Will U.S. Stocks Hit New Highs? Here is What the Regularity of Political Cycles Suggests in 2024

Will U.S. Stocks Hit New Highs? Here is What the Regularity of Political Cycles Suggests in 2024

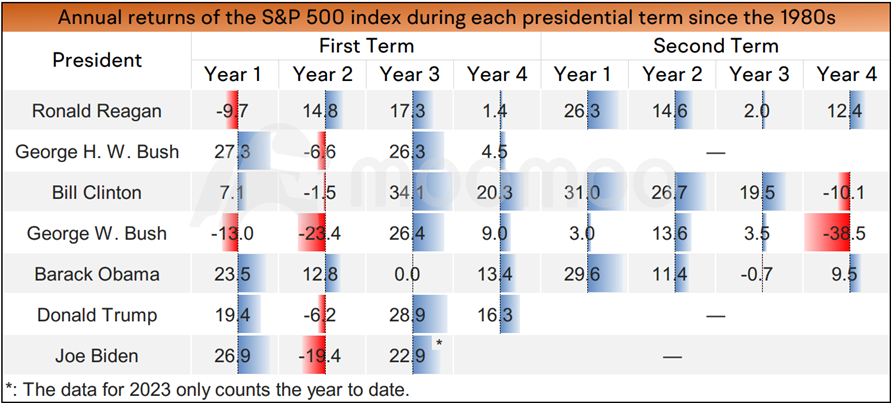

Since the 1980s, the performance of U.S. stocks has followed political cycles. The U.S. stock market will inevitably fall in the first two years of each president's first term (unless it had already halved before Obama took office), and the U.S. stock market will occasionally fall in the last two years of his second term (such as re-election), but there has never been a negative return in the middle years. The market trends were remarkably consistent unless there was a major shock, such as the Great Recession.

The U.S. political cycle normally affects the economic cycle; the election results affect private investment, and there will be a honeymoon period at the beginning of almost every government term. The regularity shows U.S. stocks will likely rise in 2024. If the Federal Reserve cuts interest rates beyond expectations in 2024, U.S. stocks may also perform stronger before the election.

■ Why does the presidential cycle exist?

Yale Hirsch, a stock market researcher, published the inaugural edition of the Stock Trader's Almanac in 1967. The book showed that the presidential election cycle, which happens every four years, is a significant indicator of stock market performance. According to Yale Hirsch, the outcomes are relatively steady, regardless of the president's political leanings in office at the time, and the year after each presidential election marks the start of a new four-year stock market cycle.

The theory indicates the reason why the stock market performs the worst during the first two years of the cycle is that wars, economic downturns, and bear markets are more likely to happen in the first half of a president's term, while bull markets are more likely to occur in the last two years. As the following election approaches, the model suggests that presidents focus on growing the economy.

■ Will the Year of 2024 continue to follow this pattern as Fed turns dovish?

Bloomberg reported that election pressure on the Biden administration next year may be one of the issues that the Fed considers. A dovish interest rate environment might be Fed's reasonable choice consistent with the political cycle.

Biden's poll numbers have declined due to voter concerns over the economy. Tobin Marcus, former Biden adviser, believes the expected rate cuts could help alleviate voter dissatisfaction with the economy. He notes that the current highest mortgage rates in a generation are among the last abnormal economic dynamics remaining after the peak inflation and pandemic shocks have passed. As rates normalize, voters are likely to feel more positive next year.

This means the stock market is likely to follow its usual pattern now that Powell has turned dovish.

Besides, Yellen said that the current decline in inflation means that while the Fed keeps nominal interest rates unchanged, real interest rates adjusted for inflation are rising. This seems to be a reasonable reason for the Fed to cut interest rates in the future. The Federal Reserve's latest dot plot forecast brings forward the interest rate cut that should have been carried out in 2025 to the "election year" of 2024.

■ What are the specific industries to watch in election years?

Eric Freedman, the Chief Investment Officer of U.S. Bancorp, suggests that public policy-induced economic instability typically affects specific sectors rather than the overall economy. For instance, government's healthcare policy changes, which vary depending on the political party in power, often lead to increased volatility in the healthcare sector.

Similarly, the energy industry is prone to greater volatility due to divergent regulatory attitudes toward domestic energy production and a push to incentivize renewable energy sources. The desire to decrease greenhouse gas emissions while promoting the use of green energy leads to uncertainty in the sector.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

HotShot369 : My guess is after he ends his presidency, it will be hell for the market because the government was boosting the economy.

HotShot369 HotShot369: not a guess actually just a fact.