Subdued Growth No Barrier To CMON Limited (HKG:1792) With Shares Advancing 31%

Subdued Growth No Barrier To CMON Limited (HKG:1792) With Shares Advancing 31%

Those holding CMON Limited (HKG:1792) shares would be relieved that the share price has rebounded 31% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

持有者CMON有限公司(HKG:1792)股價在過去30天裡反彈了31%,這會讓股價鬆一口氣,但它需要繼續努力修復最近對投資者投資組合造成的損害。並不是所有的股東都會感到高興,因為在過去的12個月裡,該公司的股價仍下跌了令人失望的27%。

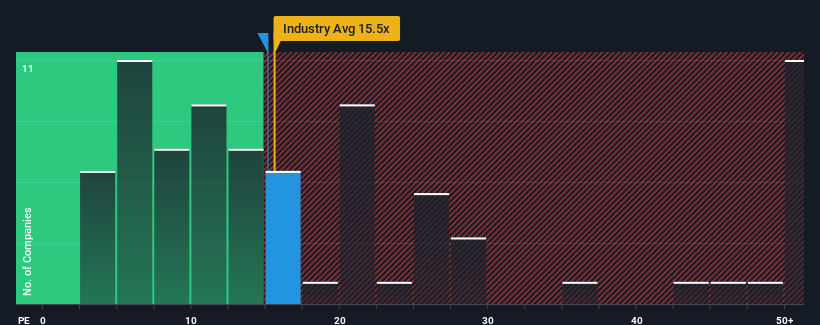

After such a large jump in price, CMON's price-to-earnings (or "P/E") ratio of 15.1x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

在股價大幅上漲後,Cmon的本益比(P/E)達到15.1倍,與香港市場相比,這可能會讓它看起來是一個強勁的賣盤。在香港,大約一半的公司的本益比低於9倍,甚至本益比低於5倍的情況也很常見。然而,本益比可能相當高是有原因的,需要進一步調查才能確定它是否合理。

Recent times have been quite advantageous for CMON as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

最近的時期對Cmon來說相當有利,因為它的收益一直在非常強勁地增長。本益比之所以高,可能是因為投資者認為,這種強勁的盈利增長在不久的將來將足以跑贏大盤。如果不是,那麼現有股東可能會對股價的生存能力感到有點緊張。

See our latest analysis for CMON

查看我們對cmon的最新分析

Does Growth Match The High P/E?

增長是否與高本益比相匹配?

The only time you'd be truly comfortable seeing a P/E as steep as CMON's is when the company's growth is on track to outshine the market decidedly.

只有當公司的增長明顯超過市場時,你才會真正放心地看到像Cmon這樣高的本益比。

If we review the last year of earnings growth, the company posted a terrific increase of 37%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

如果我們回顧過去一年的收益增長,該公司公佈了37%的驚人增長。然而,最近三年的總體表現並不是很好,因為它根本沒有實現任何增長。因此,公平地說,該公司最近的收益增長一直不一致。

Comparing that to the market, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

與預計未來12個月將實現24%增長的市場相比,根據最近的中期年化收益結果,該公司的增長勢頭較弱。

With this information, we find it concerning that CMON is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

有了這些資訊,我們發現Cmon的本益比高於市場。顯然,該公司的許多投資者比最近的情況所顯示的要樂觀得多,不願以任何價格拋售他們的股票。只有最大膽的人才會認為這些價格是可持續的,因為最近盈利趨勢的延續最終可能會對股價造成沉重壓力。

The Key Takeaway

關鍵的外賣

The strong share price surge has got CMON's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

強勁的股價飆升也讓Cmon的本益比飆升至極高。雖然本益比不應該是你是否買入一隻股票的決定性因素,但它是一個很好的盈利預期晴雨錶。

We've established that CMON currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

我們已經確定,Cmon目前的本益比遠高於預期,因為它最近的三年增長低於更廣泛的市場預測。目前,我們對高本益比越來越感到不安,因為這種盈利表現不太可能長期支撐這種積極情緒。除非最近的中期狀況明顯改善,否則要接受這些價格是合理的是非常具有挑戰性的。

And what about other risks? Every company has them, and we've spotted 3 warning signs for CMON (of which 2 are concerning!) you should know about.

還有其他風險呢?每家公司都有它們,我們已經發現CMON的3個警告信號(其中兩個是有關的!)你應該知道。

If you're unsure about the strength of CMON's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不確定Cmon的業務實力,為什麼不探索我們的互動列表,為其他一些你可能沒有達到預期的公司提供堅實的商業基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.