NewBie2021

赞并评论了

NewBie2021

参与了投票

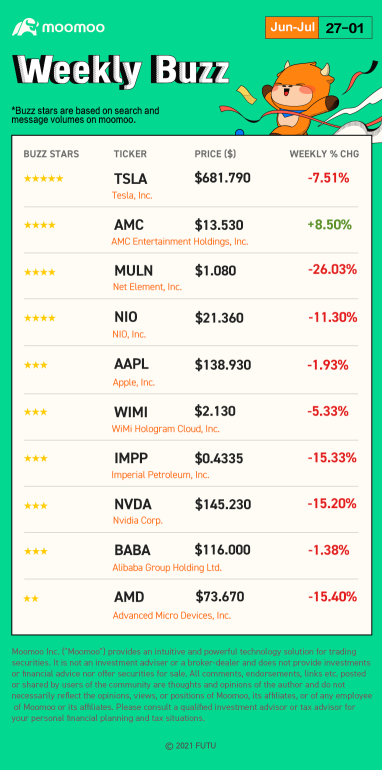

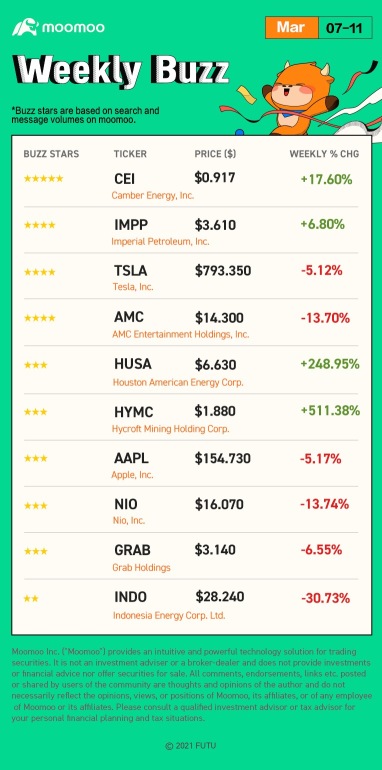

扰流片: 在这篇文章的最后,有机会为你赢得积分!周一快乐,Moo友好了!欢迎回到这里每周热议,在这里我们基于上周的搜索量和消息量,回顾了moomoo平台上精选的热股的新闻、表现和社区情绪!(纳米帽不包括在内。)Ⅰ部分:做出您的选择Ⅱ部分:热议股票榜&moo友点评三大指数变动向下,罗素2000我...

已翻译

+5

51

65

NewBie2021

参与了投票

Arthur Fleck:是只有我,还是外面越来越疯狂了?

社会工作者:确实很紧张。人们很沮丧,他们在挣扎。现在是艰难的时期。你呢?

从电影中提取部分内容 小丑.

如你所知, 冬天来了 有各种各样的漏洞,比如 石油价格超过每桶200美元 2022年,通货膨胀率持续上升,从2021年12月的7%增长到2022年2月的7.9%。随着东欧危机和新能源汽车的到来...

社会工作者:确实很紧张。人们很沮丧,他们在挣扎。现在是艰难的时期。你呢?

从电影中提取部分内容 小丑.

如你所知, 冬天来了 有各种各样的漏洞,比如 石油价格超过每桶200美元 2022年,通货膨胀率持续上升,从2021年12月的7%增长到2022年2月的7.9%。随着东欧危机和新能源汽车的到来...

已翻译

5

3

NewBie2021

参与了投票

剧透:

在这篇文章的最后,你有机会赢取积分!

星期一快乐, mooer们!欢迎回到 每周热门话题,我们根据上周的搜索量和消息量,回顾moomoo平台上精选热门股票的新闻、表现和社区情绪!(不包括纳米帽。)

第一部分:做出选择

第 2 部分 Buzzing 股票清单和 Mooers 评论

三大指数走势 向下,罗素2000指数下跌 1.07% ...

在这篇文章的最后,你有机会赢取积分!

星期一快乐, mooer们!欢迎回到 每周热门话题,我们根据上周的搜索量和消息量,回顾moomoo平台上精选热门股票的新闻、表现和社区情绪!(不包括纳米帽。)

第一部分:做出选择

第 2 部分 Buzzing 股票清单和 Mooers 评论

三大指数走势 向下,罗素2000指数下跌 1.07% ...

已翻译

55

79

NewBie2021

赞了

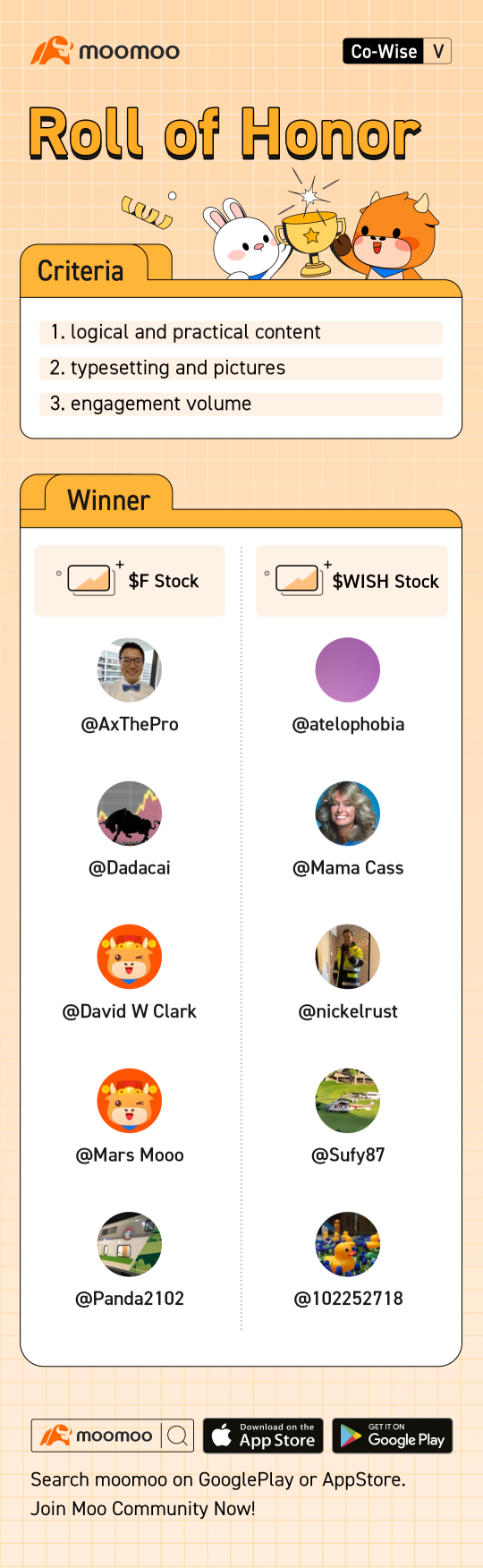

再一次, Co-Wise:moomoo 教程竞赛第 5 部分, "如何建立一个拥有100万美元意外收入的投资组合?“成功结束。感谢您参加比赛。![]() 有了100万美元的意外收入,每个人都有不同的资产配置方法和建立最佳投资组合的独特方式。入选投资组合的前三名候选人是 股票、ETF 和加密货币。 资产配置旨在最大限度地提高未来回报并最大限度地降低风险。

有了100万美元的意外收入,每个人都有不同的资产配置方法和建立最佳投资组合的独特方式。入选投资组合的前三名候选人是 股票、ETF 和加密货币。 资产配置旨在最大限度地提高未来回报并最大限度地降低风险。![]() 但是,高回报伴随着高风险。 没有最好的,只有最适合投资者的投资组合。 你能不能关注我来看一看 mmooer们的一些高质量帖子?

但是,高回报伴随着高风险。 没有最好的,只有最适合投资者的投资组合。 你能不能关注我来看一看 mmooer们的一些高质量帖子?

以下是您积极参与的奖励:1 次免费 $福特汽车(F.US$ 分享五篇最佳帖子,1 篇免费 $ContextLogic(WISH.US$ 五个未完成的帖子分享66分,最少为30个字的帖子分享66分。恭喜所有获奖者!![]()

*奖励将在 15 个工作日内发放给获奖者。排名按字母顺序排序。

第一部分:高质量帖子集

![]() @AxThePro 平衡的投资组合

@AxThePro 平衡的投资组合

一开始100万是一笔巨款,这个投资组合的增长非常重要。同时,我们还必须确保它免受重大损失。我会用以下方式分配我的投资组合 4-3-2-1 策略。我是一个赞同的投资者,我不相信债券,所以我将100%配置股票投资组合。

![]() @Dadacai 如果我有100万新元的意外收入,我的投资组合

@Dadacai 如果我有100万新元的意外收入,我的投资组合

如果我有100万美元的意外收入,我会把其中90%存入标准普尔ETF,比如 $标普500ETF-Vanguard(VOO.US$ , $SPDR 标普500指数ETF(SPY.US$ 和 $标普500ETF-iShares(IVV.US$ ,在国库券中占5%。剩余的5%将留给我认为有可能成为下一个股票的股票 $亚马逊(AMZN.US$ , $特斯拉(TSLA.US$ , $Sea(SE.US$ , $苹果(AAPL.US$ 和 $微软(MSFT.US$ .

![]() @David W Clark 我将如何投资 100 万美元

@David W Clark 我将如何投资 100 万美元

在研究股票、债券、交易所买卖基金和其他类似的投资和增长方式时,我会把它存入一个至少支付尽可能多的利息的账户。我可以用 45/45/10 的拆分来做到这一点,股息股票/价值股票/现金。

![]() @Mars Mooo Squid Game 多投资组合

@Mars Mooo Squid Game 多投资组合

Squid Game Multi-Portfolio 投资组合由四个主要投资组合组成,如下所示:

40% 权重:Player 456 (成基勋) 投资组合。

30% 权重:玩家 218 (赵尚宇) 投资组合。

20% 权重:玩家 067 (姜世标) 投资组合。

10%:权重:流动投资组合。

![]() @Panda2102 Barbell的策略是建立一个拥有100万美元意外收入的投资组合

@Panda2102 Barbell的策略是建立一个拥有100万美元意外收入的投资组合

一个投资组合(85-90%)持有极其安全的投资,而另一个激进的投资组合(10-15%)持有高度投机性或杠杆投资。取决于你是否在 财富积累阶段 要么 财富保护阶段 在你的生活中,你可以相应地调整这两个投资组合。

![]() @atelophobia 建立投资组合

@atelophobia 建立投资组合

建立投资组合就是寻找最佳平衡并在不同类别之间实现配置平衡。对于如何建立投资组合,没有正确或错误的答案,因为事实是 交易/投资是一门艺术而不是一门科学 因此,没有科学的方法可以判断一件艺术品,因为美在于旁观者的眼中!

![]() @Mama Cass 100 万美元 Playmoney!

@Mama Cass 100 万美元 Playmoney!

如果有幸找到或获得100万美元进行投资,恐怕在我这个年龄(55岁),我不会因为激进的回报投资而发狂。不同的年龄组有不同的投资组合配置。我是个喜欢鱼子酱的女孩所以我要找个专业人士拿走我的百万美元然后不损失地得到回报。

![]() @nickelrust 买。保持。卖出。重复。

@nickelrust 买。保持。卖出。重复。

作为一个较低的风险承担者,我会选择一个更安全的选择,将资金投入一篮子蓝筹股,然后让它在3到5年的时间内增长。在当前市场仍处于低位的情况下,全球经济正在开放,努力稳定并进入真正的新常态。

![]() @Sufy87 这归结为投资组合配置以及你最了解的内容。

@Sufy87 这归结为投资组合配置以及你最了解的内容。

就我个人而言,我会分配60%的股票,20%分配给ETF,15%的期权,5%的现金。股票基本上是创造财富的东西。交易所买卖基金基本上是为了投资于经济的各个部分。期权只是为了对冲我的一些头寸。机会出现时,现金永远是 “子弹”。

![]() @102252718 你投资的目的是什么?

@102252718 你投资的目的是什么?

每个人的投资原因都不一样。对我来说,我投资是为了增加我的财富,用于退休和子女的教育。

70-80% 的成长型股票 $TSLA $PLTR。

10% ETF $ARK Innovation ETF(ARKK.US$ $ARKF。

10% 加密货币 $ETH。$BTC。

请点击”如何建立一个拥有100万美元意外收入的投资组合?“以获取更多引人入胜的帖子。![]() 如果你受到来自” 的任何帖子的启发如何建立强大的投资组合?“,请分享你的想法,加入我们进行进一步的讨论。别忘了留下你的评论并告诉mooer们你学到了什么。

如果你受到来自” 的任何帖子的启发如何建立强大的投资组合?“,请分享你的想法,加入我们进行进一步的讨论。别忘了留下你的评论并告诉mooer们你学到了什么。![]()

第二部分:对 “Mentor Mooo” 称号的投票

是时候投票了!让我们为候选人投票,看看谁将获胜”Menter Mooo“标题。你认为谁的主意最好?在评估帖子时,请考虑以下因素: 逻辑、实用内容、文字设置、图片显示和参与度。

在民意调查结束时,得票最多的人将赢得 “Mentor Moo” 称号。真是太荣幸了!快来为你最喜欢的导师投票吧。你的投票对他们来说意义重大。

多元化是投资组合管理中的一个关键概念。不同的风险承受能力和持有时间可能会直接影响投资者的类别选择。你还有其他投资组合建立方法吗?与mooer们分享您的投资组合,共同探索投资机会。![]()

免责声明: 所有投资都涉及风险。Futu Inc、Futu SG和moomoo 都不支持任何特定的投资策略。在决定投资策略时,您应该仔细考虑自己的投资目标和目的。过去的表现并不能保证未来的业绩。

以下是您积极参与的奖励:1 次免费 $福特汽车(F.US$ 分享五篇最佳帖子,1 篇免费 $ContextLogic(WISH.US$ 五个未完成的帖子分享66分,最少为30个字的帖子分享66分。恭喜所有获奖者!

*奖励将在 15 个工作日内发放给获奖者。排名按字母顺序排序。

第一部分:高质量帖子集

一开始100万是一笔巨款,这个投资组合的增长非常重要。同时,我们还必须确保它免受重大损失。我会用以下方式分配我的投资组合 4-3-2-1 策略。我是一个赞同的投资者,我不相信债券,所以我将100%配置股票投资组合。

如果我有100万美元的意外收入,我会把其中90%存入标准普尔ETF,比如 $标普500ETF-Vanguard(VOO.US$ , $SPDR 标普500指数ETF(SPY.US$ 和 $标普500ETF-iShares(IVV.US$ ,在国库券中占5%。剩余的5%将留给我认为有可能成为下一个股票的股票 $亚马逊(AMZN.US$ , $特斯拉(TSLA.US$ , $Sea(SE.US$ , $苹果(AAPL.US$ 和 $微软(MSFT.US$ .

在研究股票、债券、交易所买卖基金和其他类似的投资和增长方式时,我会把它存入一个至少支付尽可能多的利息的账户。我可以用 45/45/10 的拆分来做到这一点,股息股票/价值股票/现金。

Squid Game Multi-Portfolio 投资组合由四个主要投资组合组成,如下所示:

40% 权重:Player 456 (成基勋) 投资组合。

30% 权重:玩家 218 (赵尚宇) 投资组合。

20% 权重:玩家 067 (姜世标) 投资组合。

10%:权重:流动投资组合。

一个投资组合(85-90%)持有极其安全的投资,而另一个激进的投资组合(10-15%)持有高度投机性或杠杆投资。取决于你是否在 财富积累阶段 要么 财富保护阶段 在你的生活中,你可以相应地调整这两个投资组合。

建立投资组合就是寻找最佳平衡并在不同类别之间实现配置平衡。对于如何建立投资组合,没有正确或错误的答案,因为事实是 交易/投资是一门艺术而不是一门科学 因此,没有科学的方法可以判断一件艺术品,因为美在于旁观者的眼中!

如果有幸找到或获得100万美元进行投资,恐怕在我这个年龄(55岁),我不会因为激进的回报投资而发狂。不同的年龄组有不同的投资组合配置。我是个喜欢鱼子酱的女孩所以我要找个专业人士拿走我的百万美元然后不损失地得到回报。

作为一个较低的风险承担者,我会选择一个更安全的选择,将资金投入一篮子蓝筹股,然后让它在3到5年的时间内增长。在当前市场仍处于低位的情况下,全球经济正在开放,努力稳定并进入真正的新常态。

就我个人而言,我会分配60%的股票,20%分配给ETF,15%的期权,5%的现金。股票基本上是创造财富的东西。交易所买卖基金基本上是为了投资于经济的各个部分。期权只是为了对冲我的一些头寸。机会出现时,现金永远是 “子弹”。

每个人的投资原因都不一样。对我来说,我投资是为了增加我的财富,用于退休和子女的教育。

70-80% 的成长型股票 $TSLA $PLTR。

10% ETF $ARK Innovation ETF(ARKK.US$ $ARKF。

10% 加密货币 $ETH。$BTC。

请点击”如何建立一个拥有100万美元意外收入的投资组合?“以获取更多引人入胜的帖子。

第二部分:对 “Mentor Mooo” 称号的投票

是时候投票了!让我们为候选人投票,看看谁将获胜”Menter Mooo“标题。你认为谁的主意最好?在评估帖子时,请考虑以下因素: 逻辑、实用内容、文字设置、图片显示和参与度。

在民意调查结束时,得票最多的人将赢得 “Mentor Moo” 称号。真是太荣幸了!快来为你最喜欢的导师投票吧。你的投票对他们来说意义重大。

多元化是投资组合管理中的一个关键概念。不同的风险承受能力和持有时间可能会直接影响投资者的类别选择。你还有其他投资组合建立方法吗?与mooer们分享您的投资组合,共同探索投资机会。

免责声明: 所有投资都涉及风险。Futu Inc、Futu SG和moomoo 都不支持任何特定的投资策略。在决定投资策略时,您应该仔细考虑自己的投资目标和目的。过去的表现并不能保证未来的业绩。

已翻译

153

32

NewBie2021

评论了

已翻译

2

1

NewBie2021

赞并评论了

The 9th anniversary story of Futubull users we would like to share today is about a new mom named Tina. She made her first foray into the stock market only a year ago, but successfully transformed herself from a green hand who followed the herd to a discreet and rational investor with her own investment logic.

As a mom, Tina has also set up a finance management plan for her baby born this year, hoping to save up a fortune as the baby grows up.

Used to be an “average but confident” newcomer trapped in herd mentality

At the beginning of 2020, Tina just closed her own business for good and, faced with the raging Covid-19 pandemic, she had no choice but to stay at home. Like many others who had plenty of time to kill during lockdown, Tina got intrigued by investing and making money. But by then, she was just an overconfident newbie who made quite a few silly mistakes.

“For a start, I did what other immature investors had done: bought at the top and sold at the bottom, held only those hot stocks and dreamed about turning rich overnight. I didn’t think much or do any review, because all I wanted was to make quick money,” said Tina. Yet the market trend changed dramatically in February, 2021, when the performances of growth stocks and value stocks switched, causing her portfolio to lose 30% of its value in a week. In retrospect, she confessed that “it felt like falling from heaven to hell with my face down. The excruciating loss made me deeply reflect on my operations.”

Learning from that hard lesson, Tina made up her mind to study investment from the basics. “I think what’s good about me is that I’m a constant learner.” She spotted numerous insightful articles by seasoned investors on Futubull community, who shared their investment philosophy and lent a helping hand to newcomers who struggled to build their knowledge base. Futubull also offers free courses for green hands, helping them learn investment in a systematic way, including basics such as how to value a company and diversify portfolios.

Furthermore, Tina joined several training camps offered by Money Plus, which taught her knowledge about wealth distribution, money-making tactics on the capital market and asset allocation plans for female investors.

“Futubull has taught me a lot. It gives me an opportunity to learn from investment masters and helps me grow. It’s more than a stock-trading app. I can feel Futubull takes an effort to guide investors, telling them about proper investment attitude and providing comprehensive investment knowledge and science-based approaches for them. It’s dedicated to thriving with its clients,” said Tina.

Tina’s growth stage: building her own investment pyramid

As she got deeper knowledge in investing, Tina fought her way as a mature investor, holding stocks and funds in the meantime and gaining reasonable returns within her capability step by step. Gradually, she understood what Warren Buffet meant when he said, “Time is the friend of the wonderful company, the enemy of the mediocre.”

“Now I’d put a greater emphasis on two types of companies that have a wider moat. The first ones are highly-recognized companies that cannot be changed, such as Hermès, LV, and Moutai, a household Chinese liquor brands. The other category is made up of leading companies that can change the world, like apple and Tesla.”

In terms of operations, Tina has become more prudent than she used to be. For instance, she closed her positions of Tesla at 100% yield. “I’m quite decisive in making exits. I’ll leave without hesitation if I feel it’s the right moment.”

Tina designed a “Happiness Plan” for herself in the investment pyramid, perking herself up by buying things she likes. “Apart from managing our finances, girls all enjoy shopping. If I stashed away all the money I earned, I wouldn’t be happy. But with this ‘happiness plan’ I’ll work harder on investing to make more money and reward myself with things I want.”

Her family members are also part of her investment pyramid. “I have a ‘fire plan’ included in the pyramid, too. I hope my husband won’t be so busy when I achieve my financial freedom. Instead, he can take me and the baby to travel around the world, experiencing exotic lifestyles and seeing something totally different. Since we cannot earn money beyond our perception, we need to see the bigger world before we play big.”

Setting a financial management plan for her newborn baby

2021 matters a lot to Tina for another reason—her baby was born!

“My baby’s zodiac is ox, making it a good pair with Futubull. I have redeemed many Futubull mascots and placed them around the TV. My baby will have a lot fun with them,” joked Tina.

After giving birth, Tina turns into a stay-at-home mom. “I now do financial planning while taking care of my love because good financial management matters a lot to a thriving family. As I have a penchant for managing finances, I also set up a financial management plan for my baby.”

Tina contributes a fixed amount to 3 funds on Futubull for her baby every month, hoping to save him a fortune when he grows up.

On occasion of the 9th anniversary of Futu, Tina said, “I hope Futu can continue to thrive and lead the industry, growing into a company that works for every investor and enables different means of payment so that everyone can manage their finances at ease here. Plus, I wish all investors on Futubull can earn big money. Finally, Futu, happy 9th anniversary!”

Disclaimer: The above content represents the personal sharing and opinions of the guest, and does not constitute any recommendation, purchase, sale or holding of the above-mentioned stocks or investment strategies by Futu. All investment involves risk. Prices of investment products may go up as well as down. Please understand the product risks and seek for professional advice before making any investment decisions.

As a mom, Tina has also set up a finance management plan for her baby born this year, hoping to save up a fortune as the baby grows up.

Used to be an “average but confident” newcomer trapped in herd mentality

At the beginning of 2020, Tina just closed her own business for good and, faced with the raging Covid-19 pandemic, she had no choice but to stay at home. Like many others who had plenty of time to kill during lockdown, Tina got intrigued by investing and making money. But by then, she was just an overconfident newbie who made quite a few silly mistakes.

“For a start, I did what other immature investors had done: bought at the top and sold at the bottom, held only those hot stocks and dreamed about turning rich overnight. I didn’t think much or do any review, because all I wanted was to make quick money,” said Tina. Yet the market trend changed dramatically in February, 2021, when the performances of growth stocks and value stocks switched, causing her portfolio to lose 30% of its value in a week. In retrospect, she confessed that “it felt like falling from heaven to hell with my face down. The excruciating loss made me deeply reflect on my operations.”

Learning from that hard lesson, Tina made up her mind to study investment from the basics. “I think what’s good about me is that I’m a constant learner.” She spotted numerous insightful articles by seasoned investors on Futubull community, who shared their investment philosophy and lent a helping hand to newcomers who struggled to build their knowledge base. Futubull also offers free courses for green hands, helping them learn investment in a systematic way, including basics such as how to value a company and diversify portfolios.

Furthermore, Tina joined several training camps offered by Money Plus, which taught her knowledge about wealth distribution, money-making tactics on the capital market and asset allocation plans for female investors.

“Futubull has taught me a lot. It gives me an opportunity to learn from investment masters and helps me grow. It’s more than a stock-trading app. I can feel Futubull takes an effort to guide investors, telling them about proper investment attitude and providing comprehensive investment knowledge and science-based approaches for them. It’s dedicated to thriving with its clients,” said Tina.

Tina’s growth stage: building her own investment pyramid

As she got deeper knowledge in investing, Tina fought her way as a mature investor, holding stocks and funds in the meantime and gaining reasonable returns within her capability step by step. Gradually, she understood what Warren Buffet meant when he said, “Time is the friend of the wonderful company, the enemy of the mediocre.”

“Now I’d put a greater emphasis on two types of companies that have a wider moat. The first ones are highly-recognized companies that cannot be changed, such as Hermès, LV, and Moutai, a household Chinese liquor brands. The other category is made up of leading companies that can change the world, like apple and Tesla.”

In terms of operations, Tina has become more prudent than she used to be. For instance, she closed her positions of Tesla at 100% yield. “I’m quite decisive in making exits. I’ll leave without hesitation if I feel it’s the right moment.”

Tina designed a “Happiness Plan” for herself in the investment pyramid, perking herself up by buying things she likes. “Apart from managing our finances, girls all enjoy shopping. If I stashed away all the money I earned, I wouldn’t be happy. But with this ‘happiness plan’ I’ll work harder on investing to make more money and reward myself with things I want.”

Her family members are also part of her investment pyramid. “I have a ‘fire plan’ included in the pyramid, too. I hope my husband won’t be so busy when I achieve my financial freedom. Instead, he can take me and the baby to travel around the world, experiencing exotic lifestyles and seeing something totally different. Since we cannot earn money beyond our perception, we need to see the bigger world before we play big.”

Setting a financial management plan for her newborn baby

2021 matters a lot to Tina for another reason—her baby was born!

“My baby’s zodiac is ox, making it a good pair with Futubull. I have redeemed many Futubull mascots and placed them around the TV. My baby will have a lot fun with them,” joked Tina.

After giving birth, Tina turns into a stay-at-home mom. “I now do financial planning while taking care of my love because good financial management matters a lot to a thriving family. As I have a penchant for managing finances, I also set up a financial management plan for my baby.”

Tina contributes a fixed amount to 3 funds on Futubull for her baby every month, hoping to save him a fortune when he grows up.

On occasion of the 9th anniversary of Futu, Tina said, “I hope Futu can continue to thrive and lead the industry, growing into a company that works for every investor and enables different means of payment so that everyone can manage their finances at ease here. Plus, I wish all investors on Futubull can earn big money. Finally, Futu, happy 9th anniversary!”

Disclaimer: The above content represents the personal sharing and opinions of the guest, and does not constitute any recommendation, purchase, sale or holding of the above-mentioned stocks or investment strategies by Futu. All investment involves risk. Prices of investment products may go up as well as down. Please understand the product risks and seek for professional advice before making any investment decisions.

178

18

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

NewBie2021 : 以碎股单位卖出