When U.S. bond yields enter a downward channel, the biotechnology industry may be revived.

If the ten-year U.S. Treasury yield, the anchor of global asset pricing, declines, will the tide of biomedicine rise again?

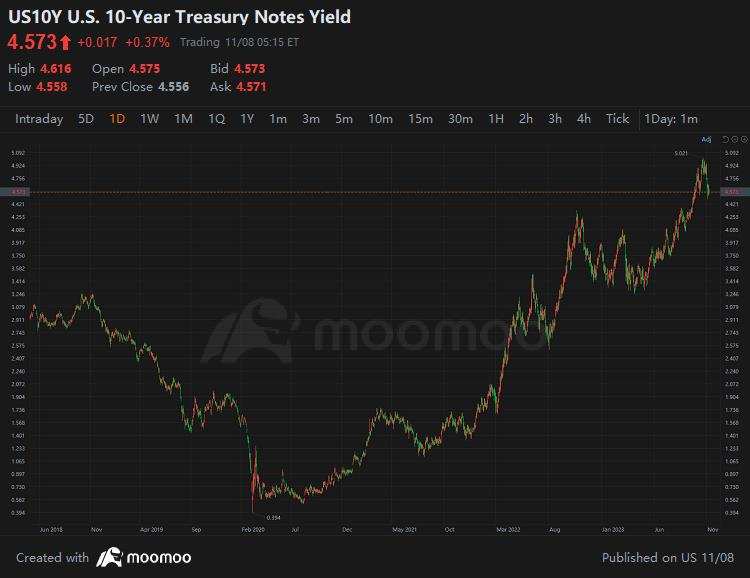

Early biotechnology cannot support itself and relies heavily on external capital for blood transfusions. When the 10-year U.S. bond yield, the anchor of global asset pricing, rises to about 5%, it means that the risk-free rate of return reaches about 5%, and you can make money while sitting still, and the financing interest rate is high, who would be willing to invest in biotechnology Risk assets?

Only when the risk-free rate of return declines will capital be willing to take risks again and flow into biotechnology. On March 3, 2020, the 10-year U.S. Treasury yield fell below 1% for the first time in 150 years, and continued to hit a record low, quickly falling below 0.5%. In 2020Q2, the U.S. Biotechnology Index Fund XBI immediately rose by 44.5%.

At this stage, it completely recovered the decline caused by the epidemic, and then continued to rise by 56% until it peaked and fell back in February 2021. The establishment of the downward turning point is almost the same as the establishment of the rising turning point of U.S. bond yields. Synchronize.

In our not-too-distant memory, 2020 and the first half of 2021 are also the first boom and bubble periods for domestic innovative drugs. As the 10-year U.S. Treasury yield surged from below 0.5% to above 5%, global biotechnology entered a cold winter.

The four seasons cycle, the US non-farm payrolls in October were lower than expected by 150,000, the unemployment rate rose to 3.9%, the highest in the past two years, and the interest rate hike cycle is basically over. When U.S. bond yields enter a downward channel, biotechnology risk assets may enter an upward channel again.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment