, an increase of 43.27% to 58.36% over the previous year; benefiting from the sharp increase in N-type advanced production capacity, the sales share of the company's TopCon module products has increased significantly, and sales of the company's high-power 210 series photovoltaic products have increased dramatically and been recognized by the market.

On the evening of January 30, Tianhe Solar released a performance forecast. The net profit for 2023 is expected to be 5.27 billion yuan to 5.83 billion yuan. Compared with the same period last year, it will increase by about 1,592 billion yuan to 2.147 billion yuan, an increase of 43.27% to 58.36% over the previous year.

During the reporting period, benefiting from a sharp increase in N-type advanced production capacity, the sales share of the company's TopCon module products increased significantly; sales of the company's high-power 210 series photovoltaic products increased dramatically and were recognized by the market; and the gradual release of the company's self-produced N-type silicon wafer production capacity further reduced the overall cost of the company's module products.

Despite facing changes in the supply and demand relationship in the industry in the second half of the year and the overall price trend of fluctuations and downward trends in the PV industry chain, the company continued to take advantage of global brands, channel advantages, and advantages in the distribution market, which enabled the company's photovoltaic product business to develop rapidly. Sales of photovoltaic modules, brackets and distributed systems increased significantly, and business performance further improved.

China Eastern Airlines: Forecast loss of 6.8 billion yuan to 8.3 billion yuan in 2023

China Eastern Airlines announced that it expects a net loss of 6.8 billion yuan to 8.3 billion yuan in 2023, and a net loss of 37.386 billion yuan for the same period last year.

Due to factors such as air traffic rights restrictions, visa policies, and insufficient security resources, the overall recovery progress of international routes fell short of expectations; the transfer of wide-body airliners to the domestic market led to an increase in capacity supply in the domestic market; and due to factors such as weak travel demand for public and business travelers and exchange rate fluctuations, the company's business performance in 2023 is expected to improve significantly compared to 2022 but still experience losses.

BOE A: Expected net profit of 2.3 billion yuan to 2.5 billion yuan in 2023, a year-on-year decrease of 67%-70%

BOE A released a performance forecast. Net profit due to mother is expected to be 2.3 billion yuan to 2.5 billion yuan in 2023, a year-on-year decrease of 67% to 70%.

In 2023, the company shipped nearly 120 million pieces of flexible AMOLED throughout the year. Shipments increased dramatically, and the annual shipment target was basically achieved. The profitability of mature production lines improved significantly year-on-year.

Although the company's performance declined during the reporting period due to the impact of the industry, it continued to grow in 2023. The company's operating income and net profit after deducting non-recurring profit and loss all maintained a steady increase from quarter to quarter, and net profit attributable to shareholders of listed companies also increased significantly in the fourth quarter of 2023, laying a good foundation for the company's development in 2024.

Huadian International: Net profit is expected to be about 4.15 billion yuan to 4.98 billion yuan in 2023. After the restatement, the year-on-year increase was 3478% to 4193%

According to the announcement, the company is expected to achieve net profit attributable to shareholders of listed companies in 2023 of 4.15 billion yuan to 4.98 billion yuan (RMB, same below), an increase of 4.05 billion yuan to 4.88 billion yuan over the same period of the previous year (before restatement), an increase of 4050% to 4880%; an increase of 4,034 billion yuan to 4.864 billion yuan over the same period last year (after restatement), an increase of 3478% to 4193% over the same period last year.

Net profit attributable to shareholders of listed companies was 3.42 billion yuan to 4.25 billion yuan, with a net loss of about 576 million yuan for the same period last year (before restatement), an increase of 3,996 billion yuan to 4.826 billion yuan over the same period of the previous year (before restatement); net loss for the same period last year (after restatement) was about 560 million yuan, an increase of 3.98 billion yuan to 4.81 billion yuan over the same period last year (after restatement), turning a year-on-year loss into profit.

According to the announcement, the pre-increase in the company's 2023 operating performance was mainly affected by a combination of lower fuel prices, incremental benefits contributed by new production projects, and reduced investment income from participating coal companies.

Aixu Co., Ltd.: Expected net profit of 735 million yuan to 775 million yuan in 2023, a year-on-year decrease of 66.71% to 68.43%

Aixu Co., Ltd. announced that it expects net profit of 735 million yuan to 775 million yuan in 2023, a year-on-year decrease of 66.71% to 68.43%.

The overall price of the photovoltaic industry chain fluctuated downward throughout the year. Industry competition was particularly intense in the fourth quarter, and the price of photovoltaic products fell rapidly; the company's main business, the price of battery and module products fell, and calculated fixed asset impairment preparations and inventory price reduction preparations had a great impact on the fourth quarter results.