The Impending Early Rate Cut: Why the Market Believes the Fed Will Act Soon

Trading on rate cut expectations undoubtedly remains one of the most crucial themes in the market this year. Despite the Fed's dot plot indicating the potential for only 75 bp in cuts for 2024, the market is widely anticipating a 150 bp cut in policy rates for the year. After hawkish speeches by Federal Reserve officials this week weakened expectations for a rate cut, traders are still placing a 63.96% probability on the earliest rate cut occurring in March, with the probability of a rate cut in May remaining high at 98.27%, according to the CME FedWatch tool.

Analysts point to several signs suggesting that a Fed rate cut may be imminent. On one hand, rising financial instability risks are causing market concerns and necessitating a rate cut to relieve liquidity pressures. On the other hand, the Fed's record-setting losses may take up to four years to recover from, while surging fiscal deficits and heavy interest burdens necessitate early rate cuts. In addition, some economic recession signals are already flashing red, which could undermine the foundation of maintaining higher rates for longer.

1. Financial Instability Risks Rising as Liquidity Levels Move Further from Comfort Zone

In our recent article, "Economists Warn of Possible Liquidity Crisis in March: Is QT Coming to an End?" we highlighted a series of signals that suggest the current liquidity levels may be under pressure, indicating the need for early rate cuts to prevent a reoccurrence of the 2019 "money crunch" crisis.

Some of these signals include:

●RRP Facility Depletes Faster and Repo Rates "Occasionally" Jump

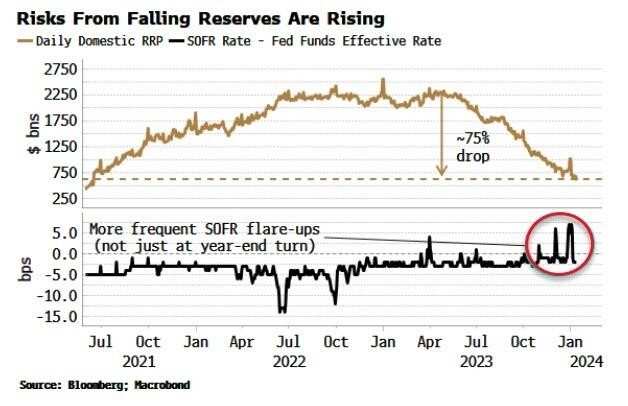

From the perspective of cash availability in the financing system, the balance of the Fed's overnight reverse repurchase agreement (RRP) facility has been declining faster than anticipated, and it could be fully depleted by sometime in March. Additionally, the frequent occurrence of spikes in repo rates has also signaled liquidity pressures at the price level.

●Imbalance in Bank Reserves Becoming Increasingly Prominent Issue

While there has been a slight increase in the overall balance of bank reserves in this round of QT, there are growing structural issues between large and small banks in the United States in terms of the unequal distribution of liquidity. This is particularly evident from the fact that the top 5% of US banks hold 40% of reserves, with reserves continuing to be transferred towards larger banks. In the event of a sudden risk event, smaller banks with weaker reserve positions may face higher financing costs, posing a potential threat to the stability of the financial system.

●Emergency Loan Program BTFP to End as Scheduled in Mid-March

2. Interest Rate Hike Leads to Record Losses for Federal Reserve and Adds to Fiscal Burden

Preliminary data released by the Federal Reserve last Friday revealed a rare loss of $114.3 billion due to a surge in interest expenses and significant unrealized losses in investment portfolios, marking the first time in 109 years that the Fed has faced such a predicament. Analysts estimate that losses for the current interest rate hike cycle could range from $150 billion to $200 billion. While the losses do not impede the Fed's ability to execute monetary policy, they will significantly impact its ability to return funds to the Treasury.

According to a study by the St. Louis Fed, it would take nearly four years for the Fed to recover from the operating losses and resume remitting profits to the US Treasury. Lowering interest rates may be a necessary step for the US government to alleviate its current fiscal pressures, and the sooner the rates are lowered, the sooner the pressure on interest payments can be relieved.

According to Treasury data, the US budget deficit for the first quarter of the 2024 fiscal year (October 1, 2023 - December 31, 2023) is expected to increase by 21% YoY to approximately $510 billion, with a deficit of $129 billion in December alone, up 52% YoY. Analysts predict that if the current trend continues, the deficit in 2024 will exceed $2 trillion. In addition, disregarding short-term debt maturing within the year, $8.6 trillion of US Treasury bonds will mature in 2024, with $5 trillion maturing in the first quarter alone, and high interest rates will lead to increased costs of debt refinancing. Lower interest rates will ease the burden of interest expenses and borrowing pressures, further reducing the pressure on the government to increase taxes.

3.Economic Recession Signals Shake the Foundation of "Higher for Longer" Interest Rates

A number of Wall Street pessimists are predicting a sluggish economic growth rate of 1.2% for the US in 2024, with a 50% chance of the economy falling into a recession. "Bond King" Jeffrey Gundlach, on the other hand, is even more pessimistic,

"The economy has a better than 50% chance of hitting a recession this year. It's more like a 75% chance of running into recession. "

●Shift from Private to Government Job Growth Sparks Concerns of Impending Recession

Historical experience indicates that as an economic recession approaches, the proportion of private sector jobs tends to shrink. Data shows that over the past year, the growth rate of private sector employment has only been half that of government sector employment, with government jobs accounting for more than 20% of new jobs added each month since September of last year. In December, government jobs accounted for 24.9% of all new jobs added, the highest proportion since March 2020.

●Inverted Yield Curve Highly Suggestive of Economic Recession, Experts Warn

Campbell Harvey, the father of the yield curve prediction model, has pointed out that the curve measuring the difference between the 3-month and 10-year US Treasury bond yields has been inverted for the past 13 months, which is the average lead time before an economic recession. In the past, every time the yield curve has inverted, it has been followed by a recession.

Source: Bloomberg, Fred, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : Very good info in this article The Fed and its policies can be tough to comprehend. You must understand what the Fed and other central banks are doing to become a more profitable investor. They essentially control the money in circulation. If you control the money, then you can sway the markets in certain directions. Just like we have seen over the past few years since the pandemic and many other times in the past.

The Fed and its policies can be tough to comprehend. You must understand what the Fed and other central banks are doing to become a more profitable investor. They essentially control the money in circulation. If you control the money, then you can sway the markets in certain directions. Just like we have seen over the past few years since the pandemic and many other times in the past.

SpyderCall : Can anybody tell me where I can find the Feds investment portfolio? Is it even public information?

intuitive Jackal_354 : just my opinion, but if the fed does cut in March it's because they broke something in the economy much worse than inflation

Ixy The Cat : Personally, I don't believe there will be a rate cut soon as inflation is coming back.

Seraphicall intuitive Jackal_354 : They can’t do a rate cut…

intuitive Jackal_354 Seraphicall : they can if they broke something

104188239 : I don’t see any real weakening in the US economy from the recent data. None of the Fed officials have signalled for a rate cut. I think it’s wishful thinking.

101608896 : if rate cut, where should people allocate their funds?

Rhonnell Hari6 : i want to close all my account in crypto,bitcoin,stock. it is useless. pahirap s buhay ng tao.hnd mo magamit ang pera mo.5 years akong nakatutok 24/7 pindutin ng pindutin ng keyboard eh wala akung ni kahit 1dollar s lahat ng ginawa.