Trump vs. Biden Again: How the 2024 election could affect Investors?

The stage is set for a political rematch, with the Republican and Democratic parties once again fielding Donald Trump and Joe Biden, respectively, for the presidency over the next four years. As the contest for the White House heats up, investors are left pondering where to place their bets.

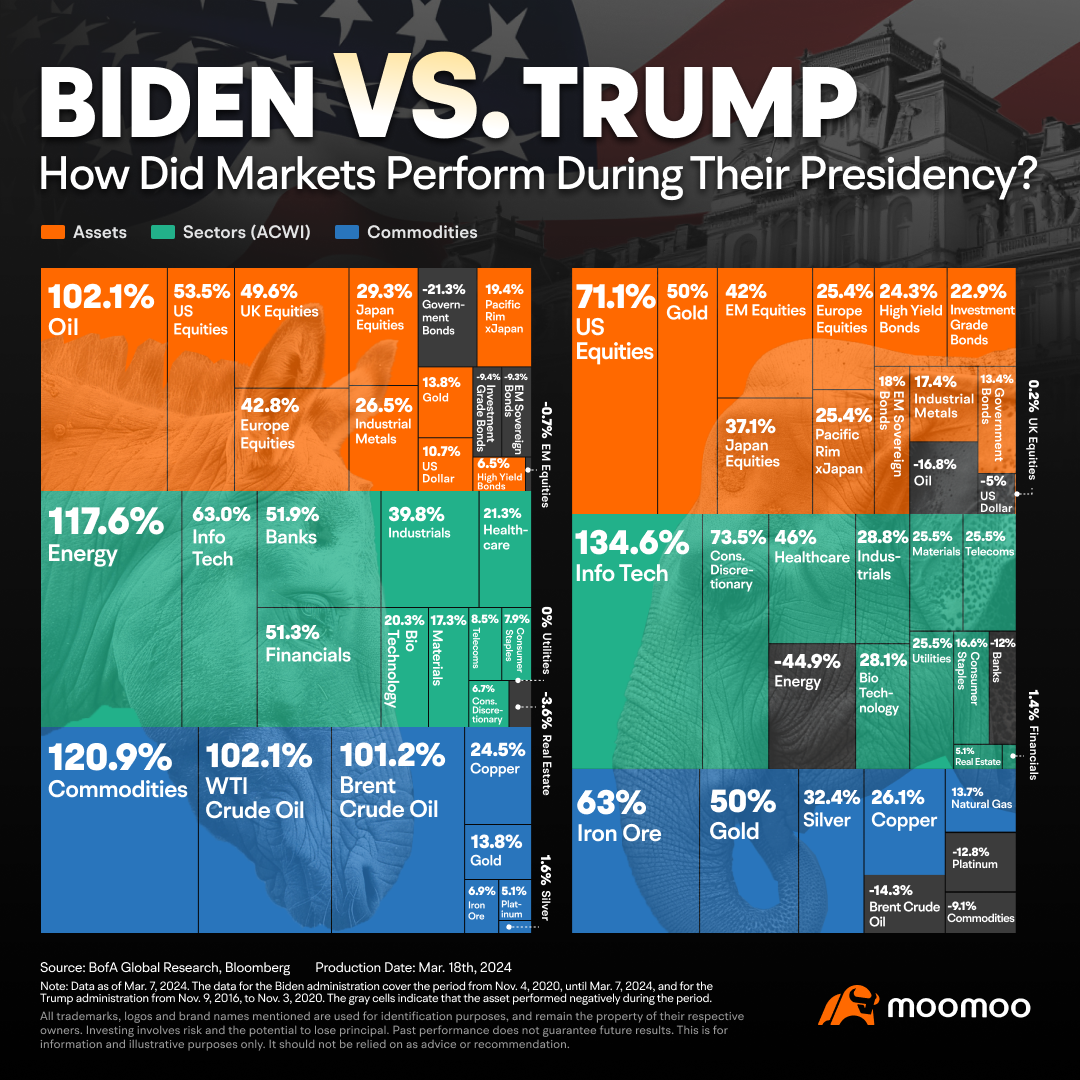

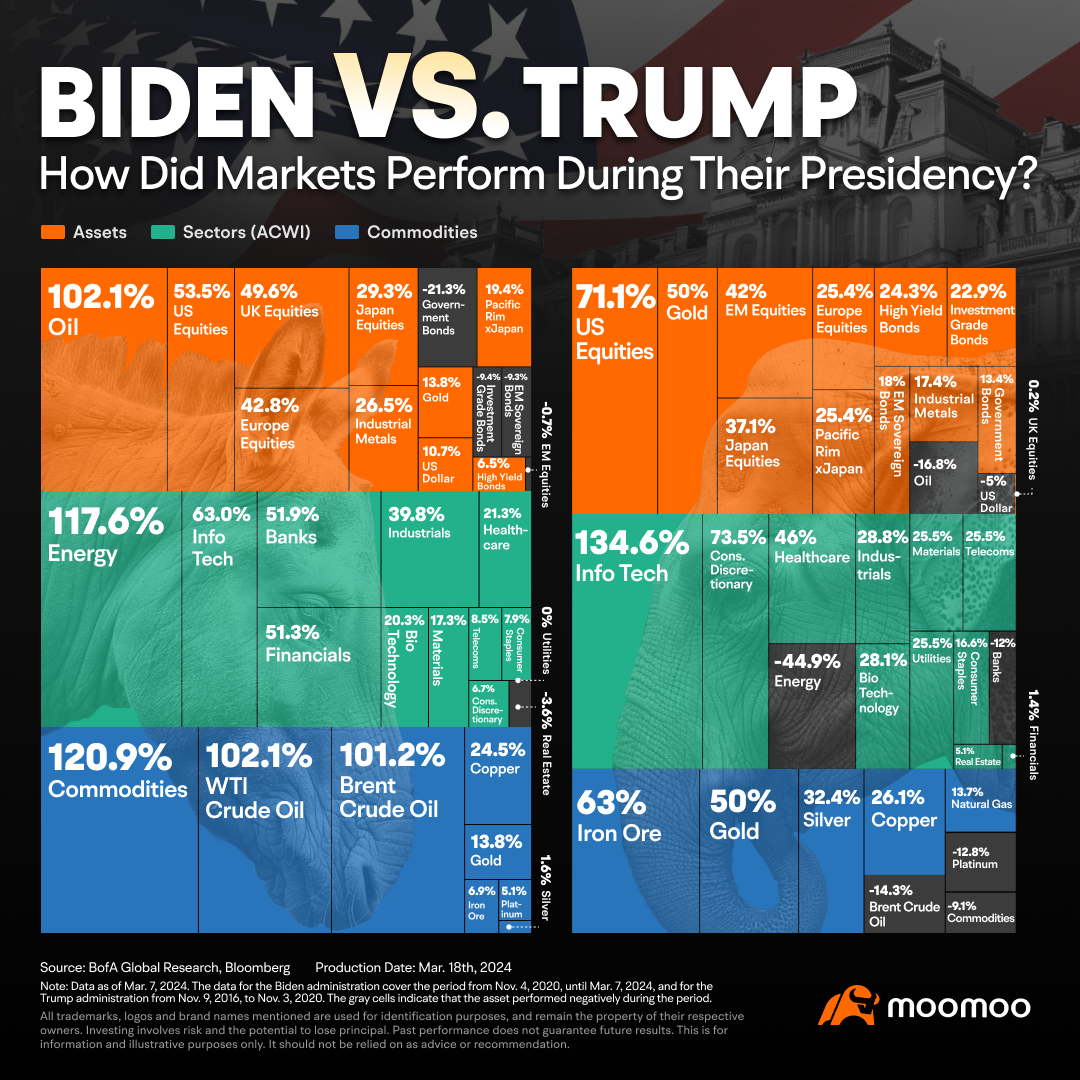

Contrasting the tenures of Presidents Biden and Trump, energy investments shone brightly during Biden's time in office, with the Energy sector surging 117.6%, according to a report by Bank of America Global Research. This was bolstered by a parallel uptick in oil, where WTI and Brent Crude both posted gains of 102.1%. Conversely, under Trump, the Information Technology sector was the standout, climbing a robust 134.6%, although the Energy sector languished, recording a 44.9% retreat, reflecting a sectoral rotation influenced by differing policy and economic cycles.

Biden's presidency witnessed Information Technology continuing its ascent with a 63% rise, while Financials and Industrials also capitalized on the economic climate, achieving gains of 51.3% and 39.8%, respectively. The Trump era, however, favored the Consumer Discretionary and Healthcare sectors, with the former soaring 73.5% and the latter up 46%, showcasing a consumer-led and health-focused market expansion during his administration.

What does it mean if Biden wins

Biden is facing intense questioning over his capacity to serve another term triggered by a US Department of Justice special counsel report. If President Joe Biden were to be re-elected, stakeholders would likely anticipate that his current policies—especially those related to economic management, taxation, healthcare, climate change, and infrastructure—would most likely persist and possibly expand.

The stock market often performs well when a sitting president runs for reelection. Since 1949, the average yearly gain by the S&P 500 of 12.8% outweighs an average decline of 1.5% in election years when it's an open field. It's due to a president in office increasing assurance over upcoming economic policies, according to the Stock Trader's Almanac's director of research, Christopher Mistal, and editor Jeffrey Hirsch.

"Sitting presidents have won reelection 15 times and lost six in the past 21 occurrences since 1900," Hirsch stated in the 2024 edition of the book. Years that incumbents were victorious in reelection had higher stock market performance early in the year. Years, when incumbents lost, had slow starts but robust finishes when unpopular administrations were overthrown."

Since 1945, Democrats in the Oval Office have outperformed Republicans on average.

Chip Industry

"Unlike my predecessor, I was determined to turn things around, to invest in America, all of America, all Americans. And that's what we've been doing," Biden said in a recent speech.

The U.S. government is set to provide Intel with significant financial support to bolster the country's semiconductor industry.

Intel will receive $8.5 billion in grants and could receive up to $11 billion in loans to expand its chip factories, which came from the 2022 Chips and Science Act, one of his signature legislative accomplishments. The financial aid from the Commerce Department will contribute to Intel's planned $100 billion investment in manufacturing advanced semiconductors in new large-scale facilities in Arizona and Ohio. Biden is arguing that his policies on infrastructure, domestic manufacturing, and clean energy will improve people's financial standing and strengthen the overall US economy.

Biden called the law a "smart investment" that would "transform the country in a way you don't even understand yet," spurring domestic job growth, shoring up supply chains disrupted by the pandemic and ensuring the US was at the forefront of developing new technologies. However, Patrick Gelsinger, Intel's chief executive, believes that the industry would at least need another CHIPS 2 Act to finish the goal, rather than one three- to five-year program.

Corporate Tax

Analysts at TD Securities suggest that a second term for President Biden could bring about prolonged or heightened corporate tax rates, potentially affecting corporate profit margins. Such a scenario might trigger investors to lock in gains, leading to increased selling in the stock market.

Biden has been seeking to lift the corporate alternative minimum tax rate to a hefty 21% for firms raking in profits exceeding the $1 billion benchmark. This recalibration is poised to clip the wings of after-tax income for these corporate juggernauts, potentially dampening their capacity to funnel earnings back into their operations—an outcome that could reverberate across the economy.

Simultaneously, the administration has set its sights on a significant escalation of the corporate income tax rate, proposing a jump to 28% from the existing 21%. This hike represents a pivot towards reversing the cuts embedded in the 2017 Tax Cuts and Jobs Act.

This could potentially reduce the after-tax income of affected corporations, impacting their ability to reinvest in business operations.

Clean Energy

A key component of the climate bill the president signed in 2022, the tax cuts he implemented provide incentives for businesses to produce and install solar panels, wind turbines, and other technology aimed at lowering emissions from fossil fuels. Additionally, that bill included tax breaks for consumers purchasing certain low-emission technologies, such as heat pumps and electric cars.

On the other hand, Baker Avenue Wealth Management points out that certain sectors, particularly solar stocks and other clean-energy enterprises, might be poised for growth. These businesses could benefit from the Biden administration's continued focus on renewable energy and climate-related policies, which would likely support and potentially boost the clean-energy industry.

What does it mean if Trump wins

Trump still has to deal with several criminal and civil cases on his way back to the White House.

Investors experienced extreme volatility in the stock market back in November 2016. As an upset in the election was brewing, Dow Jones Industrial Average futures first dropped more than 700 points in the late hours of election night. Then, as it became evident that Donald Trump had defeated Hillary Clinton in the presidential contest, the blue-chip index shot upward.

“There are multiple scenarios, but if it is Trump, history or animal spirits will say that short-term it is good for companies, for some sectors like defence [and] its good for lower taxes,” says Vincent Mortier, chief investment officer of European fund group Amundi.

According to Barclays strategists, cyclical stocks that were more vulnerable to the economy did better in the six months preceding both the 2020 election by Biden and the 2016 election by Trump.

Bad News for Oil

The net impact of a Trump "red wave" election, according to Citigroup, would be negative for oil as trade tensions would reduce demand for the commodity. As the US-Saudi relationship gets warmer, more oil may be put back on the market by Opec+. Supply of gas and oil could be eased if the Russia-Ukraine conflict was resolved sooner. Trump's administration, though, might impose restrictions on Iran's oil shipments.

Geopolitical Tension

Investors are expressing concern over the potential increase in trade tensions with China. A report from The Washington Post suggesting that Trump may be considering a significant ramp-up in trade tariffs and additional measures against China contributed to a recent downturn in Chinese stock markets. This escalation could also have broader consequences. According to US economist Xiao Cui from Pictet Wealth Management, Trump's tighter trade and immigration policies may be viewed as factors that could drive up inflation.

Federal Reserve

If Trump were to win a future presidential election, one key area of interest would be the leadership of the US Federal Reserve. Trump made it clear in February that he would not renominate Jerome Powell as the Chairman of the Federal Reserve. This stance signals potential changes in the central bank's leadership, which could have significant implications for monetary policy, interest rates, and overall economic stability.

We expect Fed independence to endure but, while not our central case, there’s a risk that communication changes and dissent grows,” Morgan Stanley analysts wrote in a report. But they added: “We’re hard-pressed to see a scenario come to fruition where the executive branch [of government] de facto sets monetary policy.”

Indifference in the long term?

However, an industry veteran also claims that it doesn't matter who wins the White House in 2024, as the future of the US economy largely depends on its troubled yet often overlooked debt position.

"A Republican coming into the White House — how is that going to help [our debt issue]? We run these deficits under every administration. It is basically a disease that we believe we can run a $2 trillion budget deficit in perpetuity. I don't think that is a Republican versus Democrat issue. I think it is a mathematician versus pseudo-economist issue," DoubleLine founder and CEO Jeffrey Gundlach, or the "bond king," said at the Yahoo Finance Invest conference recently.

Gundlach was answering a question on whether a Republican in the White House in 2024 would be best served by slashing government spending and addressing the country's yawning debt pile.

The national debt is sitting at more than $33 trillion, according to data from the Treasury. That's more than quintuple the $5.8 billion seen in the 2001 fiscal year.

According to a study from U.S. Bank, election results have only a minimal effect on the intermediate and long-term performance of the stock market. Economic and inflation trends have a much larger statistical effect.

Powell in a recent appearance on CBS's "60 Minutes," where he remarked on the "unsustainable fiscal path" of the United States. This concern is echoed by fresh forecasts from the Congressional Budget Office (CBO), the non-partisan fiscal watchdog, which this week projected that interest payments on government debt could make up approximately three-quarters of an anticipated $900 billion increase in the national deficit over the coming decade.

Government expenditure on new infrastructure projects and the Federal Reserve's decision to raise interest rates would both increase the cost of debt servicing.

Source: Bloomberg, Yahoo Finance, Ft.com, Investors.com

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

71302571 : well to all my true Fellow Retrumplicans we have to win this one or we will lose our Nation's Country America now ask yourself just how much do you really trust your Ole Forgetful Joe blow covid-19 Creepy Sleepy Brandabiden Administration as for 1 I sure the hell don't as for he has gotten us into more wars and given other Countries more of your tax dollars and helped all those Illegals down at the border and given them free money at your tax dollar expense So please America Wake up! before it's too late and then some Other Country take our Nation's Country over .

72734102 71302571 : Biden Created Inflation that We Ain’t Seen in 55 years! That’s All we need to understand! Stopping the Energy Independence that Trump Worked Hard for, was economic n political Suicide for Slow Joe! And allowed big oil to make twice The profit on 1/2 the drilling! Makes one think Big Oil actually Gave Biden tons of money to make sure he’d win! And make them Richer! Mmmm

71545516 71302571 : you can't even keep Trump's stock up and you want to win an election?

tomod6889 : hey it doesn't matter...the man needs to win

Omw2millionsSunni : We all lose if he loses I’ll be seeking asylum in another country seriously we know it’s a rigged system if that in fact happens as Jill boden we’ll call her is mad her husbands mental decline has been made a spectacle and putting him up as. Prop pres did nothing but increase destruction of families, our economy, the border, and increased security risk to us all by allowing those who wish us harm to cross easily into our country receiving debit cards on the way by while we can’t afford to eat and F middle class it’s shot gone I used to be in the non existing class am now poverty level thanks to good ol Joe dimensia man