Hallador Energy Company (NASDAQ:HNRG) shareholders have seen the share price descend 20% over the month. But over the last three years the stock has shone bright like a diamond. Over that time, we've been excited to watch the share price climb an impressive 822%. So the recent fall doesn't do much to dampen our respect for the business. The only way to form a view of whether the current price is justified is to consider the merits of the business itself. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the long term performance has been good but there's been a recent pullback of 14%, let's check if the fundamentals match the share price.

View our latest analysis for Hallador Energy

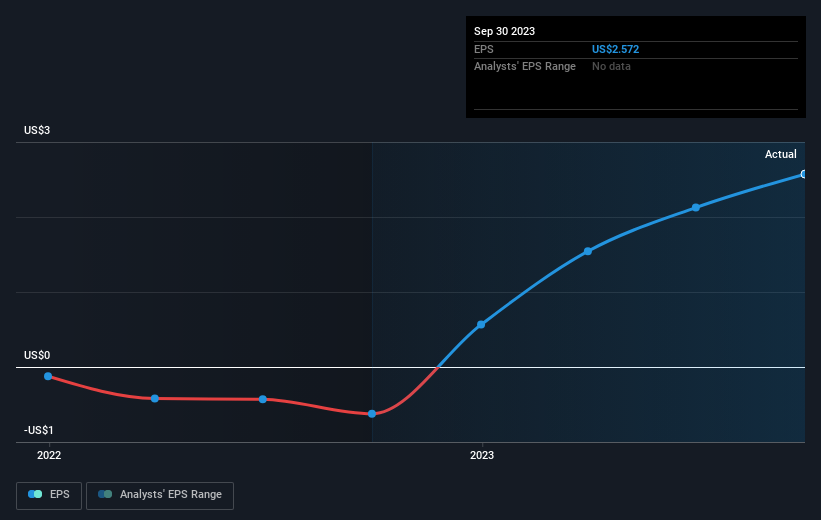

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, Hallador Energy moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Hallador Energy has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Hallador Energy stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Hallador Energy shareholders are up 7.5% for the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 16% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.