Time to 'Screaming Buy' Treasuries? Wall Street Bets on A Steeper Yield Curve as Labor Market Cools Off

All releases last week,including job openings, ADP employment report, and August payrolls report, indicated a cooling U.S. labor market. As investors trade with a "bad news is good news" approach, they are betting that a slowing economy and weakening labor market will prompt the Fed to adopt a less aggressive stance. According to CME's FedWatch tool, the markets indicate a 93% probability that the Fed will keep rates unchanged at the upcoming September meeting and over a 60% likelihood of no more hikes this year.

"There are signs of the economy slowing, which is what the Fed wants to see; It likely opens the door for no rate hike at the next Fed meeting in three weeks," said Ryan Detrick, chief market strategist at Carson Group in Omaha.

"Monetary policy implications are relatively straightforward -- it just got a lot harder to justify a hike in Q4; September is off the table; even if there is a modest upside surprise in the August CPI series," Ian Lyngen, head of U.S. rates at BMO said in a note last Friday.

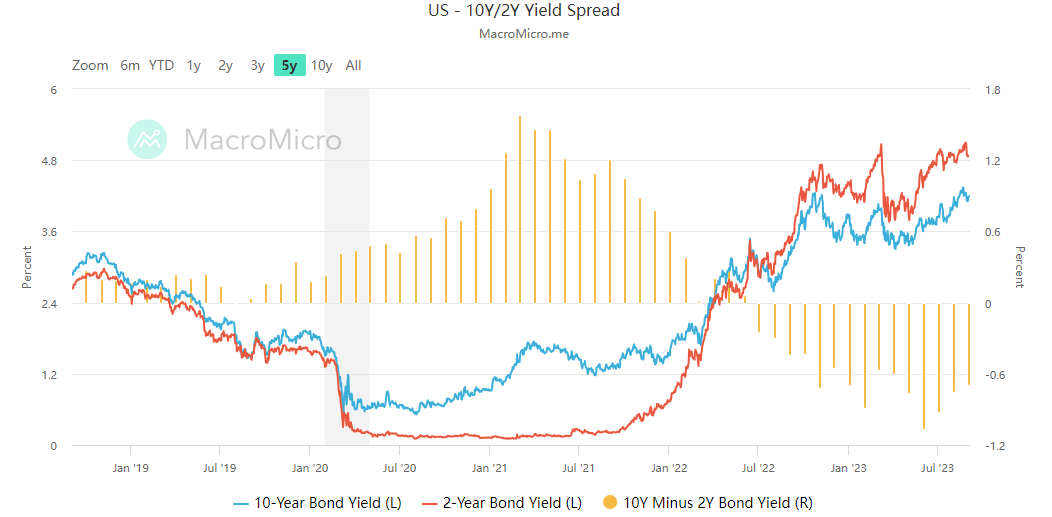

Michael Cudzil, a portfolio manager at Pacific Investment Management Co., said that the jobs data leaves "the bond market comfortable with the view that the Fed is on hold for now and maybe done for the cycle; If they are done for the hiking cycle, it's then about looking at the first cut that leads to steeper curves."

George Goncalves, head of U.S. macro strategy at MUFG, said that the employment reports looked like "the beginning of the end of the robust job market and the countdown for how long can the Fed stay on hold; this will favor the front-end versus the back-end."

Subadra Rajappa, head of U.S. rates strategy at Societe Generale, suggested that "the trade to be in is steepeners; Either the market starts to price in more Fed cuts and the curve bull-steepens, or the Fed stays on hold with strong data and long-end sells off in that case."

Source: Bloomberg, MacroMicro, CME Group

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

71673858 : , AZ cc ct

71673858 : , AZ cc ct

0020689497 71673858: 0200020689497

0020689497 71673858: 0200020689497