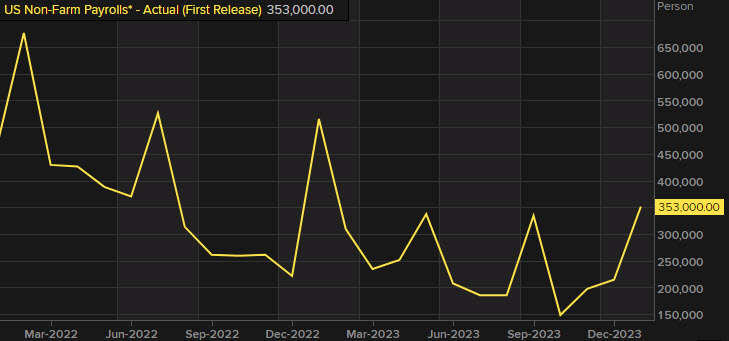

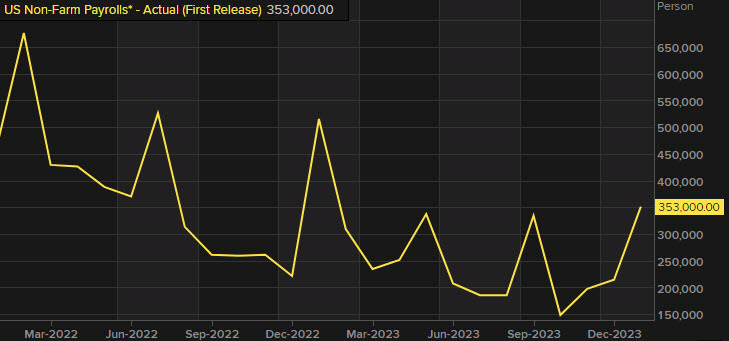

US February non-farm payrolls +275K vs +200K expected

February 2024 US employment data from the non-farm payrolls report

Prior +353K (revised to 229K)

Two-month net revision -167K vs +126K prior

Unemployment rate 3.9% vs 3.7% expected

Prior unemployment rate 3.7%

Participation rate 62.5% vs 62.5% prior

U6 underemployment rate 7.3% vs 7.2% prior

Average hourly earnings +0.1% m/m vs +0.3% expected

Prior avg hourly earnings +0.6% m/m (revised to +0.5%)

Average hourly earnings +4.3% y/y vs +4.4% expected

Average weekly hours 34.3 vs 34.3 expected

Change in private payrolls +223K vs +160K expected

Change in manufacturing payrolls -4K vs +10K expected

Household survey +63K vs -31K prior

Birth-death adjustment K vs -121K prior

Two-month net revision -167K vs +126K prior

Unemployment rate 3.9% vs 3.7% expected

Prior unemployment rate 3.7%

Participation rate 62.5% vs 62.5% prior

U6 underemployment rate 7.3% vs 7.2% prior

Average hourly earnings +0.1% m/m vs +0.3% expected

Prior avg hourly earnings +0.6% m/m (revised to +0.5%)

Average hourly earnings +4.3% y/y vs +4.4% expected

Average weekly hours 34.3 vs 34.3 expected

Change in private payrolls +223K vs +160K expected

Change in manufacturing payrolls -4K vs +10K expected

Household survey +63K vs -31K prior

Birth-death adjustment K vs -121K prior

Heading into the report, the market was pricing in 95 bps in Fed rate cuts this year and USD/JPY was trading at 147.09. S&P 500 futures were down 4 points and US 10-year yields were down 3.1 bps to 4.06%.

The headline here was strong but the details were not. Unemployment rose, there was a big negative revision and -- critically -- wage growth reversed. The market is now pricing in 97 bps in easing and USD/JPY is down to 146.81. $Dow Jones Industrial Average(.DJI.US$ $S&P 500 Index(.SPX.US$ $Nasdaq Composite Index(.IXIC.US$

The headline here was strong but the details were not. Unemployment rose, there was a big negative revision and -- critically -- wage growth reversed. The market is now pricing in 97 bps in easing and USD/JPY is down to 146.81. $Dow Jones Industrial Average(.DJI.US$ $S&P 500 Index(.SPX.US$ $Nasdaq Composite Index(.IXIC.US$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment