Why AI is not a Bubble

The explosion of interest in AI that has dominated equity markets in recent months reflects the potential for new avenues of growth and, at the same time, the power of a stock market narrative to drive expectations.

While AI as a technology is not new, the interest around its potential has gathered momentum since the launch of ChatGPT. This exuberance has fuelled a re-rating in the technology sector overall, but particularly in the easier to identify ‘early winners’ — companies innovating and investing heavily in the technology, and those that are enabling its commercialisation.

Our US equity strategists recently highlighted a list of 11 US stocks that they view as potential near-term beneficiaries of the AI revolution. They include the makers of semiconductors and related equipment needed to build AI technology: Nvidia (NVDA), Marvell Technology (MRVL), and Credo Technology Group (CRDO); hyperscalers and the mega-caps that use their extensive cloud computing infrastructures to commercialise AI on a large scale: Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN), and empowered users: companies that are currently leveraging AI technology to amplify their businesses: Meta Platforms (META), Salesforce (CRM), Adobe (ADBE), ServiceNow (NOW), and Intuit (INTU).

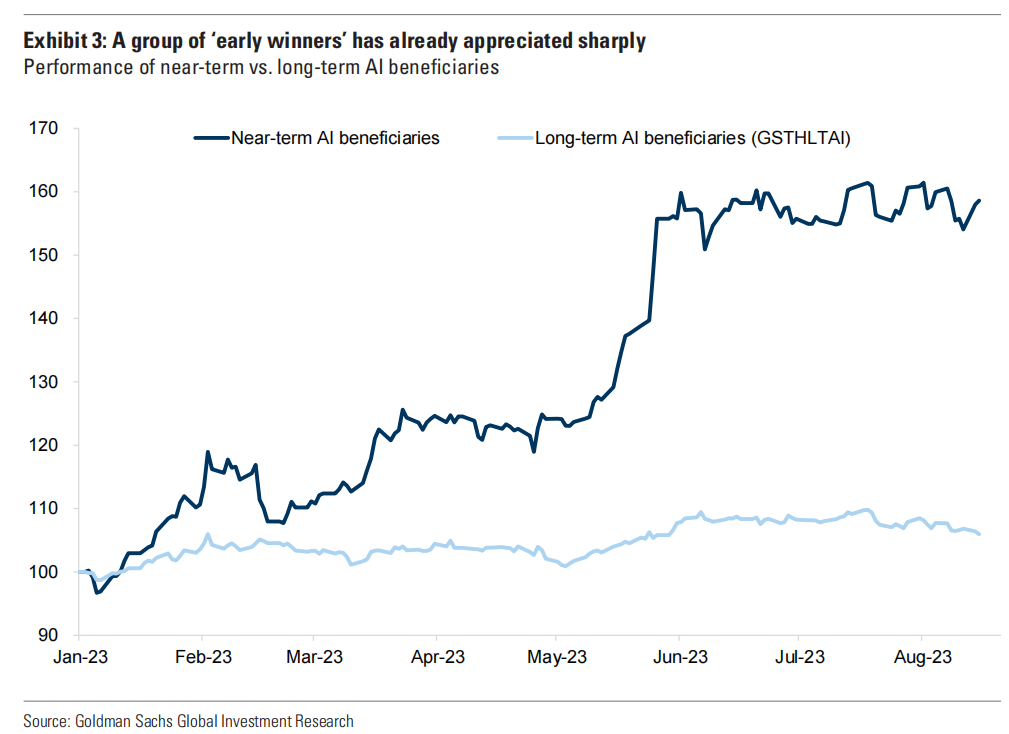

This group of ‘early winners’ has already appreciated sharply, returning roughly 60% YTD (Exhibit 3).

Since many of these early winners are very large companies, the concentration of the returns in the equity market this year has been extraordinarily high: for example, just 15 companies in the US accounted for over 90% of the S&P 500 return between January and June of 2023.

Many investors question the sustainability of this narrow leadership, the higher valuations and the potential for another technology bubble, with comparisons being made to the mania for everything tech-related in the 1990s. Like many bubbles built around new technologies throughout history, the tech bubble of the late 1990s was not without foundation. Investors correctly recognised that a major new cycle of innovations would have a profound impact on growth and profitability in the future. The problem was that the scale and timing of the likely returns were overstated at the time, and many of the eventual winners did not yet exist.

When the bubble burst, in common with many others in history, it wiped out many of the new entrants that were not yet profitable. Despite the spectacular collapse, the technologies that drove the bubble (the internet in particular) survived and thrived as the sector re-emerged as the main driver of performance and profits in the post-financial-crisis period.

While tech stocks have been the main driver of equity market returns since the financial crisis of 2007/08, their performance has come in four distinct phases:

2010-2019 — Outperformance driven by stronger earnings, the widespread adoption of smartphones, the impact of zero interest rates and the problems facing ‘value’ sectors.

2020-2022 — During the Covid-19 pandemic, the explosion of demand for technology and related services (at a time when other consumption was restricted) led to a significant outperformance of technology companies.

2022-2023 — As inflation and rising interest rates began to emerge in 2022, technology companies experienced a sharp pullback in performance, particularly in non-profitable tech companies, as they buckled under the weight of a higher cost of capital and negative impact on their ‘long duration’ cash flows. Many had also overextended, buoyed by the cheap cost of capital, and needed to reduce spending as funding costs increased.

2023-now — Since the start of this year, the technology sector has begun to outperform again, driven by the large US technology companies, viewed as potential winners from the emerging technologies around artificial intelligence.

So, while the outperformance of the technology sector over the past 15 years as a whole has reflected bouts of optimism and valuations re-rating, it has mainly relied on strong underlying fundamentals. The sector has outgrown and out-earned other parts of the equity market (Exhibit 5), enjoying sustainably higher return on equity (Exhibit 6).

Strong fundamentals support valuations

Aside from their valuation, an important difference between the current leaders in the AI technology space and those in the late 1990s bubble is that the current crop of leaders is already very profitable and cash-generative, and they are able to invest at a high rate even in an environment of higher interest rates.

For example, Exhibit 12 shows that the big tech companies in the US today hold around 4% cash as a share of market capitalisation, compared with 2% in the tech bubble, and while the net debt to equity is the same, the ROE at 44% and average margin at 25% are nearly twice the average in the tech bubble.

This has made these companies relatively defensive in terms of their revenues and earnings. As Exhibit 13 shows, the Big Tech companies have generated roughly 3x the average sales growth of the market and 2x the net income margin. High reinvestment rates and network effects are likely to make these companies defensive stable growth opportunities that can generate high compounding returns

Another interesting perspective on technology valuation is that it is far less extreme in the current environment relative to other asset classes. For example, Exhibit 14 below shows the dividend yield of the technology sector in the US relative to the yield on US 10-year bonds and on 10-year real bond yields. The dividend yield has fallen from its highs during the pandemic and is now lower than the nominal bond yield and the real yield for the first time since before the financial crisis. Investors are buying equities yielding just 1% despite being offered around 4% on 10-year treasuries and close to 2% in real terms. Nevertheless, during the optimism of 2000, investors were giving up a nominal bond yield of close to 5% and a real yield of around 4% to buy equities offering virtually no yield at all. This reflects the extreme confidence that investors then had in the ability of technology companies to offer higher returns even as the risk free returns were highly attractive.

Another important point to make about the current focus of investor attention is that it has mainly been reflected in rising valuations for profitable technology companies rather than unprofitable ones (Exhibit 15). This is an import difference to the period prior to the current interest rate cycle when unprofitable technology with high expected growth performed well and enjoyed very high valuations. Many of these companies have de-rated significantly over the past 18 months or so as the higher cost of capital has aggressively undermined their business models and valuations. The biggest profitable tech companies, however, have benefited both from less competition and from their strong balance sheets and cash flow generation, which has made them increasingly defensive on a relative basis under the weight of higher interest rates.

In summary, while the technology sector has once again become dominant in driving relative outperformance, we do not find the valuations similar to other bubble periods. There have already been significant re-ratings of a few companies that can be viewed as ‘early winners’ — companies that are either the Pioneers in the space or the Enablers. These are likely to continue to perform as the technology scales. Ultimately, the second-wave pioneers that innovate and create new products based on the original technology are also likely to offer exciting investment opportunities. In time, the bigger opportunities may be found in identifying the new Reformers that re-shape industries by leveraging what AI has to offer. Best-in-class Adaptors with industry-leading execution are likely to provide an attractive investment opportunity. However, as many companies adapt to AI, increasing benefits should feed through to consumers. Companies that can tap into this opportunity might benefit more that the market is currently discounting.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment