What to Expect From Pilbara Minerals' Upcoming Earnings Report

As Pilbara Minerals prepares to release its half-year financial figures on February 22, it stands at the focal point of investor attention amid volatile global commodity markets.

Lithium market review

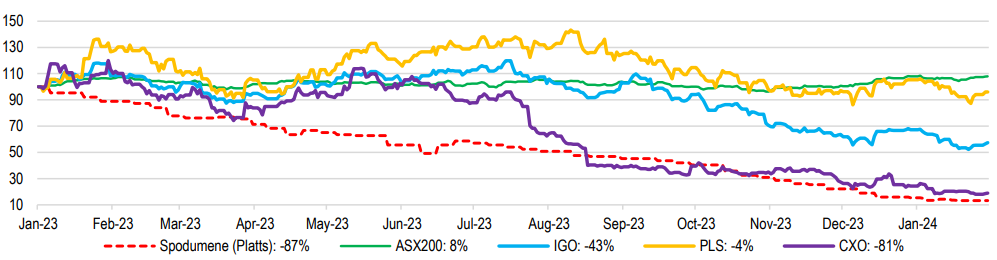

The Platts spodumene price, after reaching a high of $8,200 per tonne in November 2022, has seen a consistent decline, now hovering around $850 per tonne. Similarly, lithium chemicals have plummeted from their peak of over $80,000 per tonne to the current range of $11,000 to $13,000 per tonne. This downturn has left miners operating at the margins struggling to stay afloat. Despite the drop in spodumene prices, share prices have managed to fare better, not reflecting the full extent of the commodity's price decrease since last year.

Supply

As the year commenced, several companies have scaled back production in response to the softened market:

• $Core Lithium Ltd(CXO.AU$'s Finniss project has halted mining activities amid weak market conditions.

• $Liontown Resources Ltd(LTR.AU$'s Kathleen Valley project is postponing its expansion from 3 million tonnes per annum (Mtpa) to 4Mtpa, pending an improvement in market conditions.

• $Sayona Mining Ltd(SYA.AU$'s North American Lithium (NAL) operation is in the midst of an operational review aimed at cost optimization, set to conclude by the first quarter of 2024.

However, these supply adjustments from existing producers are relatively minor. Increased output from Wodgina and Mt Marion counterbalanced the reduced sales from Greenbushes.

While the industry is reacting to the price drops, most producers still seem to be operating with a profit margin. The cost curve has leveled, positioning Australian production costs on par with those of higher-grade African miners and suppliers of higher-grade Chinese lepidolite.

Demand

JPMorgan's demand forecasts remain largely stable, based on vehicle sales and electric vehicle (EV) penetration rate projections. With vehicle sales forecasted slightly higher, global lithium demand for EVs has been adjusted upwards.

JPMorgan estimates lithium demand to increase by 23% in 2024, with supply predicted to grow by 25%.

Supply and demand balance

JPMorgan anticipates an oversupplied lithium market extending through to 2028, after which the market is expected to tighten. While lithium prices might be nearing their lowest point, the anticipated surplus for the next four years suggests limited triggers for a price rebound.

Pilbara Minerals' Earnings Prospects

With minimal debt and a substantial cash reserve of approximately $1.4 billion following a fruitful final quarter in 2023, Pilbara Minerals could be considered one of the most robust players in the lithium supply sector. The company remains steadfast in its strategy to boost production in line with the expanding EV market.

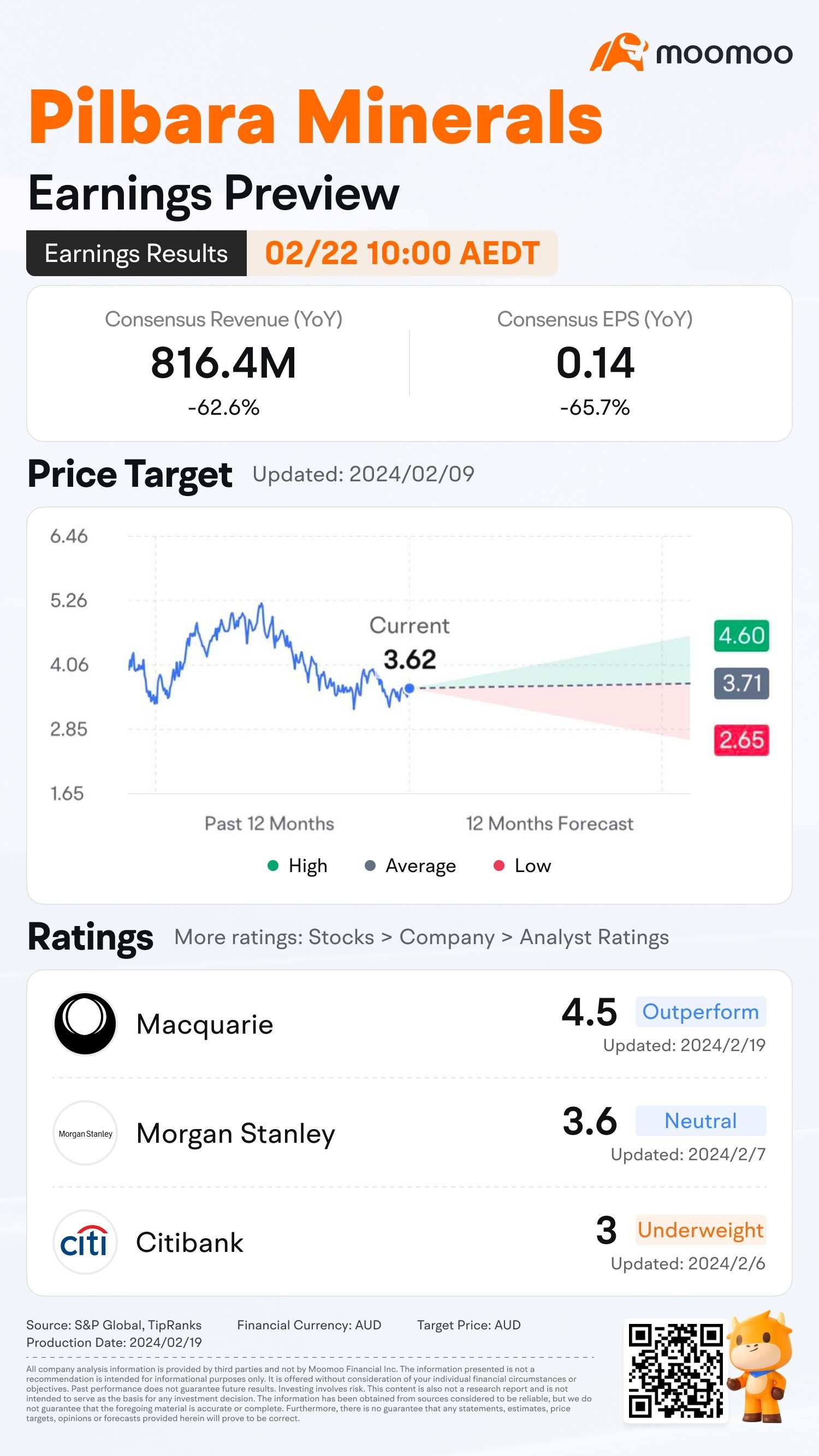

As $Pilbara Minerals Ltd(PLS.AU$ forges ahead with its Pilgangoora spodumene project and other expansion endeavors, analysts have set expectations for Pilbara Minerals's half-year revenue at A$816.4 million, down 63% on last year's number. EPS is expected to fall 66% to A$10.14.

Despite the downturn in spodumene prices, Pilbara Minerals sees an opportunity to ramp up production.

Last August, the company revealed its full-year results for the 2023 financial year with a 242% rise in revenues to $4.05 billion. The spodumene sales grew 64% to 620 metric kilotons

Bloomberg Intelligence projects a production rise to 1 million tons by fiscal 2026, but the benefits of scaled-up production and lower unit costs may be negated by the declining sale prices. Nevertheless, Pilbara Minerals' robust cash flow and strong balance sheet position it well to sustain its expansion plans.

Source: Bloomberg, JPMorgan, Pilbara Minerals, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

151345481 : If pls can rise to 4.6, many people will leave