Today's Morning Movers and Top Ratings: ADBE, MRNA, OXY, AMT and More

Morning Movers

Gapping up

$Occidental Petroleum(OXY.US$ Berkshire Hathaway has acquired nearly 10.5 million shares of Occidental Petroleum so far this week for about $588.7 million, according to a filing at the U.S. Securities and Exchange Commission on Wednesday.

The purchases bring Berkshire's stake in Occidental to about 27%. Shares of OXY rose by 1.92% in premarket trading.

$Moderna(MRNA.US$ shares rose more than 4% in pre-market Thursday after the company said its vaccine candidate, developed together with Merck (MRK) cuts the risk of skin cancer returning by nearly half.

$Pagaya Technologies(PGY.US$ Shares in Pagaya Technologies jumped 7% in U.S. premarket trading on Thursday after analysts at Jefferies initiated coverage of the fintech group with a "buy" rating.

Israel-based Pagaya uses artificial intelligence-driven technology to provide real-time customer credit assessments to clients like banks, insurers, pension funds and asset managers.

$Opendoor Technologies(OPEN.US$ Shares of the residential e-commerce platform jumped 8.5%, adding to its gains from Wednesday. The company was upgraded by to market perform from underperform at Keefe, Bruyette & Woods earlier this week.

$TripAdvisor(TRIP.US$ The travel stock popped 5% after BTIG upgraded TripAdvisor to buy from neutral and hiked its price target to $25, suggesting nearly 38% upside from Wednesday’s close. The firm cited new management, growth in the Viator and TheFork businesses and the stock’s appealing valuation for its call.

Gapping down

$Adobe(ADBE.US$ shares dropped more than 6% pre-market Thursday after the company reported FQ4 results and offered guidance. Q4 EPS came in at $4.27, compared to the consensus estimate of $4.13. Revenue grew 12% year-over-year (up 13% year-over-year in constant currency) to $5.05 billion, compared to the consensus estimate of $5.01B.

For the full year, the company sees EPS at $17.60-$18.00, compared to the consensus of $18.00, and revenue at $21.3-$21.5B, worse than the consensus of $21.73B. Moreover, Adobe sees a new FY24 ARR at $1.9 billion, below the expected $2.02 billion.

''ADBE has a history of conservative ARR guide, with final actual beating initial guide by >$200M in 2 out of last 3 FYs.'' analysts at Jefferies said.

Source: CNBC; Investing.com

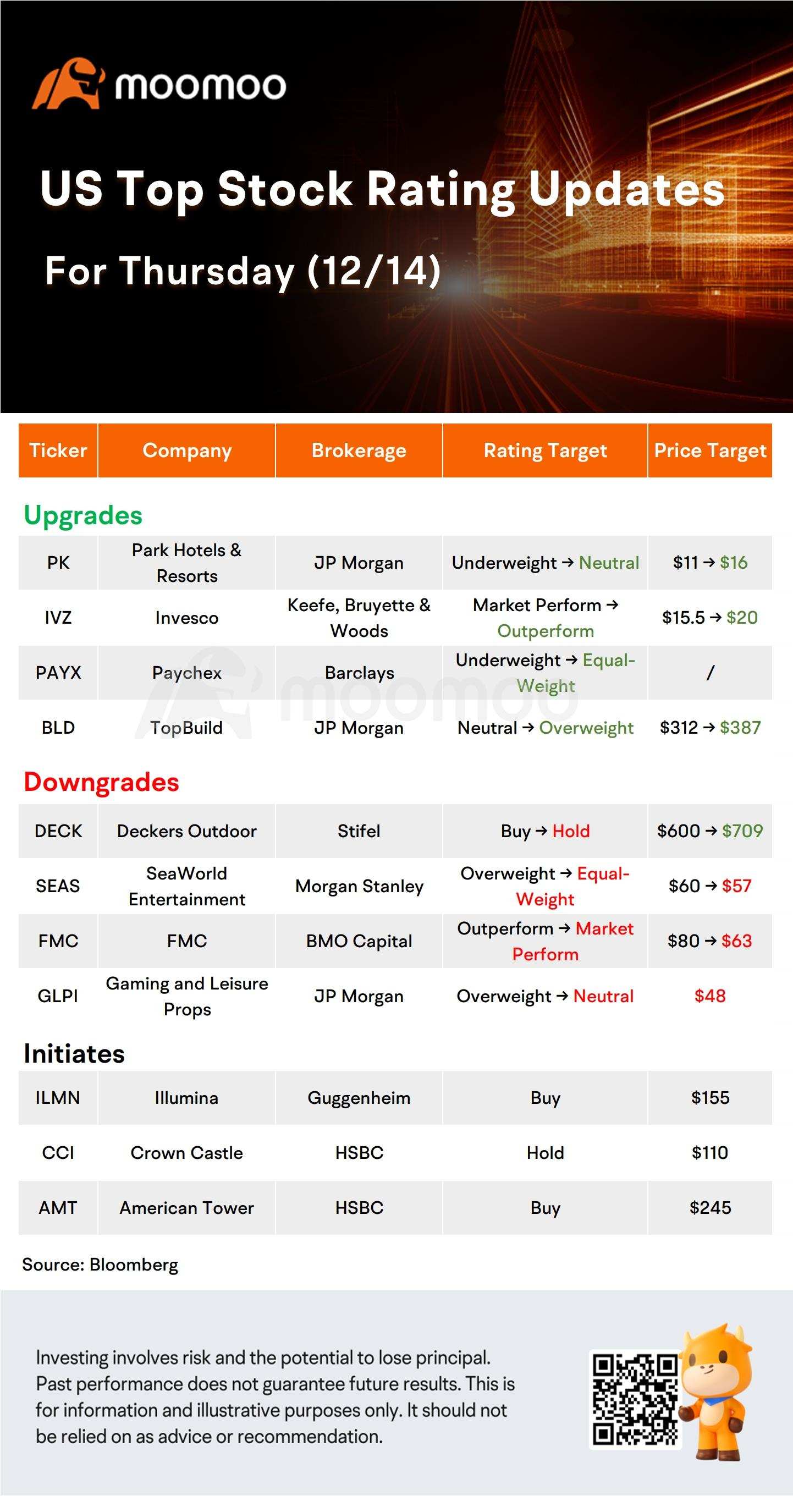

US Top Rating Updates on 12/14

Source: Dow Jones

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Robbie Weil : meh

Noorullah Lodin : Good