When prices are low everywhere, price is no longer the biggest advantage.

“Net profit attributable to shareholders of listed companies is expected to be 200 million yuan to 220 million yuan in 2023, an increase of 54.97% to 70.47% over the previous year.”

“During the 2024 goods festival, offline distribution of Three Squirrel gift boxes/gift pack products far exceeded expectations, and all products were sold out.”

Good news finally came from the Three Squirrels business.

Regarding the reason for the hot sales of products and the advance increase in performance, the company attributes this to the “high-end cost performance ratio” policy. This is also after Liangpin Store achieved remarkable results in exchanging price for volume, and another established snack company saw hope in cutting prices to save itself.

The snack industry is fighting round after round of fierce competition between low prices and old and new business formats.

Predictably, in 2024, the low price strategy will still be the common goal of brands represented by Three Squirrels and Good Products Stores, and channel players who are busy with snacks and represented by Wanchen Group.

However, it is worth thinking about, when all products are moving towards a low price trend, is the price still the most competitive advantage? When low prices become an industry consensus, what kind of moats does this low-threshold industry have?

From Tmall's top brand to Douyin's top brand, why are the three squirrels?

In 2023, low prices have gone viral, and it has become the main theme throughout retail. Young people no longer use Taobao and Jingdong as their first choice when shopping online. They are used to Pinduo's 10 billion subsidy and place orders on Douyin; famous white label groceries can also provide them with small happiness; offline, the “cost performance” of buying free brands at Hema and Allezi has become even more popular.

There is a general consensus in the market: in the face of pressure from oversupply and economic slowdown, “brands” and “premiums” can no longer impress consumers, and in the future retail will return to its essence — that is, complete product circulation with the lowest cost and maximum efficiency.

In the face of the irreversible trend of shifting from inefficient channels to high-efficiency channels, snack food brands have also embarked on a different path.

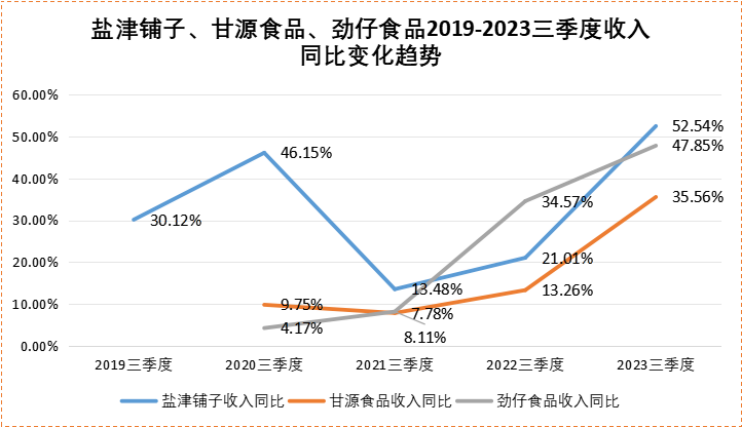

Among them, there is no shortage of upstream manufacturers such as Yanjin Stores, Jinzai Foods, and Ganyuan Foods, which have rapidly captured the dividends of the growth of snack discount stores.

In recent performance meetings, all three companies placed special emphasis on the contribution of the snack discount business to profit growth. Among them, Yanjin Shop mentioned the positive impact of the snack volume sales business on performance growth as early as 2022. Today, the snack chain channel accounts for more than 15% of sales.

(Insightful research on homemade maps)

In the 2023 performance forecast recently released by Jinzai Foods, it was revealed that the company's revenue exceeded 2 billion yuan and successfully achieved the phased goal of “doubling in three years” after listing. When summarizing the reasons for performance, emerging channels such as mass snack sales and new media e-commerce have once again become key factors that cannot be ignored.

The rise of mass snack sales has provided new growth for snack manufacturers that have transformed early and embraced new channels. However, it has had a greater impact on some traditional snack brands such as Liangpin Shop, Three Squirrels, and Laiyifen. In other words, the living environment has become more difficult for brands that fail to transform in time and still rely on the traditional path of brand premiums.

(Liangpin Shop, Three Squirrels, and Lai Yifen have all faced the problems of high sales expenses and weakening profitability in recent years. Research homemade maps with wisdom)

In order to reverse the decline in performance, these traditional snack brands also had to find ways to protect themselves.

Liangpin stores, which have always prided themselves on being high-end, have taken the lead in adopting a price reduction strategy. What is quite interesting is that soon after Liangpin Store's price was adjusted, Zhang Liaoyuan, founder of The Three Squirrels, popped out and said that he had implemented a “high-end cost performance” policy as early as a year ago. This shouting also succeeded in drawing the market's attention once again to this traditional snack brand, which is also facing a crisis.

The past performance of the Three Squirrels can be summed up by “Chengye E-commerce, Defeated E-commerce.”

In 2012, the three squirrels quickly rose to prominence on the Internet with e-commerce dividends, and have remained the “top brand” of Tmall for many years. However, as e-commerce dividends weakened, the three squirrels not only remained stuck in a traffic-centered business model, but also moved from a cost-effective direction based on Internet sales such as Tmall to a high brand premium direction and invested heavily in setting up offline stores. This also led to a wave of large-scale store closures in the later stages, and net profit dropped sharply from 411 million in 2021 to 129 million.

At the same time, ignoring new e-commerce platforms such as Douyin and live streaming caused the three squirrels to lose market share in competition and be taken over by many white cards and other brands.

By the end of 2022, the three squirrels realized that the style of play needed to change, so they began a “high-end cost performance” strategy that lasted more than a year.

However, price reduction is not an easy move. What is behind changes in retail prices is the redistribution of profits in the supply chain, logistics and transportation, raw material procurement, etc. If only price cuts do not improve efficiency, they may face the risk of not being even more profitable.

How to achieve the two seemingly contradictory concepts of “high-end” and “cost performance”? In Zhang Liaoyuan's words, the three squirrels should follow Sam's hard discount, that is, not reduce prices by sacrificing product quality.

Private branding is seen as the best path. According to the Three Squirrels, the optimization of private brands is not only about controlling costs in the middle, but can also be optimized through in-depth product ingredients and formulations, which is also a guarantee of product quality.

Currently, various brands and channels are using “low price” as a competitive advantage. As price differentiation gradually disappears, opportunities will gradually shift to the other side of the competitive balance — quality.

This is also a shortcoming of snack mass sales channels — they do not have their own supply chain, and products mainly rely on large-scale procurement in the upstream supply chain, making it difficult to strongly control quality.

In contrast, brands such as Liangpin Shop and Three Squirrels pay more attention to brand building, maintain closer ties with upstream raw materials, and have stronger brand awareness in the minds of consumers. This also explains why sales soared rapidly once the price of the three squirrels and the big item from Liangpin Store was cut.

(Picture source: Xiaohongshu)

For example, the Three Squirrels Explosive Macadamia nut product was produced in a self-built factory, and after cost optimization in the distribution process, the price in 23 was 30% lower than in '22. The store price was 26.39 yuan/kg, far lower than the price of 45.38 yuan/kg at Zhao Yiming's snack store (calculated at 5.9 yuan/65g price of Ganyuan mustard-flavored macadamia nuts).

When brands sell at lower prices than discount stores, how do consumers choose?

Judging from the data, the transformation of the three squirrels achieved initial results in 2023. According to the performance forecast for January 15, the company expects profit in 2023 to reach 200 million yuan to 220 million yuan, an increase of 54.97% to 70.47% over the previous year. As of January 15, the company has completed two-thirds of 2024 sales. Omni-channel sales have already exceeded the total sales volume of last year's New Year's Festival, and the performance is very strong.

Meanwhile, the three squirrels are returning to their old e-commerce business, with a particular focus on higher-traffic live e-commerce channels. The three squirrels have revealed to the media that in the eight months from April to the end of 2023, the three squirrels have cooperated with more than 300,000 vendors, and the Douyin talent distribution business contributed more than 4 billion yuan in sales; Douyin self-broadcast sales have increased 100%, and the growth rates of Dabao and the mall have reached 800% and 1000% respectively.

During the peak season for New Year's goods stocking in the first quarter, the three squirrels increased their investment in Douyin. By inviting leading star anchors such as Jia Nailiang and Simba to live a special live broadcast, they successfully boosted the company's sales on the Doukuai channel. According to brokerage data, from January 6 to 12, the total GMV of the Three Squirrels reached 210 million yuan, of which the total sales volume of the first special show after Jia Nailiang announced her endorsement exceeded 110 million yuan.

From the former “top brand of Tmall” to the “top name of Douyin,” the three squirrels are taking back the lost market.