timtamtom

赞了

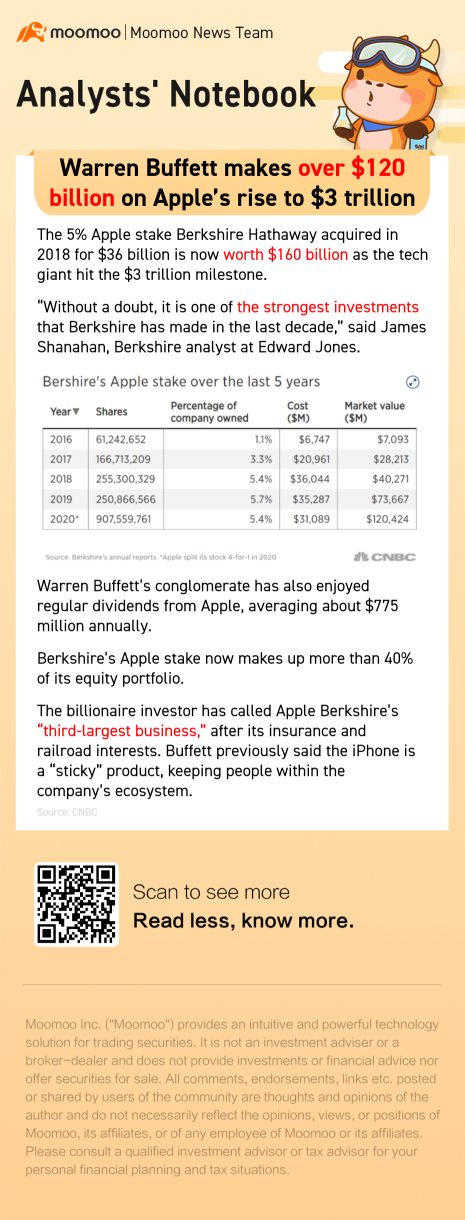

在过去的十年里,我一直在新加坡市场投资,但这真是令人失望。的股价 $吉宝有限公司(BN4.SG$ 从未康复。幸运的是,我的大部分投资都投资于房地产投资信托基金,如果不是价格上涨,我也从股息中获利。银行像 $星展集团控股(D05.SG$ 也还可以。但是没有什么能比得上美国市场,直到Moomoo这样的新投资工具问世之前,我才接触过这个市场!

已翻译

9

2

timtamtom

赞了

$向上融科(TIGR.US$ 下周一会是第二个触底6.46(双底)使我们恢复上升趋势吗?

已翻译

28

4

timtamtom

赞了

已翻译

19

1

timtamtom

赞了

Q&A is a session under a company's earnings conference that institutional and retailinvestors ask some most-concerned questions to the management. By looking into $黑石(BX.US$ , a leading investment company, we can get an in-depth understanding of the latest investing trends, and hopefully find valuable trade ideas.

Key Takeaways:

Attitudes: quarter-to-quarter, it's not fruitful to predict. But big picture, the company is in remarkably good position over time.

Goals: to have a vision of how big we can be consistent with great performance for our investors. The company is going to keep at tech investment and orient toward the ESG.

Investment: overall to identify where there are real secular tailwinds in the migration of everything online, sustainability, life sciences, global travel coming out of COVID, the rise in places of the middle class in India.

- For tech sector, the company invests in early stage companies in the fintech area, the prop tech area, the enterprise tech area, the cyber area.

- On ESG, as an asset class, the demands for capital are enormous.

Can you talk about on the deployment side how you are kind of able to deploy that to kind of keep returns going without affecting the market just from a pricing perspective?

One of the advantages we have is scale. Year-to-date we've been involved in 13 public to privates, which are transactions that are often harder for other firms because of their size and complexity. If you looked in the quarter, the 10 largest transactions we did in terms of investments and commitments, all of them were done in vehicles that did not exist 5 years ago. So, deploying capital for us at scale has gotten easier because we have more ores in that water and that has really helped us as the capital comes in. And we do it geographically across the globe. We do it across risk and return as well.

The last thing I'd say is this somatic approach that -- what we've tried to do as a firm is identify where there are real secular tailwinds in the migration of everything online, sustainability, life sciences, global travel coming out of COVID, the rise in places of the middle class in India, alternatives. Look at these different asset classes and try to deploy capital directly on scene and then sometimes one derivative off.

You hit your $100 billion core target ahead of schedule. So, what's next?

What we accomplished in the Core Plus area. And whenever we go into a new area or introduce a new product, actually it's fun for me to have a vision of how big we can be consistent with great performance for our investors. So, we certainly got this one right and we've got a lot of momentum of course behind that. Part of the way of managing a great firm is having amazing people and great prospects and discipline when we go into something and set targets for success, both investment-wise and scale-wise. And we're all used to that system here.

Hoping you might be able to give us a little sense of what's to come into 4Q.

As you know, we don't give sort of near-term guidance, but the big picture, as I mentioned in my remarks, is this net accrued performance revenue receivable. That's double what it was pre-COVID. Much of it is relatively liquid, so, we'll take advantage of that based on market conditions. Obviously, the invested performance revenue AUM has grown considerably. So, quarter-to-quarter, it's not a fruitful to guide to that or to predict that. But big picture, we're in remarkably good position over time.

Just hoping you could update us on some of the technology investments that you're making across the firm. As you think it about digitizing, automating parts of your business, how do you think about the opportunity set there?

Stepping back in the technology area, we've been investing in people and in hardware and software for a bunch of years now. We actually have nearly 400 employees in technology and data science. It's --we have to say it's the fastest-growing part of the firm. We have a Innovations Program. We don't talk a lot about it, it's a small program, but we do use internal capital to purchase small stakes in early stage companies in the fintech area, the prop tech area, the enterprise tech area, the cyber area. We're going to keep at it. It's still early days and there's a long way to go.

If you want to just talk about the potential for any ESG impact offerings.

On ESG. So, what I'd say on that is I think the most relevant areas for us are three areas.. In the energy credit and energy debt areas, there was much more orientation toward hydrocarbons and E&P. That -- a lot of those activities we've deemphasized in a significant way over the last 3 years or 4 years. And we've been doing much more around the energy transition and have great success. We put an investment into a public company called the $Array Technologies(ARRY.US$ , which moves solar panels.

And I would expect the next vintages of our energy equity and energy debt funds will be heavily oriented toward the transition, toward sustainability. I think investors will react well. And I think similarly, we'll do more in infrastructure. So, I think overall as an asset class, the demands for capital are enormous.

This article is a script from the Q&A session of Blackstone's earnings call. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

Key Takeaways:

Attitudes: quarter-to-quarter, it's not fruitful to predict. But big picture, the company is in remarkably good position over time.

Goals: to have a vision of how big we can be consistent with great performance for our investors. The company is going to keep at tech investment and orient toward the ESG.

Investment: overall to identify where there are real secular tailwinds in the migration of everything online, sustainability, life sciences, global travel coming out of COVID, the rise in places of the middle class in India.

- For tech sector, the company invests in early stage companies in the fintech area, the prop tech area, the enterprise tech area, the cyber area.

- On ESG, as an asset class, the demands for capital are enormous.

Can you talk about on the deployment side how you are kind of able to deploy that to kind of keep returns going without affecting the market just from a pricing perspective?

One of the advantages we have is scale. Year-to-date we've been involved in 13 public to privates, which are transactions that are often harder for other firms because of their size and complexity. If you looked in the quarter, the 10 largest transactions we did in terms of investments and commitments, all of them were done in vehicles that did not exist 5 years ago. So, deploying capital for us at scale has gotten easier because we have more ores in that water and that has really helped us as the capital comes in. And we do it geographically across the globe. We do it across risk and return as well.

The last thing I'd say is this somatic approach that -- what we've tried to do as a firm is identify where there are real secular tailwinds in the migration of everything online, sustainability, life sciences, global travel coming out of COVID, the rise in places of the middle class in India, alternatives. Look at these different asset classes and try to deploy capital directly on scene and then sometimes one derivative off.

You hit your $100 billion core target ahead of schedule. So, what's next?

What we accomplished in the Core Plus area. And whenever we go into a new area or introduce a new product, actually it's fun for me to have a vision of how big we can be consistent with great performance for our investors. So, we certainly got this one right and we've got a lot of momentum of course behind that. Part of the way of managing a great firm is having amazing people and great prospects and discipline when we go into something and set targets for success, both investment-wise and scale-wise. And we're all used to that system here.

Hoping you might be able to give us a little sense of what's to come into 4Q.

As you know, we don't give sort of near-term guidance, but the big picture, as I mentioned in my remarks, is this net accrued performance revenue receivable. That's double what it was pre-COVID. Much of it is relatively liquid, so, we'll take advantage of that based on market conditions. Obviously, the invested performance revenue AUM has grown considerably. So, quarter-to-quarter, it's not a fruitful to guide to that or to predict that. But big picture, we're in remarkably good position over time.

Just hoping you could update us on some of the technology investments that you're making across the firm. As you think it about digitizing, automating parts of your business, how do you think about the opportunity set there?

Stepping back in the technology area, we've been investing in people and in hardware and software for a bunch of years now. We actually have nearly 400 employees in technology and data science. It's --we have to say it's the fastest-growing part of the firm. We have a Innovations Program. We don't talk a lot about it, it's a small program, but we do use internal capital to purchase small stakes in early stage companies in the fintech area, the prop tech area, the enterprise tech area, the cyber area. We're going to keep at it. It's still early days and there's a long way to go.

If you want to just talk about the potential for any ESG impact offerings.

On ESG. So, what I'd say on that is I think the most relevant areas for us are three areas.. In the energy credit and energy debt areas, there was much more orientation toward hydrocarbons and E&P. That -- a lot of those activities we've deemphasized in a significant way over the last 3 years or 4 years. And we've been doing much more around the energy transition and have great success. We put an investment into a public company called the $Array Technologies(ARRY.US$ , which moves solar panels.

And I would expect the next vintages of our energy equity and energy debt funds will be heavily oriented toward the transition, toward sustainability. I think investors will react well. And I think similarly, we'll do more in infrastructure. So, I think overall as an asset class, the demands for capital are enormous.

This article is a script from the Q&A session of Blackstone's earnings call. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

128

6

timtamtom

留下了心情

问答是公司财报会议下的一个环节,机构和散户投资者向管理层提出一些最关心的问题。在此页面上,您可以找到一些有价值的信息,这些信息可能会在接下来的几周内影响股价。 $特斯拉(TSLA.US$

关键要点:

态度: 从长远来看,管理层感到非常乐观,但目前也存在很多不确定性。

目标: 该公司的目标是以平均每年50%的速度增长,最终能够达到每年2000万辆汽车。

产品: 该公司正在制定一项战略,以尽快提高产量。Cybertruck预计将于明年推出。

你是否还预计将在2023年开始生产价值25,000美元的车型。从现在到那时最大的障碍是什么?

是的, 我们正在制定一项尽快提高生产率的战略。当我们通常处于细胞受限的世界中时,我们不想在阵容中添加任何新车辆。尽管发展这些现有产品还有更多途径,但我们是 专注于Model Y的扩建以及柏林的扩张,进一步提高弗里蒙特的S&X水平以恢复到及格水平,同时还提高了上海弗里蒙特的3和Y的产量。

继奥斯汀的Model Y之后,我们的 下一个产品发布会将是 Cybertruck。而这要看电池容量的增加和我们目前摆在桌面上的全部产品的完成情况。

特斯拉当前工厂的汽车产能目标是什么?

作为一家公司,我们的目标是 以平均每年50%的速度增长。 我认为这将是一个艰难的目标,但这是内部团队的目标。而且他们将继续推动这一目标。我们正在努力尽快达到每周5,000辆汽车。然后我们将继续努力超越这一点, 甚至有可能在这些工厂每周生产1万辆汽车。 然后,我们将在奥斯汀添加Cybertruck,并从那里继续发展。因此,我们的目标是在未来几年内每年生产数百万辆汽车。然后 从长远来看,最终能够实现每年2000万辆汽车。

除了使用现实世界的人工智能进行FSD之外,特斯拉是否正在考虑其他可以为特斯拉带来额外软件收入的想法?

当然。在人工智能日上,我们确实讨论了将Dojo用作其他公司的神经网络训练平台的潜在未来。这不是我们今天关注的焦点,因为我们已经完全订阅了Dojo及其内部用途,我们确实希望在FSD的背景下继续改善车内体验

埃隆说,我们在一年前的11月获得了Cybertruck的最新消息,但事实并非如此,而且我们知道有很多更新。你会炫耀经过改进的全新 Cybertruck 吗?

我们收到了很多关于 Cybertruck 的问题。我们一直在忙于详细介绍Cybertruck,以实现不久前与客户共享的原型版本。正如你最近在社交媒体上看到的那样,我们已经构建了许多alpha,目前正在对其进行测试,以使设计进一步成熟。我们将继续在我们目前处于的测试阶段研究该产品, 希望在明年之前推出。

你的营业利润率达到了很低的水平。那是你的中期目标。尽管面临许多挑战,而且计划没有得到充分利用,但你现在已经实现了目标。你现在如何看待这个目标?

实际上,我们已经超出了营业利润率目标的长期预期。随着完全自动驾驶的成熟,随着取车率的提高,如果我们要提高定价,那么毛利率和营业利润率都有相当大的上升空间,因为 业务开始变得更像是基于硬件的公司和基于软件的公司的混合体。

因此,我们对这段旅程感到乐观--从长远来看,我们对这段旅程非常乐观,在接下来的 4 到 5 个季度里有点困难。 目前世界上存在很多不确定性。

本文是特斯拉财报电话会议问答环节的脚本。为了便于阅读,我们做了适当的削减。如果你想知道更多细节,你可以 点击此处重新观看财报电话会议。

关键要点:

态度: 从长远来看,管理层感到非常乐观,但目前也存在很多不确定性。

目标: 该公司的目标是以平均每年50%的速度增长,最终能够达到每年2000万辆汽车。

产品: 该公司正在制定一项战略,以尽快提高产量。Cybertruck预计将于明年推出。

你是否还预计将在2023年开始生产价值25,000美元的车型。从现在到那时最大的障碍是什么?

是的, 我们正在制定一项尽快提高生产率的战略。当我们通常处于细胞受限的世界中时,我们不想在阵容中添加任何新车辆。尽管发展这些现有产品还有更多途径,但我们是 专注于Model Y的扩建以及柏林的扩张,进一步提高弗里蒙特的S&X水平以恢复到及格水平,同时还提高了上海弗里蒙特的3和Y的产量。

继奥斯汀的Model Y之后,我们的 下一个产品发布会将是 Cybertruck。而这要看电池容量的增加和我们目前摆在桌面上的全部产品的完成情况。

特斯拉当前工厂的汽车产能目标是什么?

作为一家公司,我们的目标是 以平均每年50%的速度增长。 我认为这将是一个艰难的目标,但这是内部团队的目标。而且他们将继续推动这一目标。我们正在努力尽快达到每周5,000辆汽车。然后我们将继续努力超越这一点, 甚至有可能在这些工厂每周生产1万辆汽车。 然后,我们将在奥斯汀添加Cybertruck,并从那里继续发展。因此,我们的目标是在未来几年内每年生产数百万辆汽车。然后 从长远来看,最终能够实现每年2000万辆汽车。

除了使用现实世界的人工智能进行FSD之外,特斯拉是否正在考虑其他可以为特斯拉带来额外软件收入的想法?

当然。在人工智能日上,我们确实讨论了将Dojo用作其他公司的神经网络训练平台的潜在未来。这不是我们今天关注的焦点,因为我们已经完全订阅了Dojo及其内部用途,我们确实希望在FSD的背景下继续改善车内体验

埃隆说,我们在一年前的11月获得了Cybertruck的最新消息,但事实并非如此,而且我们知道有很多更新。你会炫耀经过改进的全新 Cybertruck 吗?

我们收到了很多关于 Cybertruck 的问题。我们一直在忙于详细介绍Cybertruck,以实现不久前与客户共享的原型版本。正如你最近在社交媒体上看到的那样,我们已经构建了许多alpha,目前正在对其进行测试,以使设计进一步成熟。我们将继续在我们目前处于的测试阶段研究该产品, 希望在明年之前推出。

你的营业利润率达到了很低的水平。那是你的中期目标。尽管面临许多挑战,而且计划没有得到充分利用,但你现在已经实现了目标。你现在如何看待这个目标?

实际上,我们已经超出了营业利润率目标的长期预期。随着完全自动驾驶的成熟,随着取车率的提高,如果我们要提高定价,那么毛利率和营业利润率都有相当大的上升空间,因为 业务开始变得更像是基于硬件的公司和基于软件的公司的混合体。

因此,我们对这段旅程感到乐观--从长远来看,我们对这段旅程非常乐观,在接下来的 4 到 5 个季度里有点困难。 目前世界上存在很多不确定性。

本文是特斯拉财报电话会议问答环节的脚本。为了便于阅读,我们做了适当的削减。如果你想知道更多细节,你可以 点击此处重新观看财报电话会议。

已翻译

190

29

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

timtamtom :