Today's Pre-Market Stock Movers And Top Ratings: ORCL, BBY, CRM, PDD and More

Pre-Market Stock Movers

Gapping up

$Best Buy(BBY.US$ stock rose 1.1% after the electronics retailer reported a smaller-than-expected drop in quarterly comparable sales, as deeper discounts encouraged consumers to shop.

$Verizon(VZ.US$ stock rose 1.5% and AT&T (NYSE:T) stock climbed 1.7% after Citigroup upgraded both telecom giants to ‘buy’ from ‘neutral’, saying they support their dividend yields.

$Oracle(ORCL.US$ stock rose 2.7% after UBS upgraded the tech company to ‘buy’ from ‘neutral’, saying it can jump another 20% as its AI story has “plenty of room” to run.

$Catalent(CTLT.US$ stock rose 3.6% after the contract drug manufacturer confirmed it has reached a settlement with activist investor Elliot Investment Management, agreeing to add four new directors to its board and to conduct a "strategic review." It added it was delaying its annual report.

$PDD Holdings(PDD.US$ U.S.-listed shares of the Chinese e-commerce company popped nearly 14% after PDD reported second-quarter earnings that surpasses Wall Street's expectations. PDD also said it saw a “positive shift in consumer sentiment” during the second quarter.

Gapping down

$Shoe Carnival(SCVL.US$ stock fell 9.2% after the footwear retailer cut its revenue guidance for the full year to $1.2 billion at the midpoint from $1.24B, citing a “challenging economic backdrop.”

$Salesforce(CRM.US$ stock fell 2% after JPMorgan removed the business software maker from its U.S. analyst focus list.

$NIO Inc(NIO.US$ ADRS fell 6.5% after the Chinese EV maker posted a widening of quarterly losses as it missed revenue expectations for the fourth straight quarter.

Source: CNBC

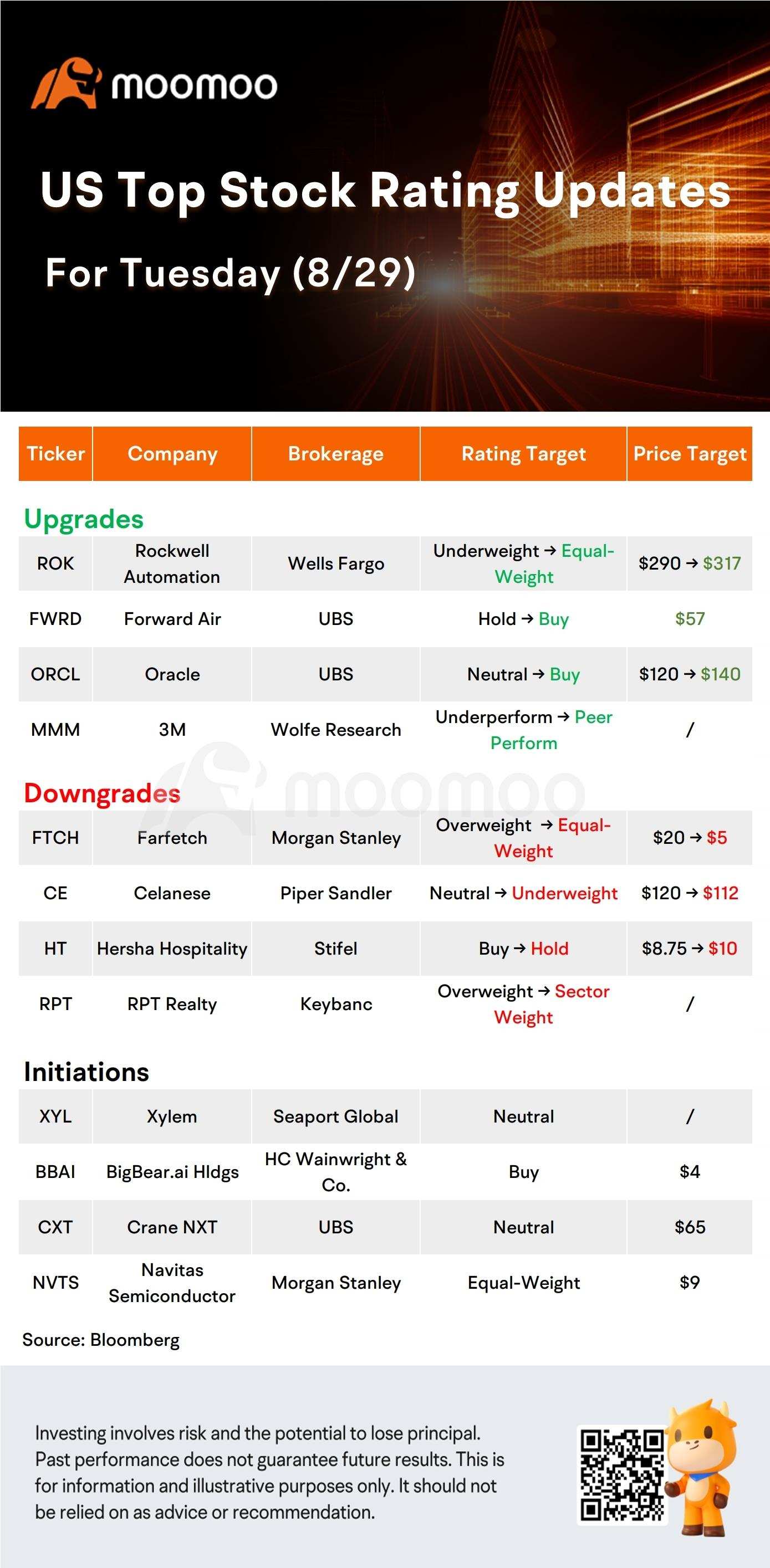

US Top Rating Updates on 8/29

$Xylem(XYL.US$ initiated at Neutral by Seaport Global.

$Rockwell Automation(ROK.US$ was upgraded by Wells Fargo from Underweight to Equal-Weight, increased target price from $290 to $317.

$Farfetch(FTCH.US$ was downgraded by Morgan Stanley from Overweight to Equal-Weight, decreased target price from $20 to $5.

$Celanese Corp(CE.US$ was downgraded by Piper Sandler from Neutral to Underweight, decreased target price from $120 to $112.

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment