The Most Worthwhile Sectors to Invest in for U.S. Stocks in 2024!

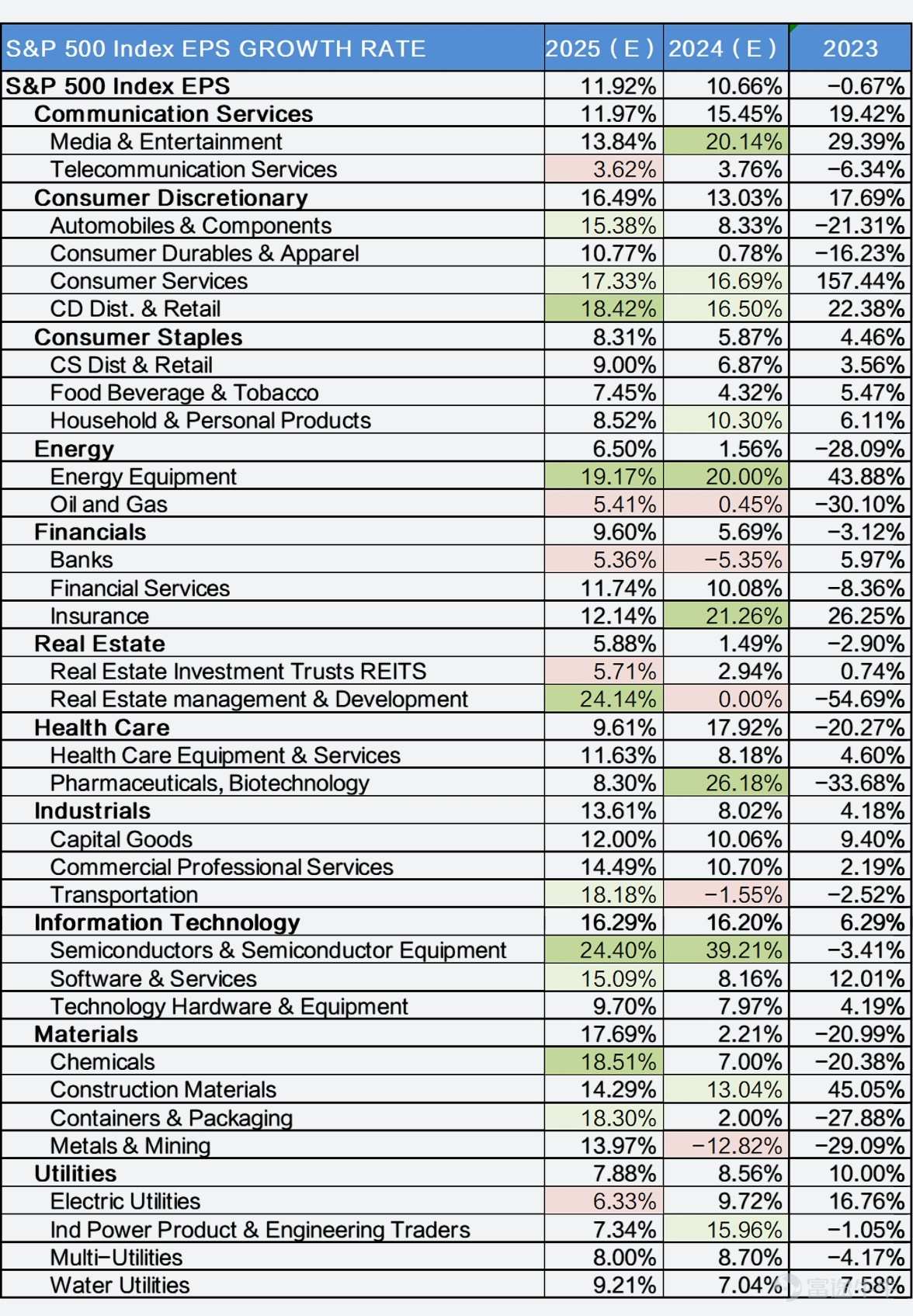

EPS growth is the main driving force for growth in U.S. stocks. Based on Bloomberg data, we have organized the expected EPS growth rates for the S&P 500 index's sub-sectors for 2024 and 2025 to provide a reference for investment.

For 2024, the most noteworthy sub-sectors with the highest expected EPS growth rates are Semiconductors & Semiconductor Equipment (+39.21%), Pharmaceuticals & Biotechnology (+26.18%), Insurance (+21.26%), Media & Entertainment (+20.14%), and Energy Equipment & Services (+20%). Sub-sectors that warrant caution due to their lowest expected EPS growth rates include Metals & Mining (-12.82%), Banks (-5.35%), Transportation (-1.55%), Real Estate Management & Development (0%), and Oil & Gas Exploration & Production (+0.45%).

In 2025, the sub-sectors to watch with the highest expected EPS growth rates are Semiconductors & Semiconductor Equipment (+24.4%), Real Estate Management & Development (+24.14%), Energy Equipment & Services (+19.17%), Chemicals (+18.51%), and Retailers & Wholesalers of Non-Essentials (+18.42%). Sub-sectors that may pose risks due to their lowest expected EPS growth rates include Communication Services (+3.62%), Oil & Gas Exploration & Production (+5.41%), Banks (+5.36%), Real Estate REITs (+5.71%), and Utilities (+6.33%).

Chart: Expected Earnings Growth Rates for S&P 500 Sub-Sectors in 2025 and 2024

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment