Even With A 55% Surge, Cautious Investors Are Not Rewarding F8 Enterprises (Holdings) Group Limited's (HKG:8347) Performance Completely

Even With A 55% Surge, Cautious Investors Are Not Rewarding F8 Enterprises (Holdings) Group Limited's (HKG:8347) Performance Completely

F8 Enterprises (Holdings) Group Limited (HKG:8347) shareholders have had their patience rewarded with a 55% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.6% in the last twelve months.

F8 企業(控股)集團有限公司 (HKG: 8347) 股東們的耐心在上個月股價上漲了55%。但是上個月的漲幅不足以使股東恢復活力,因爲股價在過去十二個月中仍下跌了8.6%。

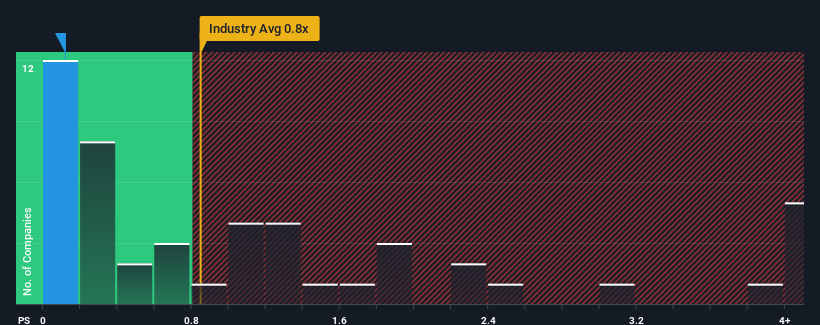

Although its price has surged higher, given about half the companies operating in Hong Kong's Oil and Gas industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider F8 Enterprises (Holdings) Group as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

儘管其價格飆升,但鑑於在香港石油和天然氣行業運營的公司中,約有一半的市盈率(或 “市盈率”)高於0.8倍,您可能仍將F8企業(控股)集團視爲一項有吸引力的投資,其市盈率爲0.1倍。但是,僅按面值計算市盈率是不明智的,因爲可能可以解釋爲什麼市盈率有限。

View our latest analysis for F8 Enterprises (Holdings) Group

查看我們對F8企業(控股)集團的最新分析

How Has F8 Enterprises (Holdings) Group Performed Recently?

F8企業(控股)集團近期表現如何?

For instance, F8 Enterprises (Holdings) Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

例如,F8 Enterprises(控股)集團最近收入的下降值得深思。也許市場認爲最近的收入表現不足以維持該行業的發展,從而導致市盈率受到影響。但是,如果這種情況沒有發生,那麼現有股東可能會對股價的未來走勢感到樂觀。

Do Revenue Forecasts Match The Low P/S Ratio?

收入預測是否與低市盈率相符?

The only time you'd be truly comfortable seeing a P/S as low as F8 Enterprises (Holdings) Group's is when the company's growth is on track to lag the industry.

只有當該公司的增長有望落後於該行業的時候,你才能真正放心地看到市盈率低至F8 Enterprises(Holdings)集團的市盈率。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.6%. This means it has also seen a slide in revenue over the longer-term as revenue is down 17% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

首先回顧一下,該公司去年的收入增長並不令人興奮,因爲它公佈了令人失望的4.6%的下降。這意味着從長遠來看,它的收入也有所下滑,因爲在過去三年中,總收入下降了17%。因此,可以公平地說,最近的收入增長對公司來說是不可取的。

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 4.9% either.

就此而言,按年計算的中期收入軌跡與整個行業的一年期收縮4.9%的預測幾乎沒有區別。

In light of this, the fact F8 Enterprises (Holdings) Group's P/S sits below the majority of other companies is unanticipated but certainly not shocking. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet, despite the industry heading down in unison. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares heavily.

有鑑於此,F8企業(控股)集團的市盈率低於大多數其他公司這一事實是出乎意料的,但肯定並不令人震驚。隨着收入的逆轉,儘管該行業齊頭並進,但不能保證市盈率會達到下限。即使僅僅維持這些價格也很難實現,因爲最近的收入趨勢已經嚴重壓低了股價。

The Bottom Line On F8 Enterprises (Holdings) Group's P/S

F8企業(控股)集團市盈率的底線

F8 Enterprises (Holdings) Group's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

F8 Enterprises(Holdings)集團的股價最近飆升,但其市盈率仍然不高。雖然市售比不應成爲你是否購買股票的決定性因素,但它是衡量收入預期的有力晴雨表。

Upon examining F8 Enterprises (Holdings) Group, we found that its recent revenue decline over the past three-year is affecting its P/S ratio more than we initially expected, even though the wider industry is also expected to experience a decline in revenue. There could be some further unobserved threats to revenue preventing the P/S ratio from keeping up with the industry average. One major risk is whether the company can maintain its 'middle of the road' medium-termrevenue growth under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide more support to the share price.

在研究F8 Enterprises(Holdings)集團後,我們發現,儘管預計整個行業的收入也將下降,但其最近三年收入下降對其市盈率的影響超過了我們最初的預期。可能還有一些未被觀察到的收入威脅,使市盈率無法跟上行業平均水平。一個主要風險是,在這些艱難的行業條件下,該公司能否保持 “中間位置” 的中期收入增長。看來有些人確實預計收入會不穩定,因爲這種相對錶現通常應該會爲股價提供更多支撐。

And what about other risks? Every company has them, and we've spotted 4 warning signs for F8 Enterprises (Holdings) Group (of which 3 are a bit unpleasant!) you should know about.

那其他風險呢?每家公司都有它們,我們已經發現了 F8 企業(控股)集團有 4 個警告信號 (其中 3 個有點不愉快!)你應該知道。

If you're unsure about the strength of F8 Enterprises (Holdings) Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你是 不確定F8企業(控股)集團的業務實力,爲什麼不瀏覽我們的互動股票清單,爲你可能錯過的其他一些公司提供堅實的商業基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 取得聯繫 直接和我們在一起。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。