Today's Pre-Market Stock Movers and Top Ratings: ARM, XOM, LMT, TSLA and More

Pre-Market Stock Movers

Gapping up

(Shares of the media giant rose more than 1% after The Wall Street Journal reported that activist investor Nelson Peltz's Trian Fund Management has hiked its stake and could seek multiple board seats, including for himself. Trian’s stake is now worth north of $2.5 billion after adding over 30 million shares from just 6.4 million at the end of June, the Journal reported. Trian declined to comment.)

(Shares of the chipmaker climbed nearly 3% after JPMorgan initiated coverage with an overweight rating and lauded the company's potential expansion into autos.)

(The stock edged higher after Barclays upgraded the cloud security company to overweight rating. Analyst Saket Kalia cited a new growth opportunity in an emerging segment as a reason for the upgrade.)

(Shares added about 1% after Evercore ISI upgraded Oracle to outperform from in line. The Wall Street firm said the software stock is at an attractive entry point after its recent pullback.)

(Energy stocks popped as oil prices rallied following the Hamas attack on Israel over the weekend. Exxon and Chevron were up more than 2%, and Occidental gained more than 3%.)

(The aerospace and defense company saw shares rise about 4.5% in premarket trading following the surprise attack on Israel by Palestinian militant group Hamas over the weekend.)

Gapping down

(The music streaming platform fell 2% after Redburn Atlantic downgraded shares to neutral from buy. The firm cited factors included gross margin dilution from the company’s recent decision to include audiobooks in its premium subscription package.)

(Shares of the investment company dropped 2.6% after Oppenheimer downgraded Blue Owl Capital to perform from outperform.)

(Shares of the commercial stage oncology company slipped 4.7% after Bristol Myers Squibb announced on Sunday that it will acquire Mirati for $58 per share in cash, for a total equity value of $4.8 billion. Mirati is known for its Krazati lung cancer medicine, which Bristol Myers Squibb will add to its commercial portfolio.)

(Tesla shares fell more than 1% after data from the China Passenger Car Association showed the company saw last month a 10.9% year-over-year sales decline in China. Meanwhile, rival BYD’s sales grew more than 40%.)

Source: CNBC

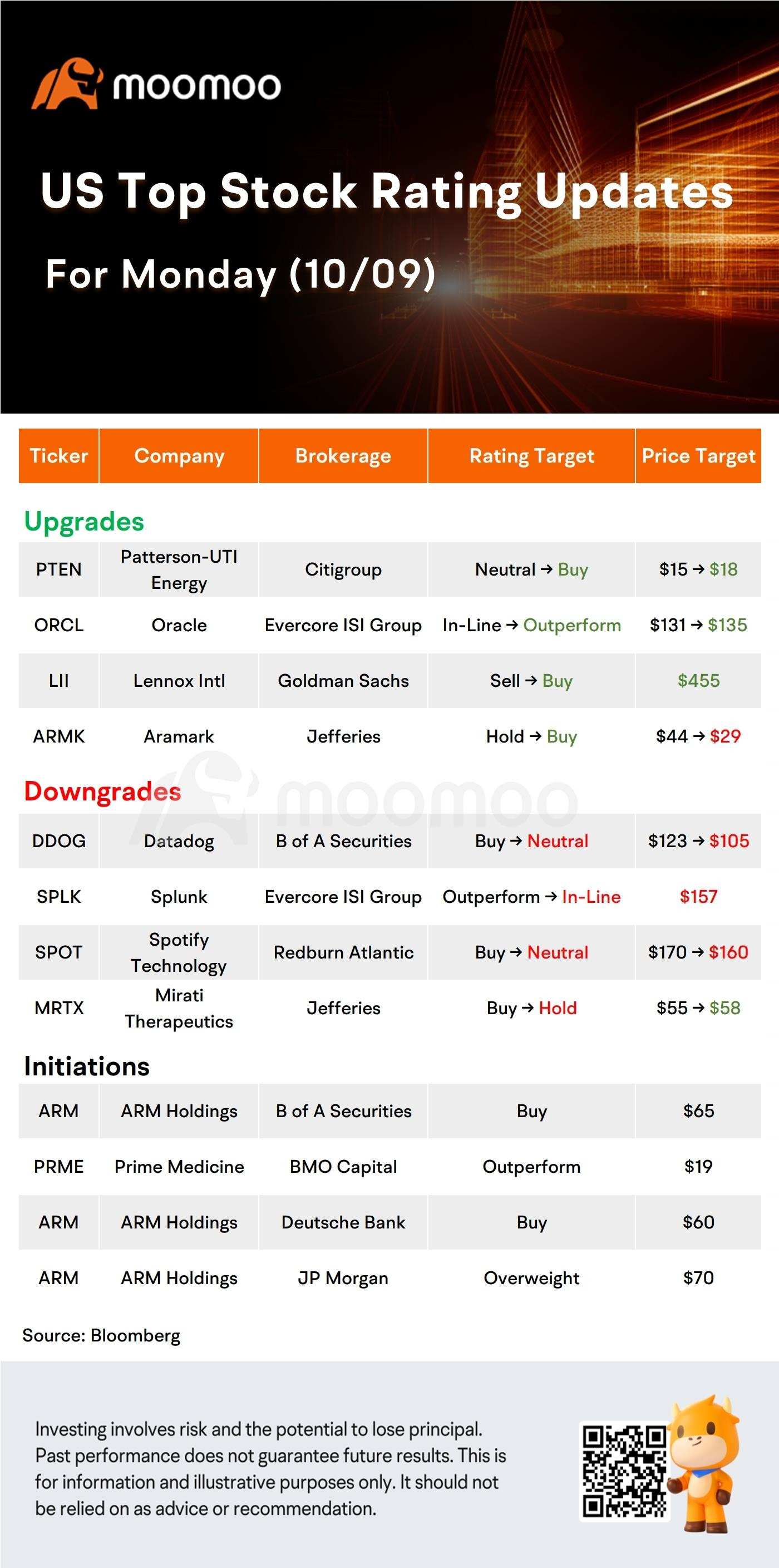

US Top Rating Updates on 10/09

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Chak : Bullshit my tesla price went down due to the war . Everything will go down today and probably this week.

73103485 : VELO3D and NUBURU both burning up the aerospace industry have secured unique government contracts and attention to detail