summary

Walmart's latest quarterly results showed strong resilience and the international division performed better than expected.

The company saw an increase in sales and profit margins during the quarter, as well as strong growth in its advertising and e-commerce business.

Walmart's Indian e-commerce platform Flipkart is showing strong growth and plans to enter the fast commerce sector, which is also supported by Google's recent investment.

Investment arguments

Compared with the same period last year, Walmart's stock price rose by about 33.3%, which greatly exceeded the 25.5% increase in the S&P 500 index during the same period, which attracted attention. In this article, I discussed the company's latest quarterly results. Although the company's valuation advantage needs to be improved, its resilience in a challenging macro environment and its international division's performance exceeding expectations made it more attractive than before, and will gradually unlock development potential in the future. If investors have confidence in the positive signals currently being released and want to invest and trade, here is a reference, you can choose BiyaPay to search for the WMT stock code on the platform and trade online in real-time; of course, if you have problems with deposits and withdrawals, you can also use the platform as a professional deposit and withdrawal tool for US and Hong Kong stocks, withdraw to a bank account, and then deposit to other brokerage firms to buy this growing stock. Compared with other platforms, the payment speed is fast and there is no limit.

Walmart's first quarter results overview

All in all, I think Walmart's performance this quarter...

Walmart's latest quarterly results showed strong resilience and the international division performed better than expected.

The company saw an increase in sales and profit margins during the quarter, as well as strong growth in its advertising and e-commerce business.

Walmart's Indian e-commerce platform Flipkart is showing strong growth and plans to enter the fast commerce sector, which is also supported by Google's recent investment.

Investment arguments

Compared with the same period last year, Walmart's stock price rose by about 33.3%, which greatly exceeded the 25.5% increase in the S&P 500 index during the same period, which attracted attention. In this article, I discussed the company's latest quarterly results. Although the company's valuation advantage needs to be improved, its resilience in a challenging macro environment and its international division's performance exceeding expectations made it more attractive than before, and will gradually unlock development potential in the future. If investors have confidence in the positive signals currently being released and want to invest and trade, here is a reference, you can choose BiyaPay to search for the WMT stock code on the platform and trade online in real-time; of course, if you have problems with deposits and withdrawals, you can also use the platform as a professional deposit and withdrawal tool for US and Hong Kong stocks, withdraw to a bank account, and then deposit to other brokerage firms to buy this growing stock. Compared with other platforms, the payment speed is fast and there is no limit.

Walmart's first quarter results overview

All in all, I think Walmart's performance this quarter...

Translated

10

summary

Dell Technologies has been partnering with major GPU manufacturers to launch AI-optimized servers, which could change their growth prospects.

Driven by AI training, inference, and data, the AI server market is expected to grow rapidly in the near future.

Dell's Client Solutions Group is a mature market, but its commercial business has grown well due to superior pricing and total revenue per device.

Dell Technologies (NYSE: DELL) provides storage, servers, networking, PCs and workstations to commercial and consumer customers. Recently, Dell has been collaborating with major GPU manufacturers including Nvidia (Nvidia, NVDA) and Advanced Micro Devices (AMD) to launch AI-optimized servers. Although AI-related businesses currently account for less than 5% of total revenue, it is anticipated that the AI-optimized server and storage product portfolio has the potential to change Dell's growth model, and Dell will raise its full-year performance forecast.

Growth due to AI-optimized servers and storage

Market.us predicts that the AI server market will grow at a compound annual growth rate of 30.3% between 2023 and 2033, mainly driven by AI training, inference, and data. The AI servers are equipped with third-party GPUs, including Nvidia's H100, H200, and AMD's MI300X.

Dell Technologies has been partnering with major GPU manufacturers to launch AI-optimized servers, which could change their growth prospects.

Driven by AI training, inference, and data, the AI server market is expected to grow rapidly in the near future.

Dell's Client Solutions Group is a mature market, but its commercial business has grown well due to superior pricing and total revenue per device.

Dell Technologies (NYSE: DELL) provides storage, servers, networking, PCs and workstations to commercial and consumer customers. Recently, Dell has been collaborating with major GPU manufacturers including Nvidia (Nvidia, NVDA) and Advanced Micro Devices (AMD) to launch AI-optimized servers. Although AI-related businesses currently account for less than 5% of total revenue, it is anticipated that the AI-optimized server and storage product portfolio has the potential to change Dell's growth model, and Dell will raise its full-year performance forecast.

Growth due to AI-optimized servers and storage

Market.us predicts that the AI server market will grow at a compound annual growth rate of 30.3% between 2023 and 2033, mainly driven by AI training, inference, and data. The AI servers are equipped with third-party GPUs, including Nvidia's H100, H200, and AMD's MI300X.

Translated

+7

10

summary

Alibaba Group Holdings announced good results for the previous fiscal year and announced a special dividend, enhancing its value proposition.

The company's sales growth is stronger, and it is increasing its share buyback efforts, making it more attractive to investors.

Alibaba's cloud computing business is performing well. The company is investing in artificial intelligence products and is expected to achieve long-term growth.

Alibaba Group Holdings Ltd. (NYSE: BABA) shares rose in April and May, thanks to the e-commerce giant reporting healthy results for the last fiscal year. Alibaba also announced a special dividend of $0.0825 per common share, further strengthening its value proposition.

The e-commerce company's sales growth is also stronger, and the company is ramping up share buybacks, which may make Alibaba more attractive to investors. I think Alibaba's current consolidation provides a buying opportunity for long-term investors interested in investing in growing e-commerce companies.

Investment arguments

I rate Alibaba's stock as a buy. What supports my investment thesis is that as a leading e-commerce platform, it is expected to benefit from an improved consumer environment. Additionally, as Alibaba announced a special dividend and increased share buybacks, the company became more attractive to investors seeking a higher return on capital.

Sales rebound, Alibaba Cloud, focus on stock buybacks

Alibaba benefited from sales growth in the last quarter...

Alibaba Group Holdings announced good results for the previous fiscal year and announced a special dividend, enhancing its value proposition.

The company's sales growth is stronger, and it is increasing its share buyback efforts, making it more attractive to investors.

Alibaba's cloud computing business is performing well. The company is investing in artificial intelligence products and is expected to achieve long-term growth.

Alibaba Group Holdings Ltd. (NYSE: BABA) shares rose in April and May, thanks to the e-commerce giant reporting healthy results for the last fiscal year. Alibaba also announced a special dividend of $0.0825 per common share, further strengthening its value proposition.

The e-commerce company's sales growth is also stronger, and the company is ramping up share buybacks, which may make Alibaba more attractive to investors. I think Alibaba's current consolidation provides a buying opportunity for long-term investors interested in investing in growing e-commerce companies.

Investment arguments

I rate Alibaba's stock as a buy. What supports my investment thesis is that as a leading e-commerce platform, it is expected to benefit from an improved consumer environment. Additionally, as Alibaba announced a special dividend and increased share buybacks, the company became more attractive to investors seeking a higher return on capital.

Sales rebound, Alibaba Cloud, focus on stock buybacks

Alibaba benefited from sales growth in the last quarter...

Translated

+4

13

summary

Tesla, Inc. (Tesla, Inc.) Facing unprecedented commercial challenges.

As the electric vehicle (EV) industry matures, competition becomes more intense, customer demand declines, and alternatives gradually become popular.

Tesla is responding to the challenge by ramping up the electric vehicle price war launched since the end of 2022.

At the same time, the company appears to be accelerating the development of a fully automated driving (FSD) platform and the launch of the Robotaxi service.

We remain optimistic about Tesla Corp. shares, reaffirming a target price of $492 per share and a buy rating.

Investment conclusion

This is no longerTesla Inc.(NASDAQ: TSLA ) It's a world of domination. The company is experiencing unprecedented competition. Demand for electric vehicles (EVs) in major markets is declining, while hybrid and plug-in electric vehicles are also on the rise.

However, Tesla's response was very appropriate. With the low-cost structure of its electric vehicle business, the company has stepped up the electric vehicle price war launched since the end of 2022. Tesla lowered the price of the 2024 Model Y to below the level of an internal combustion engine (ICE) vehicle and launched a new 2024 Model 3 for a monthly rental price of $299.

Following the release of its financial report for the first quarter of 2024, Tesla generally lowered the price of electric vehicles in the US, China, and Europe...

Tesla, Inc. (Tesla, Inc.) Facing unprecedented commercial challenges.

As the electric vehicle (EV) industry matures, competition becomes more intense, customer demand declines, and alternatives gradually become popular.

Tesla is responding to the challenge by ramping up the electric vehicle price war launched since the end of 2022.

At the same time, the company appears to be accelerating the development of a fully automated driving (FSD) platform and the launch of the Robotaxi service.

We remain optimistic about Tesla Corp. shares, reaffirming a target price of $492 per share and a buy rating.

Investment conclusion

This is no longerTesla Inc.(NASDAQ: TSLA ) It's a world of domination. The company is experiencing unprecedented competition. Demand for electric vehicles (EVs) in major markets is declining, while hybrid and plug-in electric vehicles are also on the rise.

However, Tesla's response was very appropriate. With the low-cost structure of its electric vehicle business, the company has stepped up the electric vehicle price war launched since the end of 2022. Tesla lowered the price of the 2024 Model Y to below the level of an internal combustion engine (ICE) vehicle and launched a new 2024 Model 3 for a monthly rental price of $299.

Following the release of its financial report for the first quarter of 2024, Tesla generally lowered the price of electric vehicles in the US, China, and Europe...

Translated

+2

10

Ideal Hong Kong stocks fell directly by 20% last week. If sentiment did not fluctuate, it would be impossible. Almost all shareholders are faced with the choice of whether to buy or sell, and buyers and sellers are once again abusing each other, especially when they own holdings in new energy vehicles such as Ideal. After careful thought, I asked myself two questions. These two questions determine whether to continue to hold and increase positions ideally.

First question

Are you optimistic about the future development direction of the NEV market, and do you accept that the current NEV stock prices are generally undervalued?

My answer to the first question is very firm. I am personally very optimistic about the future development of new energy vehicles. I personally believe that all car owners who have tested new energy vehicles will immediately develop the idea of replacing a new energy vehicle. The ideal car has been optimized in terms of vehicle interconnection, smart cockpit, and smart driving experience, raising the overall driving and riding experience of the car to a higher level and farther away from fuel vehicles. If you are worried about mileage, you can also choose to increase the range. Currently, more and more car owners are choosing hybrid technology cars to initially experience new energy vehicles, and the proportion of hybrid and pure electric vehicles may reach five or five this year.

In addition, mainstream NEV companies have dropped by more than 40% this year, with a decline of 60-90% from the historical high. Tesla 40 pe and ideal 14 pe are far below the historical average PE multiples.

Second question

Can Ideal occupy a leading position among new energy vehicle companies and achieve long-term growth?

However, number one...

First question

Are you optimistic about the future development direction of the NEV market, and do you accept that the current NEV stock prices are generally undervalued?

My answer to the first question is very firm. I am personally very optimistic about the future development of new energy vehicles. I personally believe that all car owners who have tested new energy vehicles will immediately develop the idea of replacing a new energy vehicle. The ideal car has been optimized in terms of vehicle interconnection, smart cockpit, and smart driving experience, raising the overall driving and riding experience of the car to a higher level and farther away from fuel vehicles. If you are worried about mileage, you can also choose to increase the range. Currently, more and more car owners are choosing hybrid technology cars to initially experience new energy vehicles, and the proportion of hybrid and pure electric vehicles may reach five or five this year.

In addition, mainstream NEV companies have dropped by more than 40% this year, with a decline of 60-90% from the historical high. Tesla 40 pe and ideal 14 pe are far below the historical average PE multiples.

Second question

Can Ideal occupy a leading position among new energy vehicle companies and achieve long-term growth?

However, number one...

Translated

10

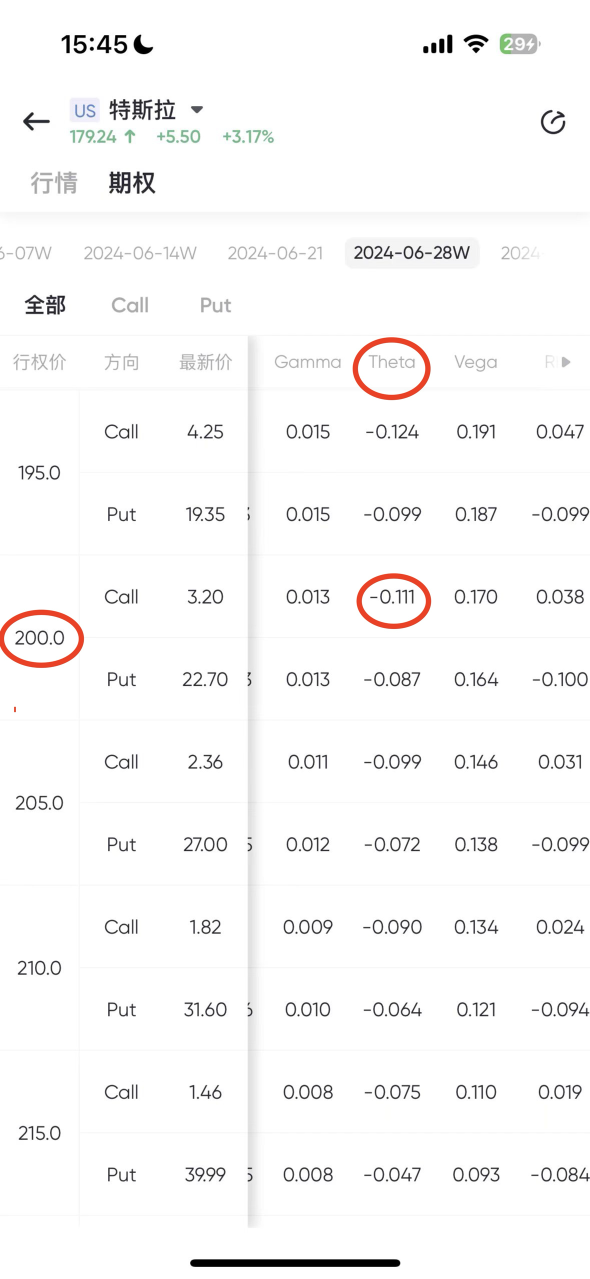

Many people say that playing options is a form of gambling with high risk and high return, but this is for newbies. For experts, options are actually a stable profit tool. So what's the difference between a novice and a pro?

The real gap between newbies and experts is not actually a difference in investment judgment, but a difference in way of thinking. Many newcomers to options are new to stock trading. They often trade options with a typical stock mentality, and this is the core reason why they keep falling behind.

However, real options traders have a completely different way of thinking and approach.

It's not a very advanced method, but it's often difficult for newbies to understand on their own without reminders from others. And this whole process will waste a lot of money, and you may even give up halfway before you have experienced the true power of expiration rights.

So, today Xiaobian will reveal the real expert trading mentality and the complete set of methods behind it. After reading it, I won't say you can become an options expert right away, but it will definitely let you take fewer detours in options trading.

What is stock thinking?

First, options newbies will habitually use stock thinking to trade options.

Simply put, it's either bullish or bearish, because stocks are only bullish and bearish.

For example, if you are bullish, you buy a call; if you are bearish, you buy a put. Those who are a little more advanced will understand that they will be bullish or bearish for a certain period of time.

For example, I'm...

The real gap between newbies and experts is not actually a difference in investment judgment, but a difference in way of thinking. Many newcomers to options are new to stock trading. They often trade options with a typical stock mentality, and this is the core reason why they keep falling behind.

However, real options traders have a completely different way of thinking and approach.

It's not a very advanced method, but it's often difficult for newbies to understand on their own without reminders from others. And this whole process will waste a lot of money, and you may even give up halfway before you have experienced the true power of expiration rights.

So, today Xiaobian will reveal the real expert trading mentality and the complete set of methods behind it. After reading it, I won't say you can become an options expert right away, but it will definitely let you take fewer detours in options trading.

What is stock thinking?

First, options newbies will habitually use stock thinking to trade options.

Simply put, it's either bullish or bearish, because stocks are only bullish and bearish.

For example, if you are bullish, you buy a call; if you are bearish, you buy a put. Those who are a little more advanced will understand that they will be bullish or bearish for a certain period of time.

For example, I'm...

Translated

+2

17

Investors often hear wealth stories about getting rich overnight, but unfortunately, the vast majority of retail investors won't be the protagonists of the story. For most of us retail investors, instead of thinking about making a fortune, it's better to get down to earth by running and getting fit.

The covered call I'm going to introduce to you today is a basic strategy similar to swimming and fitness. It doesn't make you rich overnight, but if used well, it can increase the yield of your long-term holdings by an additional 10%-20% every year. Everyone knows what level this long-term rate of return is.

What is Covered Call

A covered call means we sell 1 call option for that stock while holding 100 underlying shares (in US stock options, 1 option contract usually corresponds to 100 underlying shares).

It is important to note here that the premise for every sale of a call is that you must hold 100 shares of the original stock, also known as “covered (covered)”, that is, “ready to be exchanged and taken away at any time” (if the call to be sold becomes real value when it expires, the other party will exercise its right to take your shares).

The most important part of this strategy is this covered. Assuming you don't own the original stock, it's called naked selling. Selling naked is an extremely risky operation. If you are a novice, don't try it out at will. (Profit...

The covered call I'm going to introduce to you today is a basic strategy similar to swimming and fitness. It doesn't make you rich overnight, but if used well, it can increase the yield of your long-term holdings by an additional 10%-20% every year. Everyone knows what level this long-term rate of return is.

What is Covered Call

A covered call means we sell 1 call option for that stock while holding 100 underlying shares (in US stock options, 1 option contract usually corresponds to 100 underlying shares).

It is important to note here that the premise for every sale of a call is that you must hold 100 shares of the original stock, also known as “covered (covered)”, that is, “ready to be exchanged and taken away at any time” (if the call to be sold becomes real value when it expires, the other party will exercise its right to take your shares).

The most important part of this strategy is this covered. Assuming you don't own the original stock, it's called naked selling. Selling naked is an extremely risky operation. If you are a novice, don't try it out at will. (Profit...

Translated

13

1

summary

PayPal's valuation is very attractive, and its price-earnings ratio is extremely low compared to historical averages and revenue and earnings growth.

The company is committed to reshaping the business, improving innovation capabilities and cost efficiency.

The revenue growth potential of Venmo and its debit card wasn't fully taken into account in PayPal's valuation.

I expect PayPal to perform well in 2025.

prelude

I first reported on PayPal (NASDAQ: PYPL) at the end of December and gave it a “strong buy” rating. I thought the bullish reasons were very compelling, while the bearish reasons were gradually disintegrating. Next, I gave another “Strong Buy” rating in my earnings assessment after the fourth quarter report. Although the company lagged behind S&P in both time periods, and the stock fluctuated in a range for several months, my confidence in the value shown by the stock remained strong. I reaffirm my “Strong Buy” rating for the reasons discussed below.

It's really disheartening to keep investing in underperforming stocks while watching AI stocks rise rapidly. I understand the disappointment of many investors and bullish analysts at this company.

But I'm sure investors who are patient with PayPal will be well rewarded for years to come. Despite many signs of optimism, the business's current pricing is based on the most pessimistic expectations.

Reasons for optimism: valuations and buybacks

First, PayPal's valuation is still very...

PayPal's valuation is very attractive, and its price-earnings ratio is extremely low compared to historical averages and revenue and earnings growth.

The company is committed to reshaping the business, improving innovation capabilities and cost efficiency.

The revenue growth potential of Venmo and its debit card wasn't fully taken into account in PayPal's valuation.

I expect PayPal to perform well in 2025.

prelude

I first reported on PayPal (NASDAQ: PYPL) at the end of December and gave it a “strong buy” rating. I thought the bullish reasons were very compelling, while the bearish reasons were gradually disintegrating. Next, I gave another “Strong Buy” rating in my earnings assessment after the fourth quarter report. Although the company lagged behind S&P in both time periods, and the stock fluctuated in a range for several months, my confidence in the value shown by the stock remained strong. I reaffirm my “Strong Buy” rating for the reasons discussed below.

It's really disheartening to keep investing in underperforming stocks while watching AI stocks rise rapidly. I understand the disappointment of many investors and bullish analysts at this company.

But I'm sure investors who are patient with PayPal will be well rewarded for years to come. Despite many signs of optimism, the business's current pricing is based on the most pessimistic expectations.

Reasons for optimism: valuations and buybacks

First, PayPal's valuation is still very...

Translated

+3

16

summary

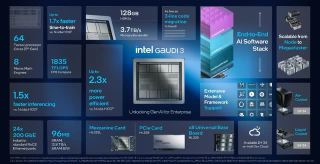

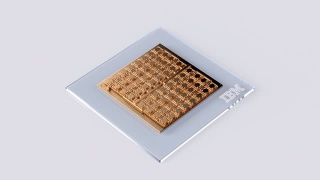

Nvidia is already the winner of the AI competition.

The competition is heating up, and it's not just AMD and Intel. Nvidia's own customers are also developing competitive AI chips to bypass Nvidia.

Software is an untapped revenue stream for Nvidia. They have all the necessary foundations, and now it's time to act.

Nvidia performed well in the first quarter and is expected to grow even more in the next few quarters, in addition to announcing a 10-split 1 share split.

Investment arguments

Nvidia (NASDAQ: NVDA) (NEOE: NVDA: CA) is the biggest beneficiary of the surge in AI demand. They already have the hardware and software, and most importantly, their systems were already being used for AI applications before the viral popularity of Chat GPT made companies and countries around the world recognize the potential of AI.

The surge in Nvidia's valuation is due to a significant increase in revenue last year, and it looks like this growth trend is likely to continue. Nvidia is well positioned in 2024, and the shortage of its products is likely to continue until 2025. What is worrying is the next few years. Nvidia currently has a strong moat, but it also has many challengers, including Nvidia's own...

Nvidia is already the winner of the AI competition.

The competition is heating up, and it's not just AMD and Intel. Nvidia's own customers are also developing competitive AI chips to bypass Nvidia.

Software is an untapped revenue stream for Nvidia. They have all the necessary foundations, and now it's time to act.

Nvidia performed well in the first quarter and is expected to grow even more in the next few quarters, in addition to announcing a 10-split 1 share split.

Investment arguments

Nvidia (NASDAQ: NVDA) (NEOE: NVDA: CA) is the biggest beneficiary of the surge in AI demand. They already have the hardware and software, and most importantly, their systems were already being used for AI applications before the viral popularity of Chat GPT made companies and countries around the world recognize the potential of AI.

The surge in Nvidia's valuation is due to a significant increase in revenue last year, and it looks like this growth trend is likely to continue. Nvidia is well positioned in 2024, and the shortage of its products is likely to continue until 2025. What is worrying is the next few years. Nvidia currently has a strong moat, but it also has many challengers, including Nvidia's own...

Translated

+4

17

The financial management market over the past few years has generally given people the impression that it is a mess. Every now and then, runaway news pops up. The stock market has plummeted, and the wealth management yield of major banks, institutions, etc. has declined, all making people feel like they don't know how to manage money. But in reality, no matter how the market changes, you still have a choice; you just don't understand it. Today, let's expand your knowledge in one issue.

Over the past few days, friends have been asking about US debt. After the Federal Reserve postponed interest rate cuts, everyone's expectations for interest rate cuts are high. I always feel that interest rate cuts are coming soon. This is also the reason why many people are paying attention to US debt recently. Everyone is expecting US debt to rise after interest rate cuts. Today, let me share with you what US debt is? How's the revenue? Who is it for? How to buy US bonds?

What are US Treasury bonds?

“US Treasury bonds” refer to the large amount of capital required by the US government to continuously stimulate the country's economy, and raise funds from investors through the issuance of bonds. When bonds issued by the US government are purchased by investors, we call them “US Treasury bonds.” When you buy US debt, you are lending money to the US government, let them use your money for construction, and then give you interest.

US Treasury Yield

I looked at the US government's official website. The 30-year US Treasury yield is 4.625%, and the 10-year yield is 4.375%.

Looking at the bulls and Futubull, the 2-year yield is 4.833%, and the 5-year and 10-year yield is around 4.4. Of all bonds, US bonds have the highest yield.

Suitable for people

Conservative investors,...

Over the past few days, friends have been asking about US debt. After the Federal Reserve postponed interest rate cuts, everyone's expectations for interest rate cuts are high. I always feel that interest rate cuts are coming soon. This is also the reason why many people are paying attention to US debt recently. Everyone is expecting US debt to rise after interest rate cuts. Today, let me share with you what US debt is? How's the revenue? Who is it for? How to buy US bonds?

What are US Treasury bonds?

“US Treasury bonds” refer to the large amount of capital required by the US government to continuously stimulate the country's economy, and raise funds from investors through the issuance of bonds. When bonds issued by the US government are purchased by investors, we call them “US Treasury bonds.” When you buy US debt, you are lending money to the US government, let them use your money for construction, and then give you interest.

US Treasury Yield

I looked at the US government's official website. The 30-year US Treasury yield is 4.625%, and the 10-year yield is 4.375%.

Looking at the bulls and Futubull, the 2-year yield is 4.833%, and the 5-year and 10-year yield is around 4.4. Of all bonds, US bonds have the highest yield.

Suitable for people

Conservative investors,...

Translated

+2

13

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)