Frasers Property Limited's (SGX:TQ5) CEO Might Not Expect Shareholders To Be So Generous This Year

Frasers Property Limited's (SGX:TQ5) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

關鍵見解

- Frasers Property to hold its Annual General Meeting on 24th of January

- Salary of S$996.0k is part of CEO Panote Sirivadhanabhakdi's total remuneration

- The total compensation is 230% higher than the average for the industry

- Frasers Property's EPS declined by 6.2% over the past three years while total shareholder loss over the past three years was 21%

- 弗雷澤地產將於1月24日舉行年度股東大會

- 996.0萬新元的薪水是首席執行官帕諾特·西里瓦達納巴克迪總薪酬的一部分

- 總薪酬比該行業的平均水平高出230%

- 弗雷澤地產的每股收益在過去三年中下降了6.2%,而過去三年的股東總虧損爲21%

Frasers Property Limited (SGX:TQ5) has not performed well recently and CEO Panote Sirivadhanabhakdi will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 24th of January. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

弗雷澤地產有限公司(新加坡證券交易所股票代碼:TQ5)最近表現不佳,首席執行官帕諾特·西里瓦達納巴克迪可能需要提高競爭力。在1月24日的下一次股東周年大會上,股東們可以藉此機會追究董事會和管理層對錶現不佳的責任。他們還將有機會通過對諸如高管薪酬之類的決議進行投票來影響管理決策,這可能會影響企業未來的價值。根據我們的分析,我們認爲鑑於最近的表現,可能需要對首席執行官的薪酬進行審查。

See our latest analysis for Frasers Property

查看我們對弗雷澤地產的最新分析

Comparing Frasers Property Limited's CEO Compensation With The Industry

將弗雷澤地產有限公司的首席執行官薪酬與業界進行比較

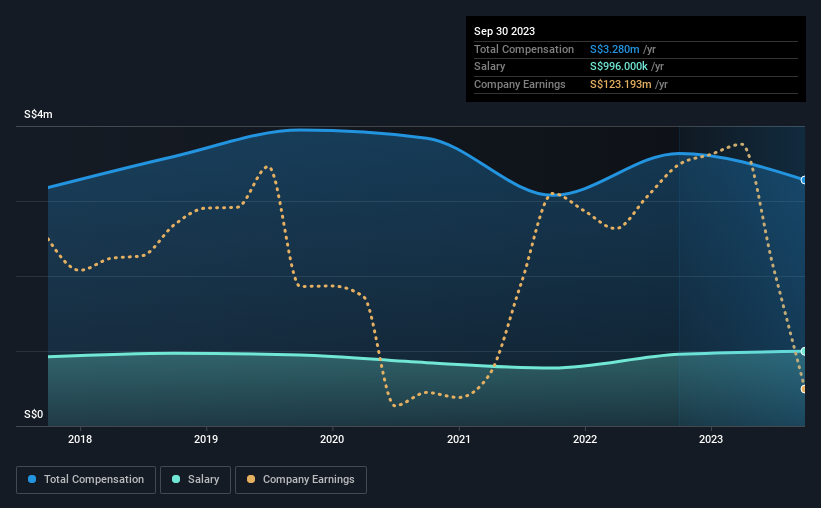

Our data indicates that Frasers Property Limited has a market capitalization of S$3.7b, and total annual CEO compensation was reported as S$3.3m for the year to September 2023. Notably, that's a decrease of 9.8% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at S$996k.

我們的數據顯示,弗雷澤地產有限公司的市值爲37億新元,截至2023年9月的一年中,首席執行官的年薪酬總額報告爲330萬新元。值得注意的是,這比上年下降了9.8%。我們認爲總薪酬更爲重要,但我們的數據顯示,首席執行官的薪水較低,爲99.6萬新元。

On comparing similar companies from the Singaporean Real Estate industry with market caps ranging from S$2.7b to S$8.6b, we found that the median CEO total compensation was S$995k. Accordingly, our analysis reveals that Frasers Property Limited pays Panote Sirivadhanabhakdi north of the industry median.

在比較新加坡房地產行業市值從27億新元到86億新元不等的類似公司時,我們發現首席執行官的總薪酬中位數爲99.5萬新元。因此,我們的分析顯示,弗雷澤地產有限公司向帕諾特·西里瓦達納巴克迪支付的款項位於行業中位數以北。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | S$996k | S$956k | 30% |

| Other | S$2.3m | S$2.7m | 70% |

| Total Compensation | S$3.3m | S$3.6m | 100% |

| 組件 | 2023 | 2022 | 比例 (2023) |

| 工資 | 996 萬新元 | 956 萬新加坡元 | 30% |

| 其他 | 230 萬新元 | 270 萬新元 | 70% |

| 總薪酬 | 330 萬新元 | 360 萬新元 | 100% |

On an industry level, around 45% of total compensation represents salary and 55% is other remuneration. Frasers Property sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

在行業層面上,總薪酬中約有45%代表工資,55%是其他薪酬。與整個行業相比,弗雷澤地產撥出的工資薪酬份額較小。值得注意的是,對非工資薪酬的傾向表明,總薪酬與公司的業績掛鉤。

Frasers Property Limited's Growth

輝盛地產有限公司的增長

Over the last three years, Frasers Property Limited has shrunk its earnings per share by 6.2% per year. It achieved revenue growth of 1.8% over the last year.

在過去的三年中,弗雷澤地產有限公司的每股收益每年縮水6.2%。去年,它實現了1.8%的收入增長。

The decline in EPS is a bit concerning. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

每股收益的下降有點令人擔憂。而且,在每股收益下降的情況下,12個月的溫和收入增長並不令人滿意。很難說該公司正在全力以赴,因此股東可能不願接受高額的首席執行官薪酬。暫時偏離目前的形式,查看這份對分析師未來預期的免費可視化描述可能很重要。

Has Frasers Property Limited Been A Good Investment?

輝盛房地產有限公司是一項不錯的投資嗎?

With a three year total loss of 21% for the shareholders, Frasers Property Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

由於股東三年的總虧損爲21%,弗雷澤地產有限公司肯定會有一些股東不滿意。這表明該公司向首席執行官支付過於慷慨的薪水是不明智的。

To Conclude...

總而言之...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

股東不僅沒有獲得可觀的投資回報,而且業務表現也不佳。很少有股東願意向首席執行官加薪。在即將舉行的股東周年大會上,董事會將有機會解釋其計劃採取的改善業務績效的措施。

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 4 warning signs for Frasers Property you should be aware of, and 1 of them doesn't sit too well with us.

首席執行官薪酬是你需要關注的重要領域,但我們也需要關注公司的其他屬性。在我們的研究中,我們發現了你應該注意的弗雷澤地產的4個警告信號,其中一個不太適合我們。

Switching gears from Frasers Property, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

如果你正在尋找良好的資產負債表和保費回報,那麼這份免費的高回報、低負債公司的清單是一個不錯的選擇。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。