Will Dividend-Paying Stocks Make a Comeback in 2024 After a Tough 2023?

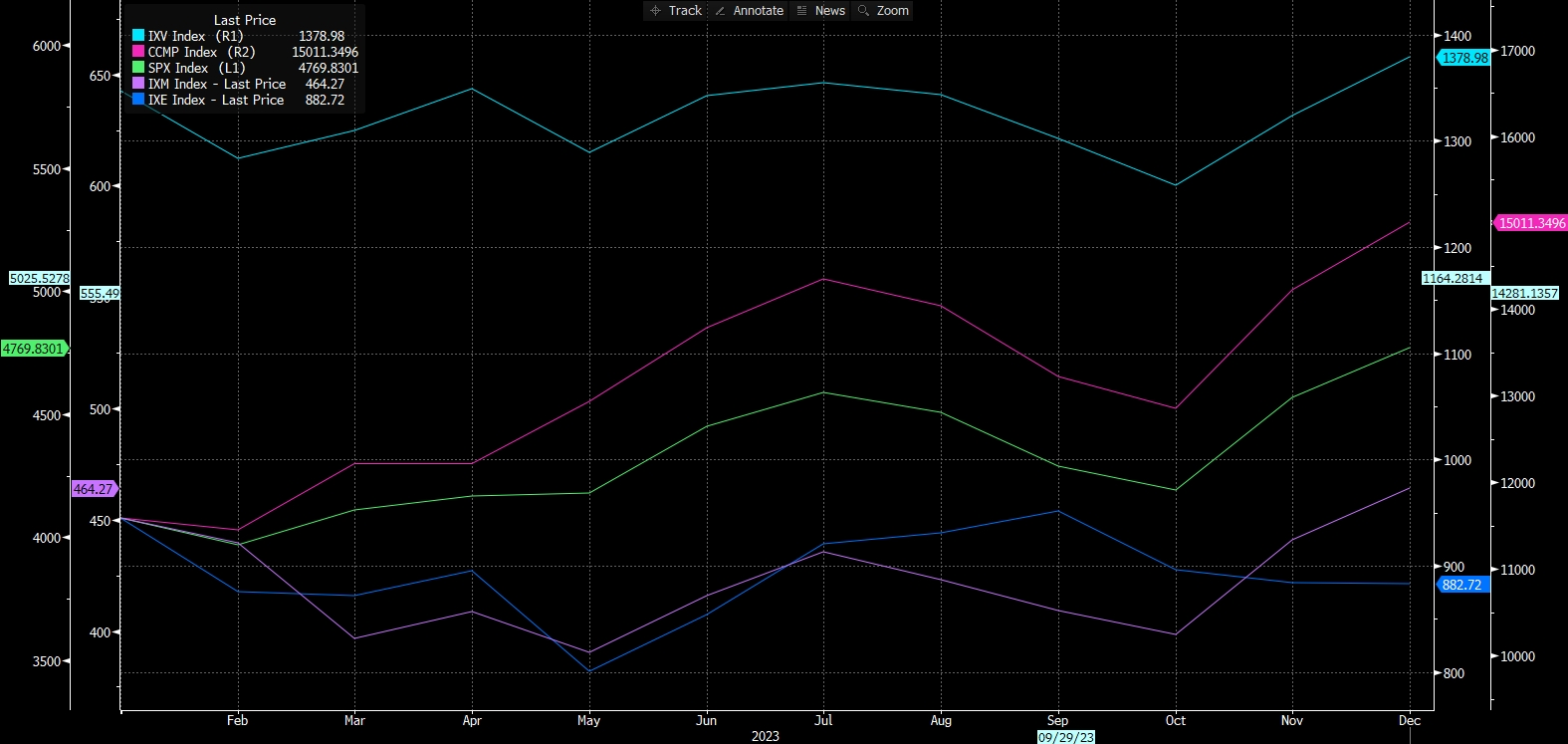

In 2023, the limelight shifted to Big Tech, with the Nasdaq Composite surging over 40%, fueled by excitement over artificial intelligence. Meanwhile, the Federal Reserve's aggressive rate hikes made income-generating assets, like short-term Treasuries, competitive against dividends.

The dominance of the tech-centric market surge overshadowed dividend-paying stocks, but signs point to a potential revival in 2024.

Why Dividend Stocks Underperformed in 2023?

1. The underperformance of banks, biopharma, and energy stocks has hindered the dividend-paying segment of the market. The sector faced challenges in financial services due to bank failures, leading to a decline in confidence. Truist, the Dividend Yield Focus Index constituent, witnessed a 27% share price decline.

Within the energy sector, constituents of the Dividend Yield Focus Index, including ExxonMobil, Chevron, and Pioneer Natural Resources, reported negative performances in the first half of 2023 and stayed volatile in the second half of the year.

Biopharma stocks not benefiting from the weight-loss drug trend faced diminished favor in healthcare in 2023. Pfizer and AbbVie, constituents of both Dividend Yield Focus and Dividend Growth, experienced declines from COVID-related highs and encountered competitive pressures.

2. Equities and income-focused stocks faced headwinds as interest rates climbed. The premise is straightforward: higher rates elevate yields on other investments like bonds and cash, potentially dimming the allure of dividends for income-seeking investors.

3. In 2023, the tech sector experienced a significant influx of capital, driven by robust performance that attracted investors. Notably, in the first half of the year, nearly 75% of the gains in the Morningstar US Market Index were attributable to the 'Magnificent Seven' stocks, none of which qualify as dividend champions.

Only 4.8% of the highest-quality dividend stocks are found in the technology sector, as per Morningstar figures. In contrast, the technology sector makes up 28.4% of the US equity market.

Outlook for Dividend Stock in 2024

Many sectors with robust dividend yields are currently deemed to have attractive valuations in 2023, with financial services (P/E of 16.06x) and healthcare (P/E of 22.78x) standing out among them. For reference, the P/E ratio for tech is P/E of 34.96x in 2023.

Investors shouldn't give up on dividend-paying stocks in their portfolio. However, the key is for investors to be selective and seek out durable dividends over the long run according to Morningstar.

Looking ahead, catalysts may favor dividend payers in 2024, driven by the Fed's anticipated three rate cuts. According to Charlie Gaffney, Managing Director at Morgan Stanley Investment Management, a lower interest rate environment benefits equity markets. Gaffney emphasized growth, yield, and valuation as positive indicators for dividend payers in the upcoming year.

"The key that I think will work really well in 2023 are companies with solid business franchises – they are durable and can generate tremendous amounts of free cash to generate distributions and grow dividends in time," he said.

For that reason, Gaffney highlighted companies with robust business franchises, focusing on Broadcom, a chipmaker yielding 1.9%, and Broadridge Financial Solutions, up 52% this year with a 1.6% yield.

Broadcom's strong cloud computing and AI growth potential aligns with market trends. The investor emphasized that Broadridge's capacity to enhance profit margins and earnings directly leads to increased dividends, positioning the stock as a timeless compounder set to provide impressive returns to shareholders over the long term consistently.

Another contrarian pick is Allstate, a property-casualty insurer with a 2.6% dividend yield. Gaffney sees Allstate as underappreciated, anticipating growth driven by a firming pricing environment, allowing for increased dividend payments and growth.

These selections align with recent endorsements, including Bernstein naming Broadcom a top pick and Evercore ISI adding Broadridge to its tactical outperform list. Piper Sandler also raised its 2023 estimates on Allstate, citing improved catastrophe losses and continued price increases.

Mooers, do you think dividend-paying stocks will perform well in 2024? Please feel free to leave your comments.

Source: CNBC, Morningstar, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SharonH6 : yes I do

Nicco330 : hope