What to Expect in the Week Ahead (NVDA, WMT, RIVN and CVNA Earnings; FOMC Meeting Minutes)

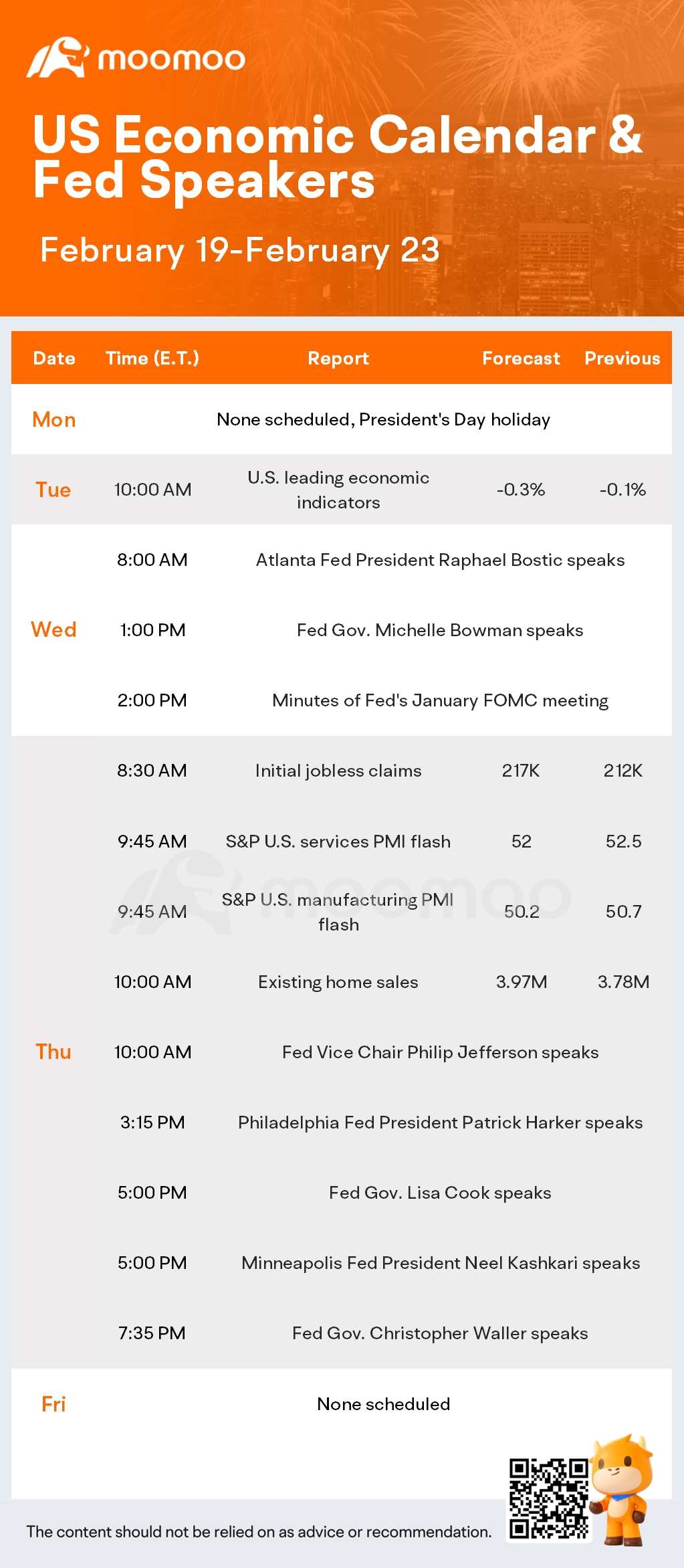

The upcoming earnings release from semiconductor company Nvidia could serve as a crucial test for this high-flying stock and the burgeoning excitement around artificial intelligence, which has been a driving force behind the recent advances in the U.S. stock market. Several Fed officials will speak in the coming week, including Fed Governors Michelle Bowman, Lisa Cook, and Christopher Waller, Philadelphia Fed President Patrick Harker, and Minneapolis Fed President Neel Kashkari.

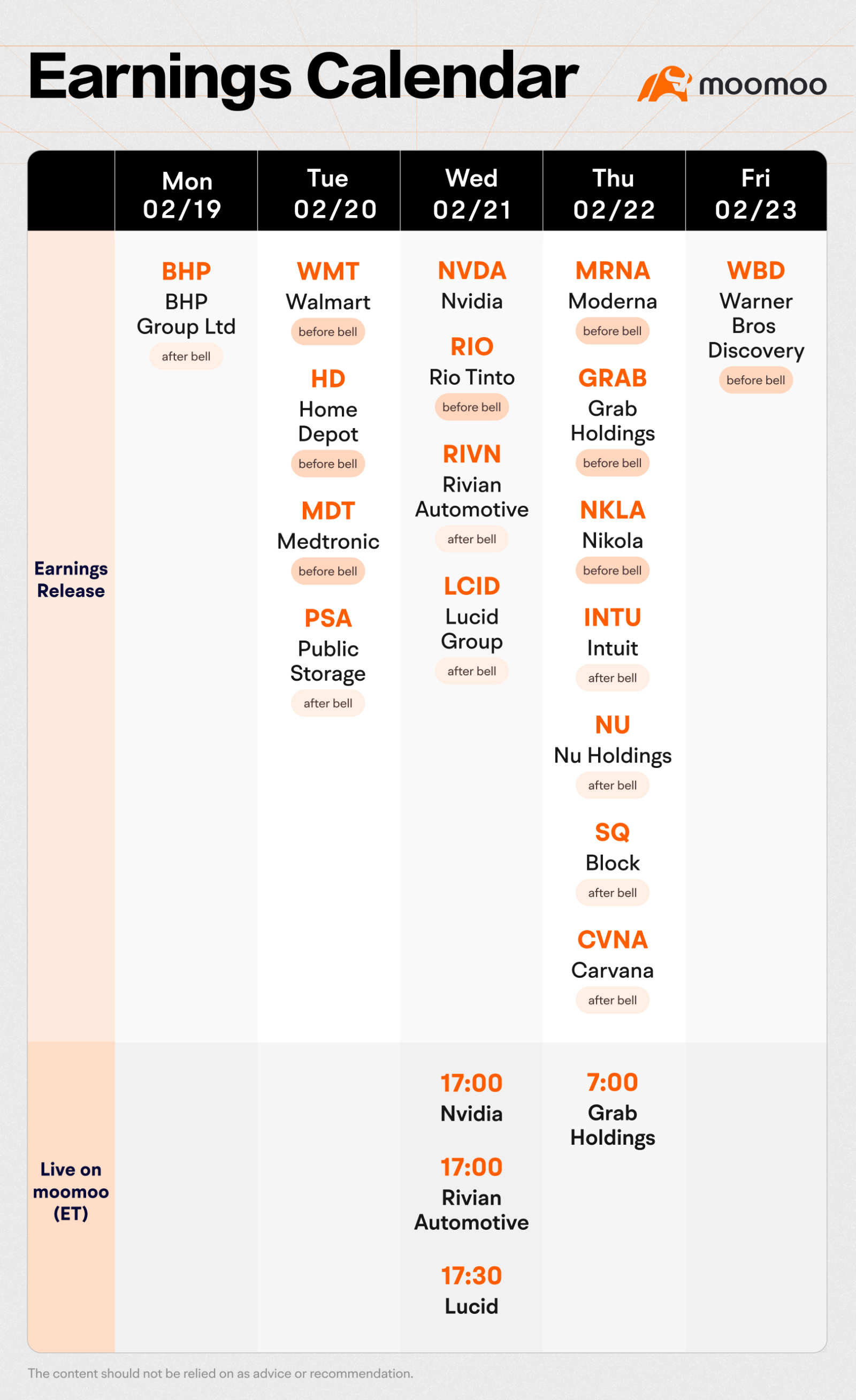

Upcoming earnings of the week include $Walmart(WMT.US$, $Home Depot(HD.US$, $NVIDIA(NVDA.US$, $Rivian Automotive(RIVN.US$, $Lucid Group(LCID.US$, $Moderna(MRNA.US$, $Nikola(NKLA.US$, $Nu Holdings(NU.US$, $Block(SQ.US$, $Carvana(CVNA.US$ and more.

$NVIDIA(NVDA.US$ is poised to report its Q4 earnings for fiscal year 2024 after market close on Wednesday, with projections pointing to a substantial increase in both profits and revenue, riding the wave of the AI industry's expansion. Analysts forecast that Nvidia's revenue could surge to $20.38 billion, a significant leap from the previous year's quarter, as per Visible Alpha's data. Expected net income is set to soar to $10.4 billion, up from $1.41 billion, with earnings per share predicted to rise sharply to $4.18 from just 57 cents a year earlier, reflecting the company's accelerated growth amid the AI boom.

$Walmart(WMT.US$ is set to report a 4% revenue increase to $170.33 billion for its fiscal Q4 2024 on Tuesday, despite an expected 30% drop in net income to $4.36 billion. Analysts predict the retail behemoth's e-commerce growth will offset softer comparable store sales and general merchandise performance.

$BHP Group Ltd(BHP.US$ will report its half-year results, and with iron ore prices remaining robust in the first half, there is heightened anticipation. Analysts at Goldman Sachs anticipate that the company will disclose a 6.2% rise in first-half revenue to US$27,595.57 million, compared to US$25,982 million from the same period last year. Earnings are also projected to follow an upward trend, with the average prediction being US$1.43 per share, marking a 10% increase from the previous year's comparable half.

$Rivian Automotive(RIVN.US$ is anticipated to report an improved year-over-year quarterly loss of $1.39 per share, marking a 19.7% positive change, alongside a significant revenue increase of 94.1% to $1.29 billion for the quarter ending December 2023. The consensus outlook suggests these results could influence Rivian's stock price in the short term.

FOMC Meeting Minutes

The minutes from the Jan. 30-31 FOMC meeting are expected to shed light on why Fed Chair Jerome Powell and colleagues hesitated to initiate rate cuts in March, despite positive inflation data prior to January. This caution may stem from robust economic indicators, such as the unexpectedly swift 4Q GDP growth and strong December retail sales, leading several FOMC members to reconsider the neutral interest rate as being higher post-pandemic, suggesting that the current policy may be less restrictive than previously thought.

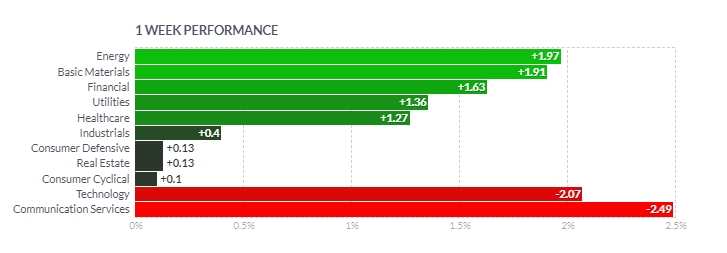

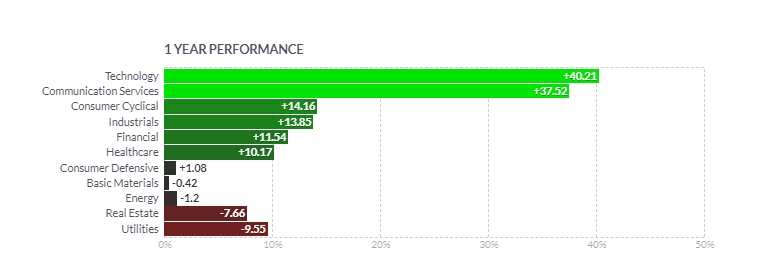

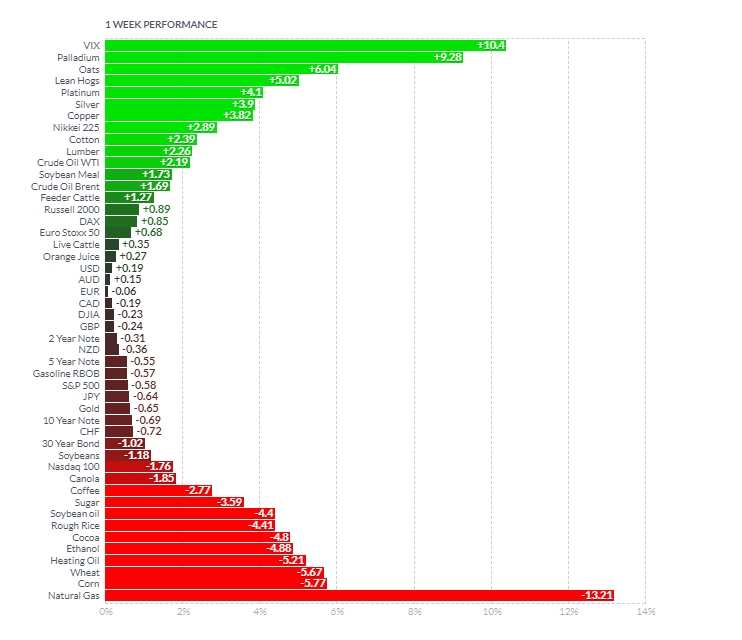

Sectors Performance

Source: Dow Jones, Market Watch, CNBC, Finviz, Yahoo Finance

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Nurhatili1704 : TNG acc

NoahK : $NVIDIA (NVDA.US)$ earning will set the course for whole wallstreet this week. Other then nVidia, those crazy inflated stocks need to go down. Expected that it will go down for short term due to unrealistic pressure, but it will perform in long term. Selling for short term, buying for long term.

Business Investor : Alright, so everyone's buzzing about Nvidia's earnings drop this week for a few cool reasons:

Nvidia's on Fire: Basically, Nvidia is killing it in the tech game, especially with AI stuff. The demand for their gear is through the roof, making this earnings report kinda like the big reveal at a tech magic show. People are super curious to see if they've managed to keep up with the hype

Could Kickstart a Tech Party: If Nvidia's numbers are good, it could set off a chain reaction and get the whole tech sector moving and grooving again. Think of it as Nvidia hitting the play button on a banger that gets the whole party (aka the tech market) jumping

AI's Big Moment: This isn't just about Nvidia; it's about the whole AI scene. Nvidia's been leading the charge, and how they've done lately could give us some clues about where AI and tech are headed. It's a bit like checking the pulse on the future of tech, and whether we're in for more cool AI breakthroughs or if things are cooling off$NVIDIA (NVDA.US)$TL;DR: HUAT BIG BIG or eat cai peng for the rest of our lives.

SanjBot : Why I read that as burning excrement instead of burgeoning excitement.... I'm at a loss.