On the evening of January 29th, BYD announced its 2023 performance forecast. With the profit growth rate of most NEV companies turning negative, and even showing profit and loss, BYD's net profit has maintained a steady high growth rate.

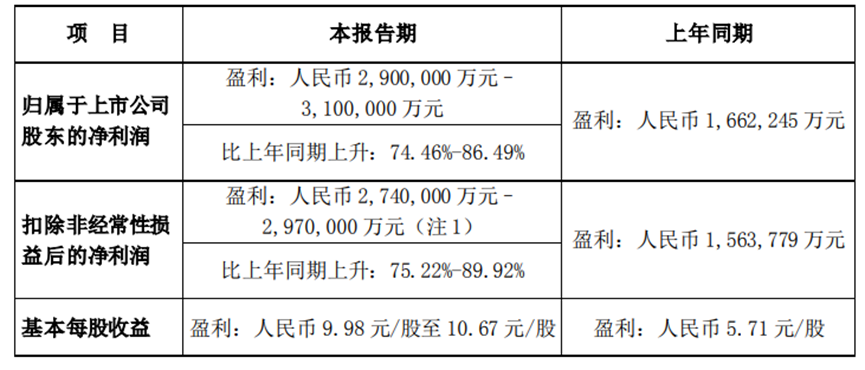

For the full year of 2023, BYD expects to achieve net profit attributable to shareholders of listed companies of 29 billion yuan to 31 billion yuan, an increase of 74.46%-86.49% over the previous year; to deduct non-net profit of 27.4 billion yuan to 29.7 billion yuan, an increase of 75.22% to 89.92% over the previous year.

In the fourth quarter of 2023, BYD expects to achieve net profit attributable to shareholders of listed companies of 7.63 billion yuan to 9.63 billion yuan, an increase of 4.4% to 31.7% year on year and a decrease of 7.5% to 26.7% month on month; to achieve deducted non-net profit of 8.05 billion yuan to 10.35 billion yuan, an increase of 10.7%-42.3% year on year, a change of -16.6% -7.2% month-on-month.

1. After sales volume and gross margin surpass Tesla, the next target is profit

In 2023, BYD successfully won the top spot in the global electric vehicle sales rankings. The annual sales volume of electric vehicles reached 3.024 million units, an increase of 62.3% over the previous year. While successfully achieving the annual sales target, it also left its old rival Tesla (1.81 million units) behind.

In addition, BYD's gross profit margin (18.7%) surpassed Tesla (18.2%) for the first time in the second quarter of 2023, and continued to lead in the third quarter. Considering that Tesla's gross margin in the fourth quarter once again hit its lowest level since 2019, it is likely that BYD will continue to maintain its dominant position in gross margin.

However, it is worth noting that in terms of bicycle profits, BYD experienced a decline in the fourth quarter.

Excluding the estimated net profit of 980 million yuan for the fourth quarter announced by BYD Electronics, the net profit for the fourth quarter of BYD's auto business is estimated to be 6.65 billion yuan to 8.65 billion yuan, and BYD's bicycle profit is around 70,000 yuan to 0.92 million yuan, which is a month-on-month decline compared with the bicycle profit of 10,800 yuan in the third quarter.

According to Wall Street News and Insights research, the reasons for the month-on-month decline in BYD's bicycle profit are the following two points:

First, in order to guarantee the achievement of the sales target of 3 million vehicles, BYD reduced the prices of the main models in the Dynasty series, such as the Qin, Han, Tang, and Song, in the fourth quarter, ranging from 30,000 yuan to 15,000 yuan. Judging from BYD's 2023 model sales structure, the sales share of the Dynasty series products still remains around 50%, so the price reduction for this part of the model had a negative impact on BYD's bicycle profits in the fourth quarter.

Second, in order to celebrate the achievement of sales targets, BYD distributed an additional 2 billion yuan in rewards to its major car dealers at the end of the year. If this amount is added back, BYD's bicycle profit for the fourth quarter will return to more than 10,000 yuan.

2. High-end products and intelligent architecture are BYD's top priorities in the future

2023 is the first year that BYD officially enters the high-end market. The high-end models launched, such as the U8 and Equation Leopard 5, have received great attention in the market. However, due to the short launch time, the total sales volume of such high-end series models in 2023 is still less than 5%, unable to support BYD's sales and profit growth.

However, 2024 will be a year when BYD's high-end products explode, which is expected to change the situation where low-end models in the BYD Dynasty series continue to account for half of sales.

First, BYD's high-end products will launch more products in 2024, including models such as Tensei N9, Equation Leopard 3, Equation Leopard 8, and Upward U9. This will all improve the sales structure of BYD's new energy vehicle products and drive an increase in bicycle revenue and profit levels.

Second, BYD, which has always kept a very low profile in the field of intelligent driving, has also officially launched the Xuanji Architecture, the industry's first intelligent architecture that integrates intelligence and electricity. It is worth noting that this intelligent driving solution, which brings together the efforts of more than 4,000 BYD engineers, will not only be equipped with high-end brands Looking Up and Tension, but will also provide intelligent driving options for more than 200,000 models, and intelligent driving solutions as standard for more than 300,000 models. Undoubtedly, this will greatly enhance the appeal of BYD's mid-range and high-end models.

However, this is just the beginning. BYD will continue to invest 100 billion yuan in the field of intelligence in the future to maintain its dominant position in the field of intelligent driving.

As BYD completes the last few pieces of the puzzle — high-end brand models and intelligent driving solutions — on the map, BYD will achieve a spectacular transformation from a domestic NEV leader to a global automobile giant.