Today's Morning Movers and Top Ratings: SPOT, LLY, TSLA, UBS and More

Morning Movers

Gapping up

$Spotify Technology(SPOT.US$ Shares of Spotify Technology jumped over 3% in premarket trading Tuesday after the company's upbeat Q1 operating income guidance.

Spotify's Q4 loss per share in the quarter decreased significantly to €0.36 from €1.40 year-over-year. Analysts were looking for a loss per share of €0.37. Revenue reached €3.67 billion in the quarter, marking a 16% increase YoY.

$NXP Semiconductors(NXPI.US$ Shares of the chipmaker gained 3% after NXP reported stronger-than-expected fourth-quarter results, with adjusted earnings coming out at $3.71 per share, or 8 cents above estimates from analysts polled by LSEG. The company’s revenue of $3.42 billion also beat analysts’ forecasts of $3.40 billion.

$Eli Lilly and Co(LLY.US$ reported fourth quarter EPS of $2.49, $0.18 better than the analyst estimate of $2.31. Revenue for the quarter came in at $9.35B versus the consensus estimate of $8.95B. Shares jumped 5.35% in premarket trading.

$Palantir(PLTR.US$ Shares of the data analytics provider surged more than 20% after the company on Monday reported $608.4 million in revenue for the quarter, versus the $602.4 million expected by analysts surveyed by LSEG. Earnings and guidance for 2024 was about in line with expectations.

$Linde(LIN.US$ climbed 1.6% in the market pre-open Tuesday after the chemicals company posted better-than-anticipated earnings and revenue for the fourth quarter.

The firm reported Q4 earnings per share (EPS) of $3.59, topping the consensus estimates of $3.49. Revenue came in at $8.3 billion, while analysts were looking for $8.07 billion.

$DuPont(DD.US$ beat Wall Street estimates for fourth-quarter profit on Tuesday as well as announced a new $1 billion share repurchase program and hiked its dividend, sending its shares up about 3% in low-volume premarket trading. The company's adjusted profit was 87 cents per share for the three months ended Dec. 31, compared with analysts' average estimate of 85 cents per share, according to LSEG data.

$Li Auto(LI.US$ Shares of the Chinese EV maker jumped 8.6% after Deutsche Bank upgraded U.S.-listed shares of the stock to buy from hold, highlighting Li’s “best-in-class” management team and history of exceeding ambitious targets for volume and cost.

Gapping down

$Tesla(TSLA.US$ The beaten-down electric vehicle stock lost 2.3% after Daiwa downgraded Tesla to neutral from outperform, citing concerns around the company's corporate governance and uncertainty around possible board or leadership changes.

$Coca-Cola(KO.US$ On Tuesday, a Jefferies analyst revised the price target for Coca Cola, setting it at $63 per share, a change from the previous target. Despite the adjustment, the analyst maintained a Hold rating on the stock.

The firm's decision to revise the price target was based on several factors, including the anticipation of Coca Cola's $5.6B tax payment being placed in escrow within the year. Shares dropped by 0.15% in premarket trading.

$UBS Group(UBS.US$ Shares dropped about 4.1% after the bank reported a second consecutive quarterly loss, as its revenue of $10.86 billion fell slightly short of analysts’ expectations per FactSet. The Swiss bank increased its dividend and said it plans to reinstate share repurchases in the second half of this year, however.

Source: CNBC; Investing.com

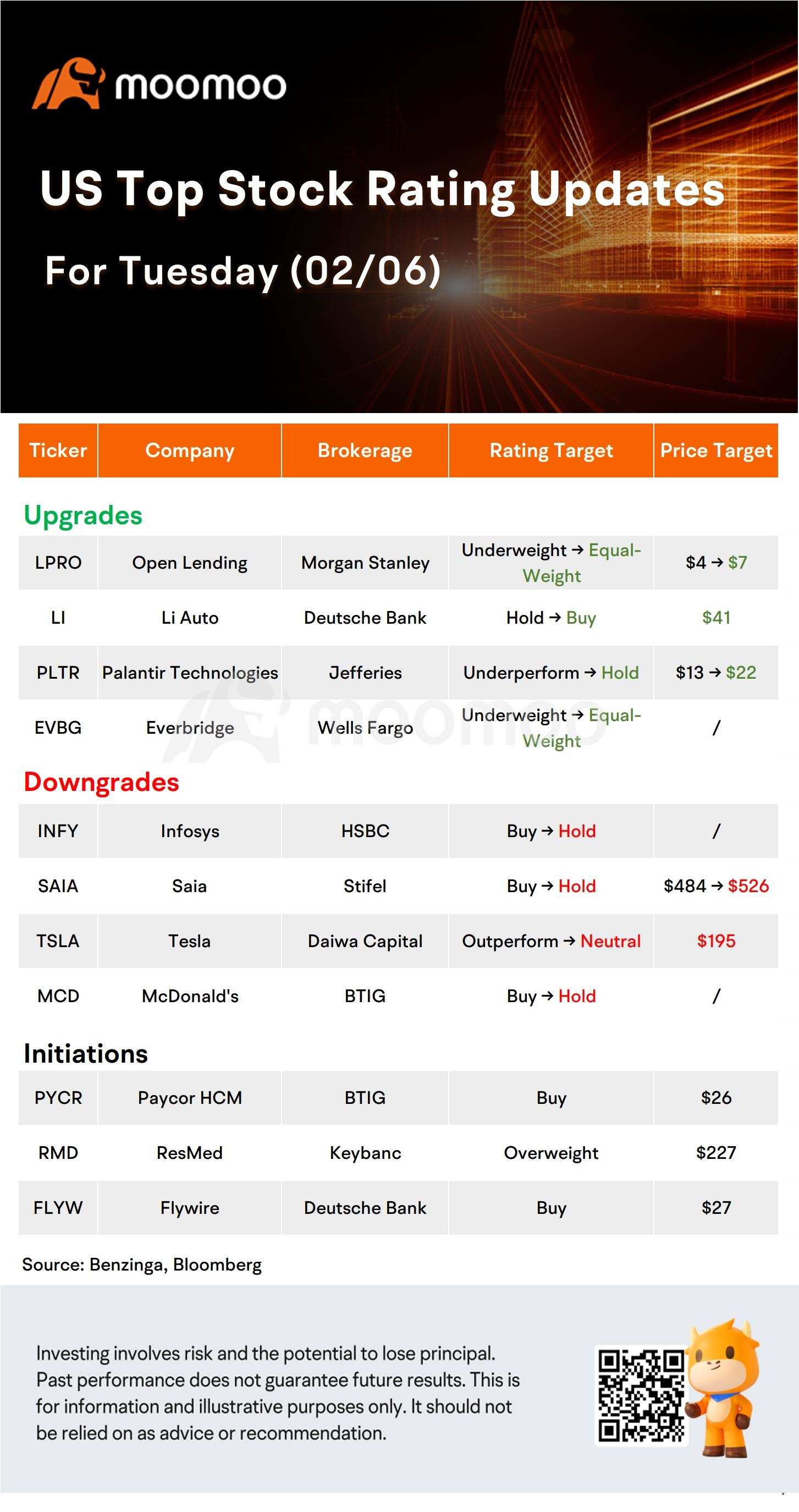

US Top Rating Updates on 02/06

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

72839409 : no way still tring to get in my head cant wont fall into a trap. hommie dont play that game to real been on that side. i know the way u think it like me but just a bit better u hear that so its always a morherr fucking text not a game LOL

AllOnCrypto : What

72758525 : Looks good.