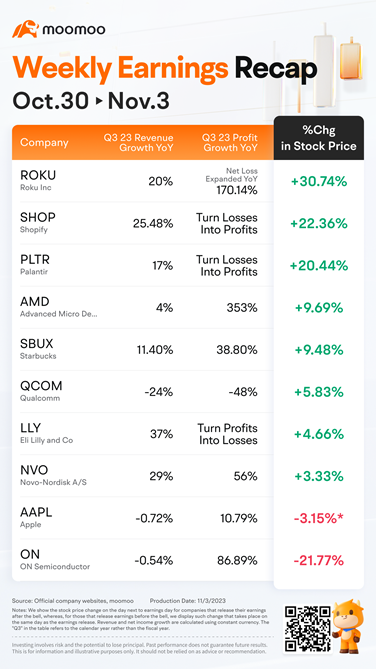

Weekly Earnings Recap: Novo Nordisk and Eli Lilly Profit From Weight-Loss Drugs, Apple's Hardware Outlook Raises Concerns

This week's US earnings season is headlined by the world's most valuable publicly-listed company, Apple. With other major stocks such as chipmaker AMD and tech firm Qualcomm also attracting significant attention. In addition, pharmaceutical giants Eli Lilly and Novo Nordisk are in the spotlight.

Tech Giants Company

AMD stock rose over 9% on Wednesday after the company announced better-than-expected Q3 earnings and a promising forecast for its AI chip business in 2024.The chipmaker's earnings per share of 70 cents narrowly beat estimates, and revenue was slightly higher than expected at $5.8 billion.

Apple's revenue and profit for the Third-quarter were higher than expected, but for the first time since 2001, revenue declined year on year for four consecutive quarters. Although iPhone revenue reaching an all-time high in the fourth fiscal quarter and service revenue was at a record high, other hardware revenue fell year on year, and Mac plummeted 34%. Revenue in Q4 may have remained flat, contrary to market expectations for a return to growth. Apple stock fell 4% after the market.

Pharmaceutical giants

With the help of the star “weight-loss drug” Mounjaro's income soaring, Eli Lilly and Co Revenue for the third quarter exceeded expectations, but due to lower earnings expectations for the full year, Eli Lilly's US stock rose slightly before the market.

Lilly released its third quarter earnings report prior to the opening of the US stock market on November 2. The financial report showed that Lilly's revenue for the third quarter was 9.5 billion US dollars, up more than 37% from the previous year, exceeding expectations of 9.02 billion US dollars. Gross margin was 80.4%, up from 77.3% in the same period last year, but lower than analysts' estimates of 80.7%. The adjusted earnings per share were 10 cents, less than the same period last year of $1.98.

In contrast, Novo Nordisk received sales revenue of US$2.2 billion and operating profit of US$920 million in 2023Q3, both up 5% and 7% year on year. The company has launched a number of new products, including innovative medicines for diseases such as type 2 diabetes, obesity, and hemophilia. The company has achieved a steady increase in sales all over the world.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment