Today's Morning Movers and Top Ratings: GM, FL, GME, CRWD and More

Morning Movers

Gapping up

$General Motors(GM.US$ stock rose 8.9% after the auto giant reinstated its 2023 guidance, plans to boost its dividend by 33% and announced a $10 billion accelerated share buyback.

$Foot Locker(FL.US$ stock soared over 9.1% after the athletic apparel retailer reported better-than-expected earnings and a shallower than anticipated slide in sales in the third quarter, although the athletic apparel retailer narrowed its full-year earnings guidance due to "ongoing consumer uncertainty."

$CrowdStrike(CRWD.US$ stock rose 2.4% after the cybersecurity company raised its annual guidance after reporting third-quarter results that topped expectations as a ramp-up in cybersecurity subscription revenue boosted performance.

$Workday(WDAY.US$ stock rose 8.6% after the financial and corporate software company beat third-quarter expectations and raised its full-year subscription revenue guidance.

$NetApp(NTAP.US$ stock rose 11% after the intelligent data infrastructure company raised its annual profit forecast on resilient demand for its cloud-based data solutions.

$GameStop(GME.US$ stock rose over 10% with the distressed video game retailer seemingly once more in demand, as indicated by the surging volume of options trading.

$KKR & Co(KKR.US$ stock rose 0.9% after the private equity firm said it would buy a remaining 37% stake in Global Atlantic Financial Group that it does not already own for $2.7 billion in an all-cash deal.

Gapping down

$Dollar Tree(DLTR.US$ stock fell 2.1% after the discount retailer missed expectations with its quarterly earnings and sales, citing “softer demand from low-income households.”

$Farfetch(FTCH.US$ stock fell 13% after Richemont said it would not inject any cash into the online luxury retailer, following a report that the latter was exploring going private.

$Las Vegas Sands(LVS.US$ stock fell 4.2% after the casino operator announced its largest shareholder, Miriam Adelson, is selling $2 billion of her shares to purchase a sports franchise.

Source: Investing.com

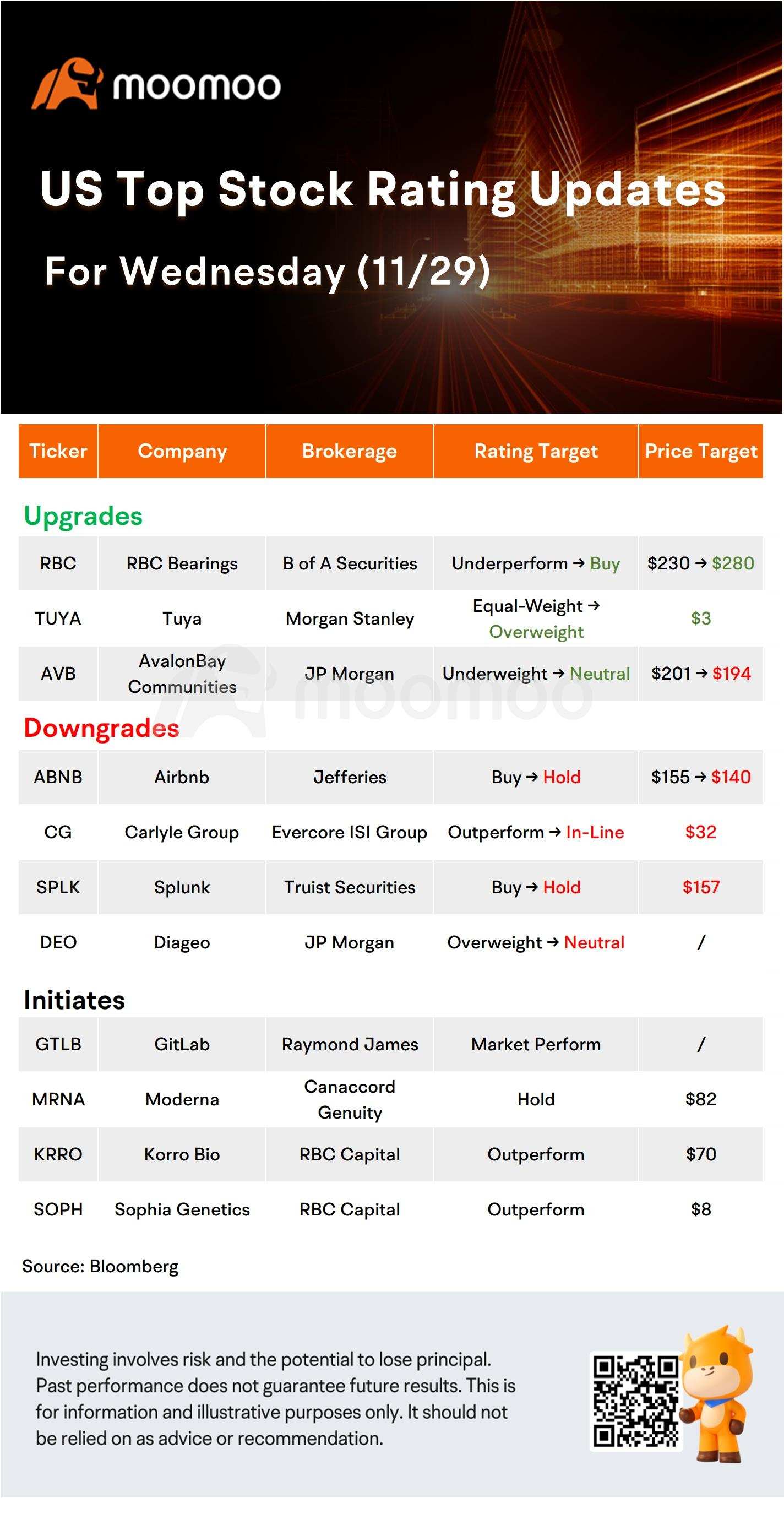

US Top Rating Updates on 11/29

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment