Bill Ackman's SPAC in talks to buy 10% of Universal Music for $4 Billion. The Stock is falling.

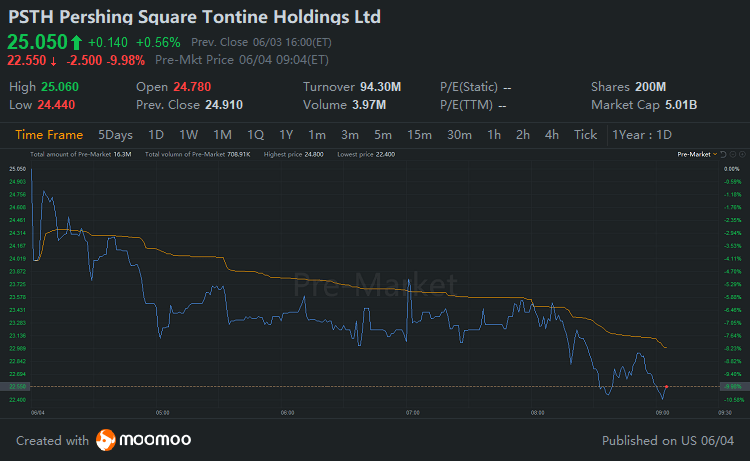

Bill Ackman's SPAC $Pershing Square Tontine Holdings Ltd(PSTH.US)$ drop 9.98% during premarket after announcing merge with Universal Music

Hedge-fund billionaire William Ackman's special purpose acquisition company (SPAC) is in talks with Vivendi to buy a 10% stake in Universal Music Group, the record label for artists including Taylor Swift, Lady Gaga and Billie Eilish. Vivendi said it had entered discussions with Ackman's blank-check company Pershing Square Tontine Holdings and that the potential deal would give Universal Music an enterprise value of EUR35 billion ($42.4 billion).

The deal would be the largest ever SPAC transaction, according to The Wall Street Journal, which first reported the talks late on Thursday. If completed, it would eclipse the $35 billion valuations of Singapore-based ride-hailing company Grab Holdings following a similar deal earlier this year. Shares in Pershing Square Tontine Holdings fell 7% in premarket trading on Friday following confirmation of the talks. Pershing Square Tontine also confirmed the discussions to acquire a 10% stake for approximately $4 billion, setting out the rationale behind the move. "Universal Music Group is one of the greatest businesses in the world," Ackman said, adding that it met all of his company's acquisition criteria as the world's leading music company with a "royalty on the growing global demand for music."

"We are delighted to work with Vivendi on this iconic transaction and look forward to its consummation," he added. Unlike other SPAC deals, Ackman's Pershing Square will remain a publicly traded company and retain $1.5 billion in cash to seek a new business combination partner, the company said. French media conglomerate Vivendi plans to distribute 60% of Universal Music's share capital and list the company in Amsterdam, subject to shareholder approval next month. Chinese internet giant Tencent Holdings owns about 20% of the music label. Looking ahead. Ackman attempting a duet with the music industry may come as a surprise to some. Investors certainly seem unsure as shares in Pershing Square Tontine were 7% lower in premarket trading on Friday.

However, Universal Music's revenue has been on the up due to subscription and streaming growth. Revenue climbed 9.4% to EUR1.8 billion in the first quarter of 2021, while earnings rose 62% to EUR136 million. The planned IPO is designed to capitalize on the music industry's resurgence in recent years and Universal Music certainly has some high-profile backers coming along for the ride.

Perhaps more interestingly, Pershing Square Tontine is keeping $1.5 billion for another potential deal in the future.

(END) Dow Jones Newswires

June 04, 2021 08:13 ET (12:13 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.