US Stock Market Continues to Carnival! Wall Street Updates New Year Forecasts Ahead of 2024

Wall Street investors and analysts spent months strategizing how to position for 2024. Federal Reserve Chair Jerome Powell shredded their best-laid plans in a matter of minutes.

After the Federal Reserve taking a dovish turn, the Dow Jones Industrial Average and Nasdaq 100 surged to records, while bonds soared, credit boomed and risky assets around the world rallied.

Goldman strategists lift S&P 500 forecast to 5,100 a month after setting it.

In its initial outlook released about a month ago, Goldman Sachs had projected the benchmark index to end the year at 4,700, which at the time had reflected about 5% upside for stocks in the next year.

In the updated forecast, Goldman Sachs specifically cited recent economic data that included softer-than-expected inflation for producers and better-than-expected November retail sales numbers.

"Above-consensus retail sales growth further evidenced economic resilience, while lower-than-expected jobless claims affirmed that the labor market remains healthy," Goldman Sachs' equity strategy team led by David Kostin wrote in a research note over the weekend.

The S&P 500 recently surpassed Goldman's initial 2024 target, with the benchmark closing in on its record high of 4,740.56.

Moreover, Goldman also predicts that the Fed is likely to slash interest rates five times in 2024.

The bank's chief economist Jan Hatzius said Monday that the world economy has now entered a period of "Great Disinflation" that will enable policymakers to start cutting borrowing costs in early 2024.

"Global inflation continues to plummet, we therefore now see earlier and more aggressive rate cuts from several major developed market central banks," according to Jan Hatzius.

Goldman Sachs is forecasting that the Fed will slash rates by 25 basis points three times in a row between March and June and then ease twice more over the second half of the year. Traders are also predicting that the central bank will loosen five times in 2024, according to the CME Group's FedWatch tool.

Funnily enough, Goldman Sachs is not the only firm that "upended" on its views.

JPMorgan Asset Management’s Philip Camporeale increased the equity allocation in his stock-bond portfolio to the highest in nearly two years after Powell’s speech. John Roe at $1.4 trillion Legal & General said he’s unwinding long duration bets on inflation-protected Treasuries and reconsidering his underweight exposure to stocks. And Spencer Hakimian of Tolou Capital Management said signs the Fed will start cutting rates as soon as the first quarter prompted him to wager on a steeper yield curve.

Piper Sandler’s Michael Kantrowitz, one of the most bearish equity forecasters on Wall Street, is also rethinking his outlook.

“A Fed pivot has clear bullish historical precedence,” Kantrowitz wrote in a note. “Thus, we believe that breadth in the market will continue to improve,” adding that “stocks can drift higher on the back of lower yields.”

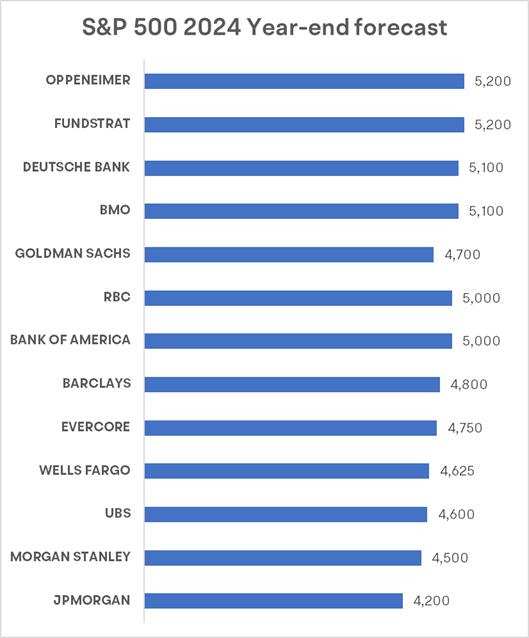

Several major banks are updating their target prices for the S&P 500 index in 2024.

Like Goldman Sachs, Deutsche Bank also predicts that the S&P 500 index will reach 5,100 points by the end of next year. Other Wall Street peers, such as Oppenheimer Asset Management, expect a fresh high in 2024.

However, it's amusing to note that historically, humans haven't been good at predicting things, and some strategists having to change their price targets merely a few weeks after originally writing the year-ahead outlooks last month!

So Mooers, what are your thoughts on how long this year-end stock market rebound will last? And what is your view on the stock market trend in 2024?

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Mumford : Outlook will definitely be changing based on geopolitical scenarios. That is why we need to closely watch global events as well as company performance to ensure our investment is growing.

1000proof : Global events in the near future could be a sight too see

103750432 : $Basin Energy Ltd (BSN.AU)$

Rocael Ramirez : $Netflix (NFLX.US)$

Meme_Short_Queen : 3800

DudeThatsDerpy : Are these analysts insane or simply lying? A Fed pivot is anything but a bullish indicator.