What on earth is happening to Super Micro Computer?

Over the last 36 months, the stock is up 27-fold ![]()

Here's why:

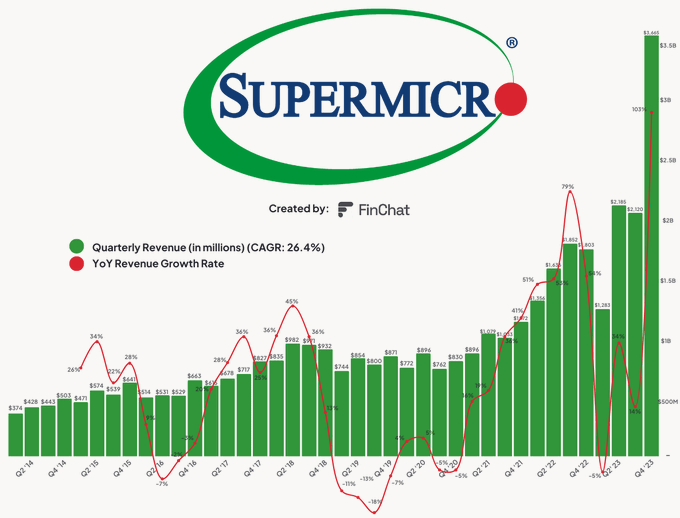

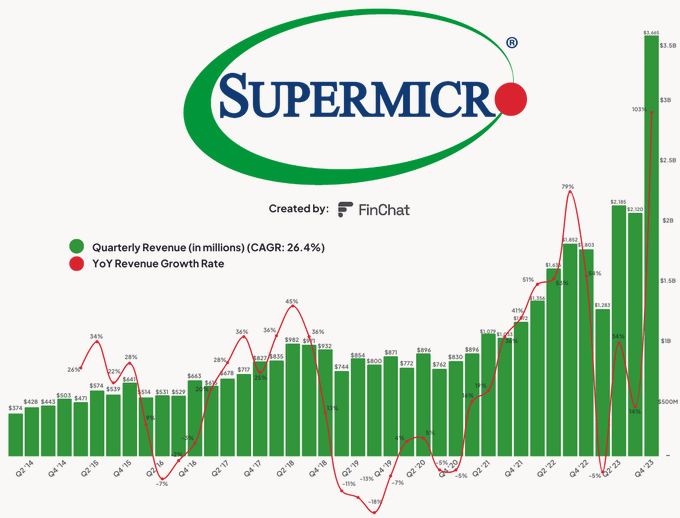

AI driven demand - Everywhere you look, companies are investing in AI. While that means different things to different businesses, one thing is consistent. They're virtually all spending more on data-center hardware.

And SMCI is right there to benefit. Super Micro manufactures high performance servers and storage systems. So as companies have expanded their server capacity to handle the AI investment, SMCI has seen a surge in demand from both new and existing customers.

Operating Leverage - Since customers are willing to spend more on their data center hardware, not only has Super Micro seen its revenue surge, but its profit margins have expanded as well.

Operating margins for the company have jumped from 3.5% in 2021 to 9.4% over the last 12 months. To put this in perspective, Super Micro’s $372 million in operating income that it generated last quarter is almost 3x what it earned in all of 2021.

In total, the company’s earnings per share is up ~15x from 2018.

Multiple Expansion - As is often the case, with improved earnings comes improved expectations, and Super Micro is no exception.

According to FinChat, SMCI’s Forward Enterprise Value to EBIT (earnings before interest and taxes) multiple has gone from ~9x to 29x over the last 3 years.

Here's why:

AI driven demand - Everywhere you look, companies are investing in AI. While that means different things to different businesses, one thing is consistent. They're virtually all spending more on data-center hardware.

And SMCI is right there to benefit. Super Micro manufactures high performance servers and storage systems. So as companies have expanded their server capacity to handle the AI investment, SMCI has seen a surge in demand from both new and existing customers.

Operating Leverage - Since customers are willing to spend more on their data center hardware, not only has Super Micro seen its revenue surge, but its profit margins have expanded as well.

Operating margins for the company have jumped from 3.5% in 2021 to 9.4% over the last 12 months. To put this in perspective, Super Micro’s $372 million in operating income that it generated last quarter is almost 3x what it earned in all of 2021.

In total, the company’s earnings per share is up ~15x from 2018.

Multiple Expansion - As is often the case, with improved earnings comes improved expectations, and Super Micro is no exception.

According to FinChat, SMCI’s Forward Enterprise Value to EBIT (earnings before interest and taxes) multiple has gone from ~9x to 29x over the last 3 years.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

102328260 : Can still buy Smci?

102328260 : Wow flying tonight