Launching the first performance forecast, Dang Sheng Technology, and net profit turned negative.

Dangsheng Technology was the first to release a profit forecast for the fourth quarter of 2023. As a leader in domestic ternary cathode materials, Dangsheng Technology's net profit declined for the first time in 4 years.

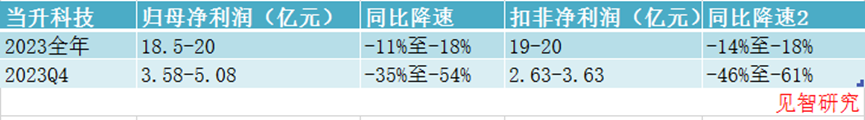

Throughout 2023, Dangsheng Technology is expected to achieve net profit of 1.85 billion yuan to 2 billion yuan, a year-on-year decrease of 11.45%-18.09%; net profit after deducting non-recurring profit and loss is expected to be 1.9 billion yuan to 2 billion yuan, a year-on-year decrease of 13.99%-18.29%.

Among them, in the fourth quarter of 2023, Dangsheng Technology expects net profit attributable to the parent company to be 358 million yuan to 508 million yuan, a year-on-year decrease of 35%-54%; net profit after deducting non-recurring profit and loss is 263 million yuan to 363 million yuan, a year-on-year decrease of 46% to 61%.

(1) The proportion of ternary lithium batteries dropped to 32.6%

Manufacturers of ternary cathode materials are now facing an embarrassing situation where product volume and price are poor. Specifically, as more and more new energy vehicle companies begin to choose lithium iron phosphate batteries, the proportion of domestic ternary lithium batteries installed is getting lower and lower.

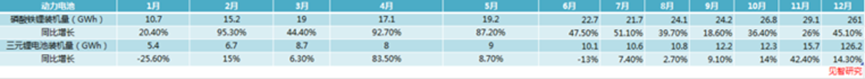

Throughout 2023, the installed capacity of domestic ternary lithium batteries was only 126.2 GWh, and the year-on-year growth rate has dropped to 14.3%. It is only one step away from single-digit growth, opening a big gap with the 42% year-on-year growth rate of lithium iron phosphate batteries, and its share of total installed capacity has also dropped from half of the previous volume to 32.6% today.

(2) The price of ternary cathode material products

As the first year of a complete decline in new energy vehicles, in 2023, the price of battery-grade lithium carbonate dropped from a peak of around 520,000 yuan/ton to 100,000 yuan/ton, while the price of ternary cathode materials also fell again and again. The prices of the three main specifications of the 523, 622, and 811 models all dropped by more than 60%.

New energy vehicle companies have begun to increase the proportion of lithium iron phosphate batteries installed. Coupled with large fluctuations in the price of raw material battery-grade lithium carbonate, the market size of midstream ternary cathode materials has begun to shrink, and competitive pressure has also increased dramatically. As a result, the price of ternary cathode materials has dropped again and again.

Against the backdrop of a sharp drop in the volume and price of ternary cathode materials, even Dangsheng Technology, a leader in the industry, found it difficult to resist the downward cycle, and profits began to decline.

(3) Ternary cathode material manufacturers generally have poor profits

The contraction of the ternary cathode materials market has not only affected Dangsheng Technology, but competitors such as Changyuan Lithium have also been hit hard. In 2023, Changyuan Lithium is expected to lose 110 million yuan to 150 million yuan in net profit for the whole year. Despite the contraction of the ternary cathode materials market, Dangsheng Technology maintained positive profits, mainly due to its leading position (the top five in the global market share of ternary cathode materials, accounting for about 10%) and an international customer base.

Dangsheng Technology has many international customers, and its high-margin overseas business accounts for a large share. As the first domestic company to export ternary cathode materials, Dangsheng Technology has a clear first-mover advantage in overseas markets. It has established deep strategic cooperation with world-class brand power battery companies such as SK ON, AESC, LG New Energy, and Murata, and has jointly invested with FMG and FBC to build a European new materials industry base in order to maintain its leading position in overseas markets.

In the first half of 2023, Dangsheng Technology's overseas business profit reached 630 million yuan, accounting for 42.63% of total profit. The gross margin was 21.68%, far higher than 15.4% of the domestic business. In contrast, Dangsheng Technology's competitors, such as Rongbai Technology, Changyuan Lithium, Xia Tungsten New Energy, and Zhenhua New Materials, accounted for only 3.27%, 1.34%, 6.27%, and 4.26% of profits, respectively (some ternary cathode material manufacturers did not disclose their overseas share in the first half of 2023, which was replaced by the overseas sales level for the full year of 2022).

This data shows that Dangsheng Technology's penetration rate in overseas markets is much higher than that of other domestic ternary cathode material manufacturers, and this advantage is particularly important in the face of the overall downturn in the industry.

Against the backdrop of middle- and downstream manufacturers in the domestic lithium battery industry chain starting an inventory removal model this year, Dangsheng Technology's high share of overseas customers guarantees Dangsheng Technology's profitability.