Weekly Australia Market Wrap for the Week-Ended 13 October 2023

Last week started with a sharp rally in energy and gold prices due to the rapidly escalating conflict in Israel. The turmoil also saw safe haven buying of the US dollar.

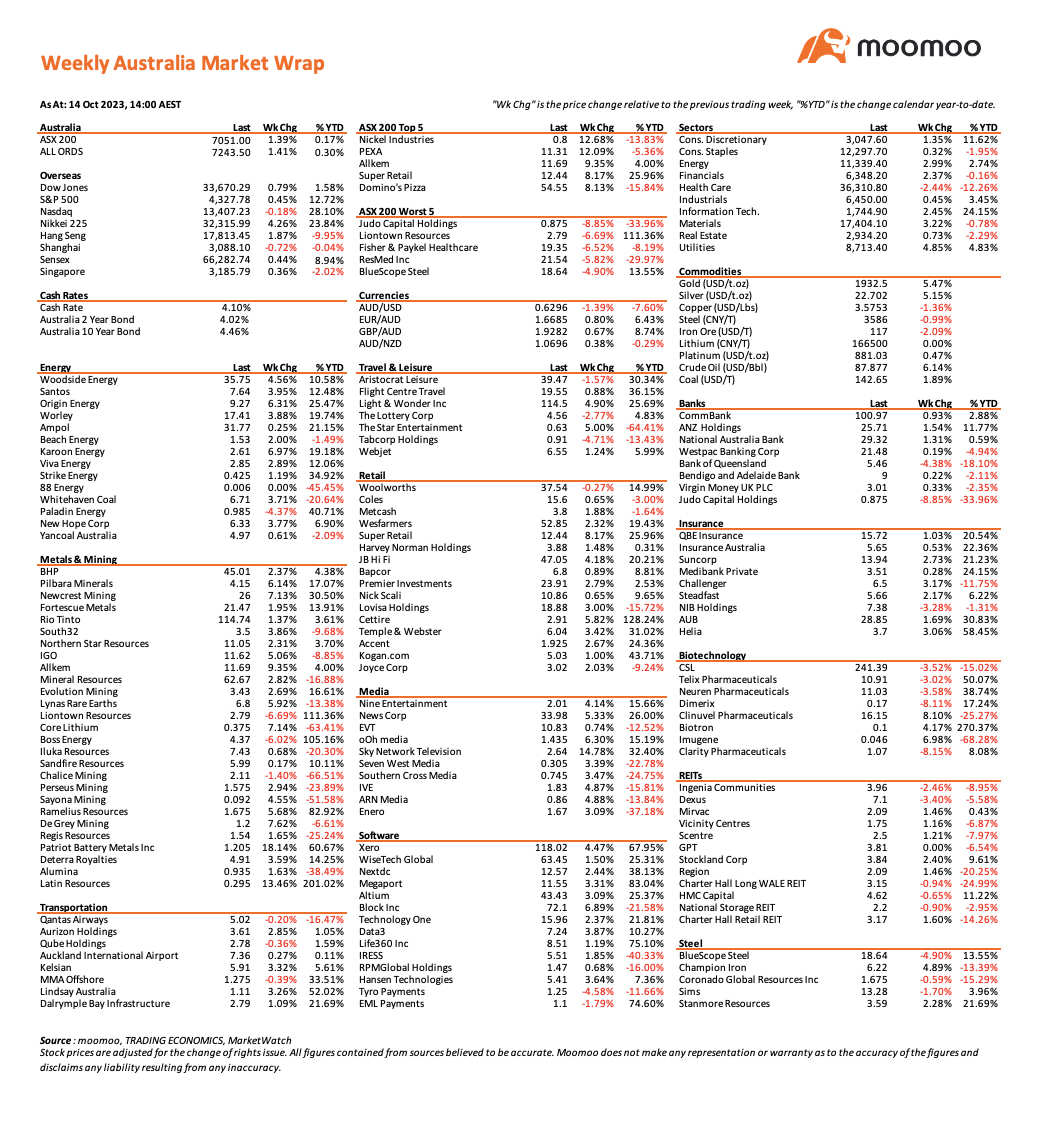

By the end of the week Gold had risen by 5.47% to $US1932.50 per ounce and Crude Oil had rallied 6.14% to $87.88 a barrel. The Australian Dollar dropped 1.39% to close below 63 US cents at $US0.6296 its lowest level in twelve months. US 2 year and 10 year Treasuries saw yields come down as investors sought the safety of bonds.

Also by the end of the week there was talk of China's Government working on a 1 trillion yuan spending package to stimulate its economy after the inflation rate recently hit zero from a year earlier.

All that news resulted in Australian shares surging 1.39% (S&P/ASX200) and 1.41% (All Ordinaries Index) respectively.

US shares were more subdued rising only 0.79% (Dow Jones), 0.45% (S&P500) and with the Nasdaq falling 0.18%. Japan’s Nikkei rose 4.26%, Hong Kong lifted 1.87% but China’s market fell 0.72%. Eurozone shares rallied 0.95% despite a forecast by the German Government that its economy would shrink by 0.4% in the next 12 months. Germany is Europe’s largest economy by some margin.

The best performing sector in the Australian market was the Utilities sector rising 4.85% with the largest component Origin Energy rising 6.31%. The Materials sector gained 3.22%, Energy rose 2.99%, IT gained 2.45% and Financials gained 2.37%.

The only sector to fall was the Health Care sector which is down around 18% since the middle of June largely due to CSL, the largest component by far, falling around 21% over the same period. CSL fell 3.22% over last week. The company narrowly avoided a first strike on its remuneration report at its AGM last week but also rebounded on news that Eli Lilly’s drug to rival Novo Nordisk’s Ozempic was looking promising.

Also in the sector Fisher & Paykel Healthcare dropped 6.52% and medical device business ResMed lost 5.82%.

Across the energy sector Woodside rose 4.56%, Santos rallied 3.95%, Karoon jumped 6.97% and Worley gained 3.88%. Whitehaven Coal lifted 3.71% and New Hope rose 3.77%.

The Materials sector saw solid gains with heavyweight BHP rising 2.37%, Rio Tinto lifting 1.37% and Fortescue Metals gaining 1.95%.

Gold miner Newcrest rose 7.13%, De Grey gained 7.62%, Ramelius Resources was up 5.68% and Northern Star lifted 2.31%.

Despite the Lithium price being flat over the week, Lithium stocks went on a tear with Allkem up 9.35%, Pilbara up 6.14%, IGO gaining 5.06%, Core Lithium jumping 7.14% and Sayona Mining rising 4.55%.

In takeover news, NZ pay TV operator Sky Network television jumped 14.78% after it disclosed to the market that it had received an indicative proposal from a third party. It declined to name the third party and said talks were at “an early stage”.

In the retail sector, Super Retail shares jumped 8.17% on no new news and a slight lift in trading volumes, JB HiFi gained 4.18%, Cettire rose 5.82% and Temple and Webster gained 3.42%.

Financial stocks performed reasonably well last week with ANZ (+1.54%) and NAB (+1.31%) outperforming CBA (+0.93%) and Westpac (+0.19%). Bank of Queensland dropped 4.38% and touched 16-month lows as its CEO announced an 8% drop in cash earnings over the last year. He blamed margin pressures from the ‘mortgage war’ between banks.

Magellan dropped another 4.87% to $6.83 taking its losses since the start of October to almost 26% as institutions continue to pull their money away from the international fund manager. The stock was trading as high as $76.67 in Feb 2020.

TAB shares closed the week down 4.71% after releasing a first quarter 2024 trading update saying that group revenue had declined 6.1% over the previous corresponding period.

Petrol prices and mortgage rates are still high and causing pain for the Australian consumer and this was reflected in last week’s Consumer and Business Confidence Survey released by NAB. It would seem that businesses are managing the volatile economy without too much stress appearing.

In Australia a Referendum to amend the Constitution to include an Aboriginal Voice to Parliament was rejected soundly and in New Zealand the Labor Government was sent packing after the National Party won the election on Saturday.

In the week ahead we will be watching the US earnings season as it kicks off in ernest, Chinese September quarter GDP (Wed), the RBA Minutes of its last Board meeting (Tues) and UK employment data (Tues). A number of countries are releasing the latest Inflation numbers this week including Canada and New Zealand (Tues), UK (Wed) and Japan (Fri).

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment