Wall Street Today | Nvidia Carries Nasdaq to Another Closing High

RECAP

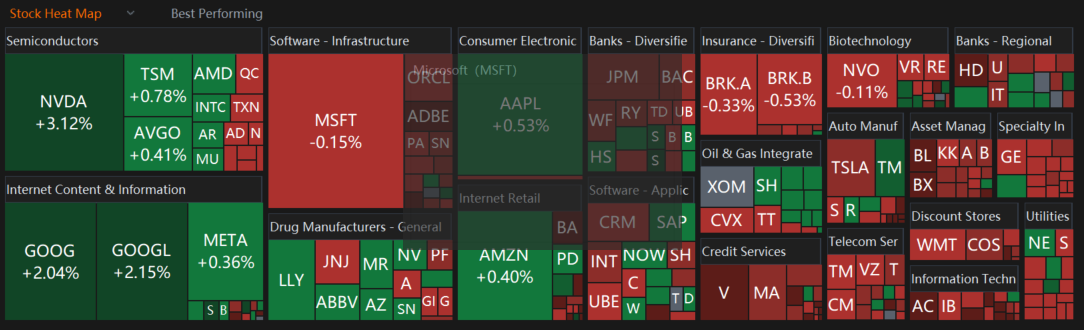

$NVIDIA(NVDA.US$ continued to carry the Nasdaq on its back, taking the index to another record closing high on Friday, even as other major indices take a breather.

$Nasdaq Composite Index(.IXIC.US$ gained 0.3% to 16,454.42, while the $S&P 500 Index(.SPX.US$ slipped 0.1% to 5,234.18. The $Dow Jones Industrial Average(.DJI.US$ slid 0.8% to 39,475.90.

$Nasdaq Composite Index(.IXIC.US$ gained 0.3% to 16,454.42, while the $S&P 500 Index(.SPX.US$ slipped 0.1% to 5,234.18. The $Dow Jones Industrial Average(.DJI.US$ slid 0.8% to 39,475.90.

Nvidia advanced 3.1% to $942.89 in New York, making it the biggest gainer on the Nasdaq. $Alphabet-A(GOOGL.US$ rebounded 2.1%.

MACRO

The market has been cheering this week's median projections of the voting members of the Federal Open Market Committee that penciled in three 25-basis points in interest rate cuts this year, unchanged from their previous outlook, even after the hotter-than-expected inflation posted earlier this year.

Traders are now pricing in a 66.5% chance that the reduction will begin in June, up from 52% a month ago, according to the CME FedWatch tool. If it holds true, that will take the benchmark rate to a range of 5% to 5.25%, from the current 5.25% to 5.5%.

SECTORS

Treasury Yields Slip

Treasury yields slipped after the Fed maintained its median projection of rate cuts this year. Bond prices typically move inversely to yields.

Oil Slips

Crude oil futures declined as the dollar strengthened, making the commodity more expensive for holders of other currencies.

COMPANIES

Nvidia Gets More Love

Nvidia, the market leader in semiconductors designed to power artificial intelligence applications, is getting more love from a lot of analysts. UBS Securities analysts raised their price target on the stock to $1,100 from $800, MT Newswires reported. Thirteen other analysts boosted their price target this week, according to a Benzinga report yesterday.

UBS analysts, including Timothy Arcuri expect Nvidia's new product launches, including the recently unveiled Blackwell computing platform to fuel the semiconductor company's "solid growth" in its fiscal 2026, MT Newswires reported.

After the company launched its Blackwell platform, the analysts said they're confident that Nvidia "sits on the cusp of an entirely new wave of demand from global enterprises and sovereigns -- with each sovereign potentially as big as a large US cloud customer," the report quoted UBS analysts as saying.

Nike Shares Tank

$Nike(NKE.US$ shares tumbled, weighing down on the S&P 500, as the company's financial results fail to impress analysts. According to a Reuters report, at least 12 brokerages cut their price target on the stock, dragging down the median target to $116, from $126 in December.

During the earnings call with analysts, Nike Chief Financial Officer Matt Friend said revenue in the first half of the fiscal year is expected to be down single digits, reflecting "near-term headwinds from lifecycle management of key product franchises, more than offsetting the scaling of new products," according to the unofficial transcript posted on the company's website.

Source: Bloomberg, Dow Jones, CNBC, Reuters

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment