Ron Baron 预言特斯拉股价将翻6倍,飙升至1500美元!

$特斯拉(TSLA.US)$

别说预测未来会发生什么了,99%的人连过去和现在到底发生了什么都搞不清楚。Tesla正在发生深刻的变化,……。

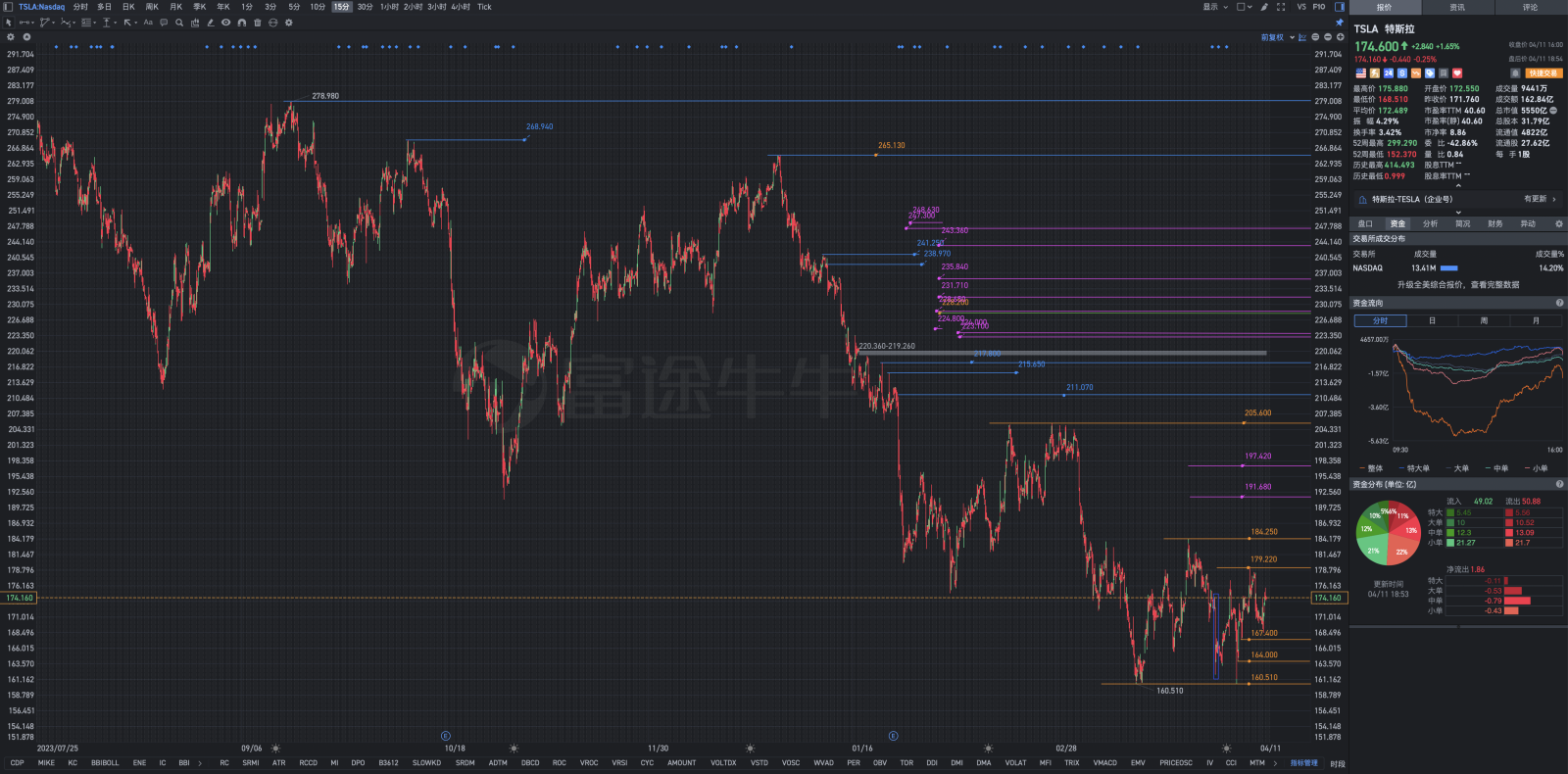

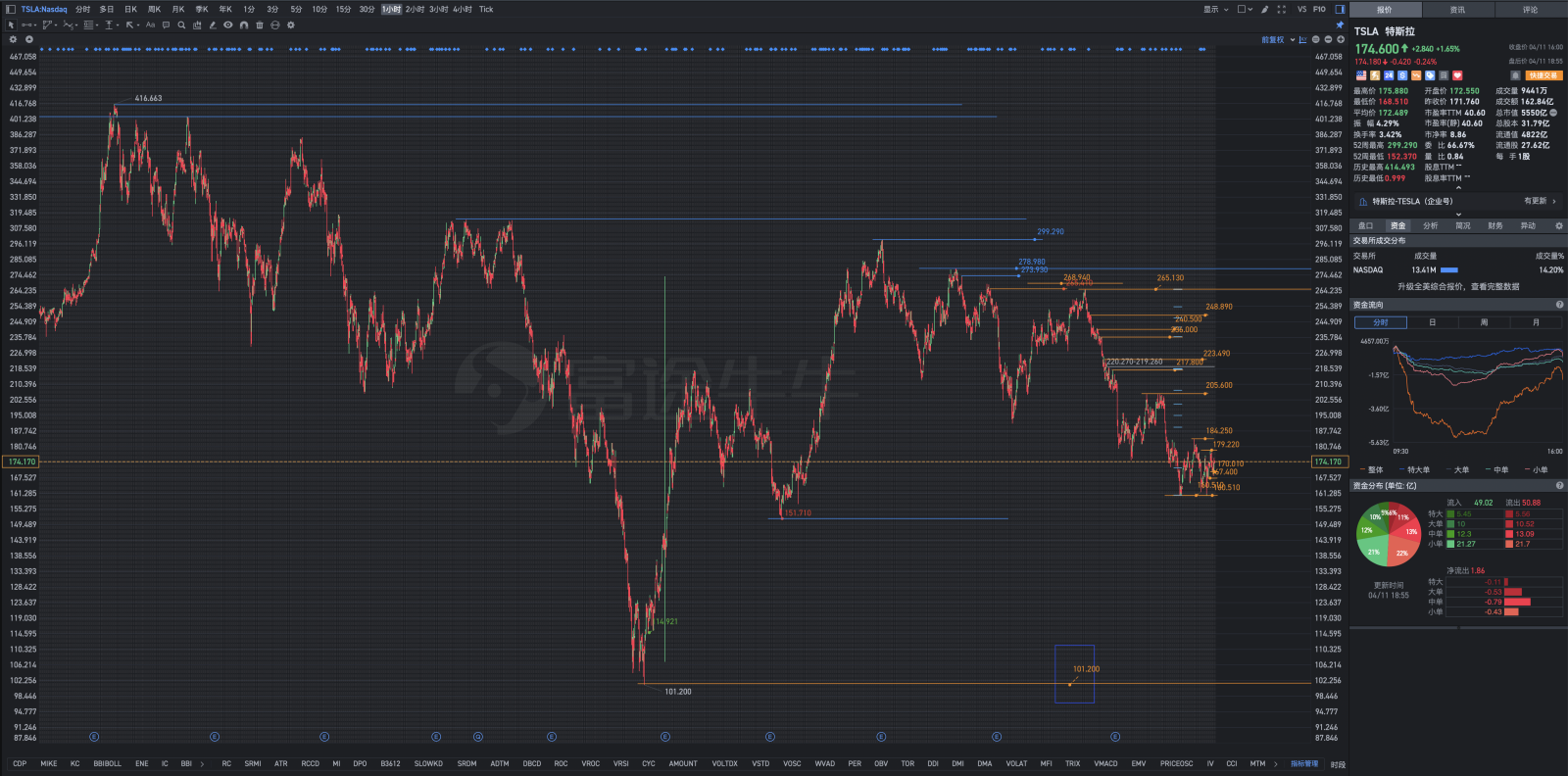

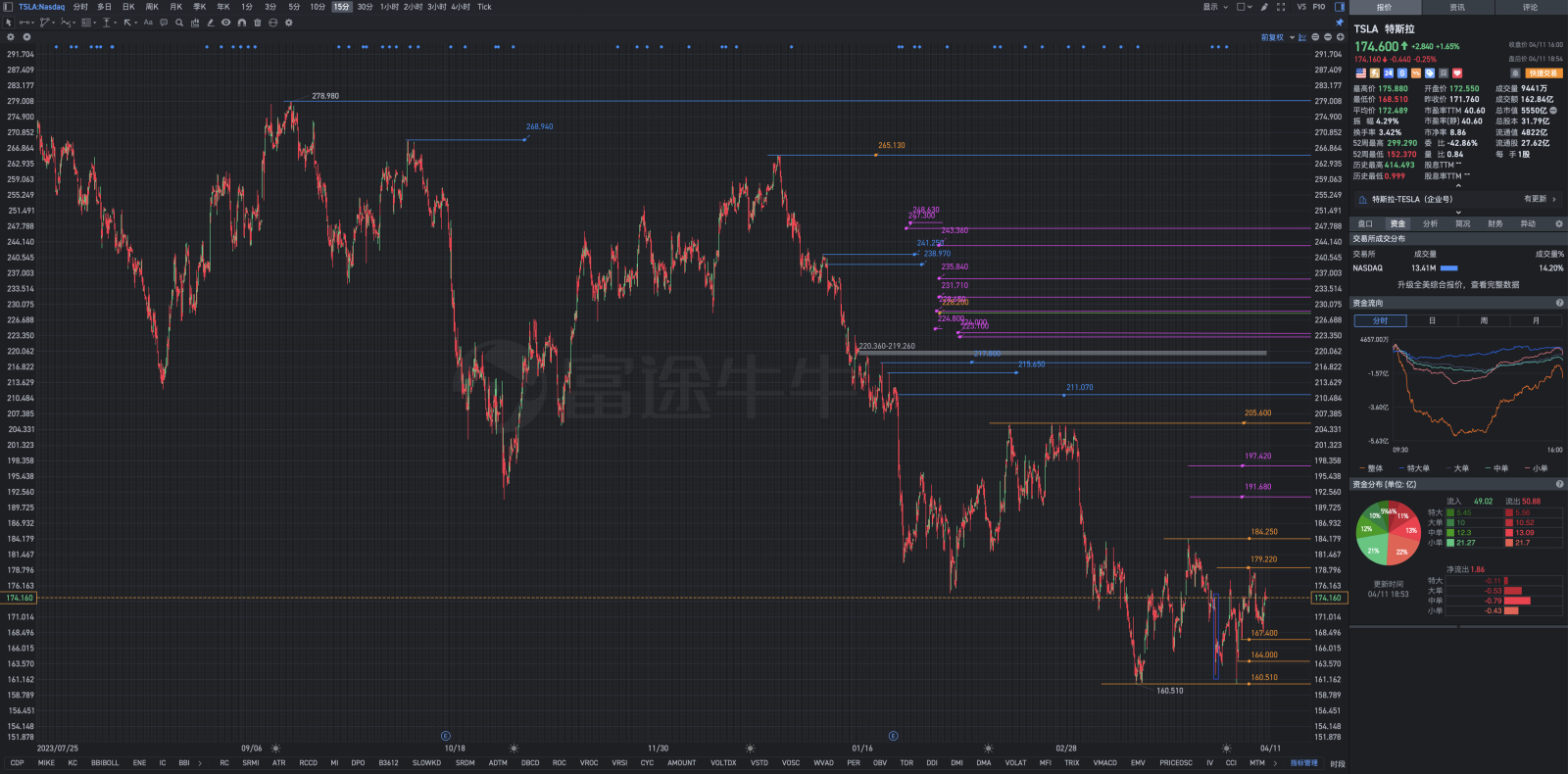

稳扎稳打,不慌不忙,中线结合短线操作。投入60%的资金作战,留40%的资金作为预备队。

Historical big data shows that speculative profits cannot exceed investment profits.

Ronald Stephen Baron (born 1943)(also known as Ron Baron) is an American mutual fund manager and investor. He is the founder of Baron Capital, an investment management firm. The New York City based firm manages the Baron Funds, which he also founded, and has approximately $45 billion in assets under management.

As of November 2022, Baron had a net worth of US$5 billion.

Baron grew up in a Jewish familyin Asbury Park, New Jersey, one of two children of Morton Baron, an engineer, and his wife Marian.Baron invested $1,000, saved from shoveling snow, waiting tables, working as a life guard, and selling ice cream, and turned it into $4,000 by investing in stocks, prompting cohorts to call him "Count", a nickname which still sticks. He studied chemistry at Bucknell University and attended George Washington University Law School at night on scholarship.His first job out of school was with the United States Patent Office.

Baron worked for several brokerage firms from 1970 to 1982. During this time, he developed a reputation for investing in small companies.

He founded Baron Capital Management in 1982. Baron Capital is well known for its long-term strategy in growth equity investments. The firm will typically hold a stock for 4–5 years, sometimes as many as 10–15 years. The firm prefers to invest in mega-trends driven by broad societal and demographic trends, including baby boomer demands for healthcare - trends where demand is expected to remain steady for years, or even decades.The firm seeks to invest in companies that have strong management teams, investing in people not assets. They look for companies that have strong growth opportunities, are appropriately financed, have competitive advantages, and are a leader in their field. Baron Capital places a unique focus on the strength of the management teams of the companies they invest in, looking for credible, dependable, trustworthy leadership. In 2011, Baron Capital had approximately $19.5 billion in assets under management. In an effort to thank investors, Baron hosts an annual shareholder meeting which typically features rock acts such as Elton John, the Beach Boys, and Lionel Richie.In 2012, Baron Capital purchased 24 percent of the stock of the Manchester United Football Club that was offered on the New York Stock Exchange by the Glazer family. Baron's investment amounts to a 5.8% ownership interest in the club as only 10% of the team's stock was floated.In September 2014, Baron Capital raised its stake in the club to 9.2% of the entire club (equivalent to 37.8% of all shares available on the NYSE).

In 2014, the fund invested $380 million in Tesla stock at an average cost per share of $43.07.

In 1978, Baron married Judy Bernard in a Jewish ceremony at the Harmonie Club. In 2007, he paid $103 million for a house in East Hampton, New York, the most ever paid for a residential property at that time, from Adelaide de Menil, heiress to the Schlumberger fortune. De Menil's house had been built by piecing together historic East Hampton buildings that she moved to the property to protect them from demolition. Prior to the close of the sale, de Menil broke up the structures and moved them to various locations in the town for protection, including six that were moved a mile north to where they will form the new campus of the East Hampton Town government.Baron built a new 28,000-square-foot (2,600 m2) house, designed by Hart Howerton, a New York architectural firm with several other projects in the Hamptons, which specializes in large-scale land use. The house was included in a 2008 Vanity Fair article.

视频播放链接🔗:Ron Baron 预言特斯拉股价将翻6倍,飙升至1500美元!

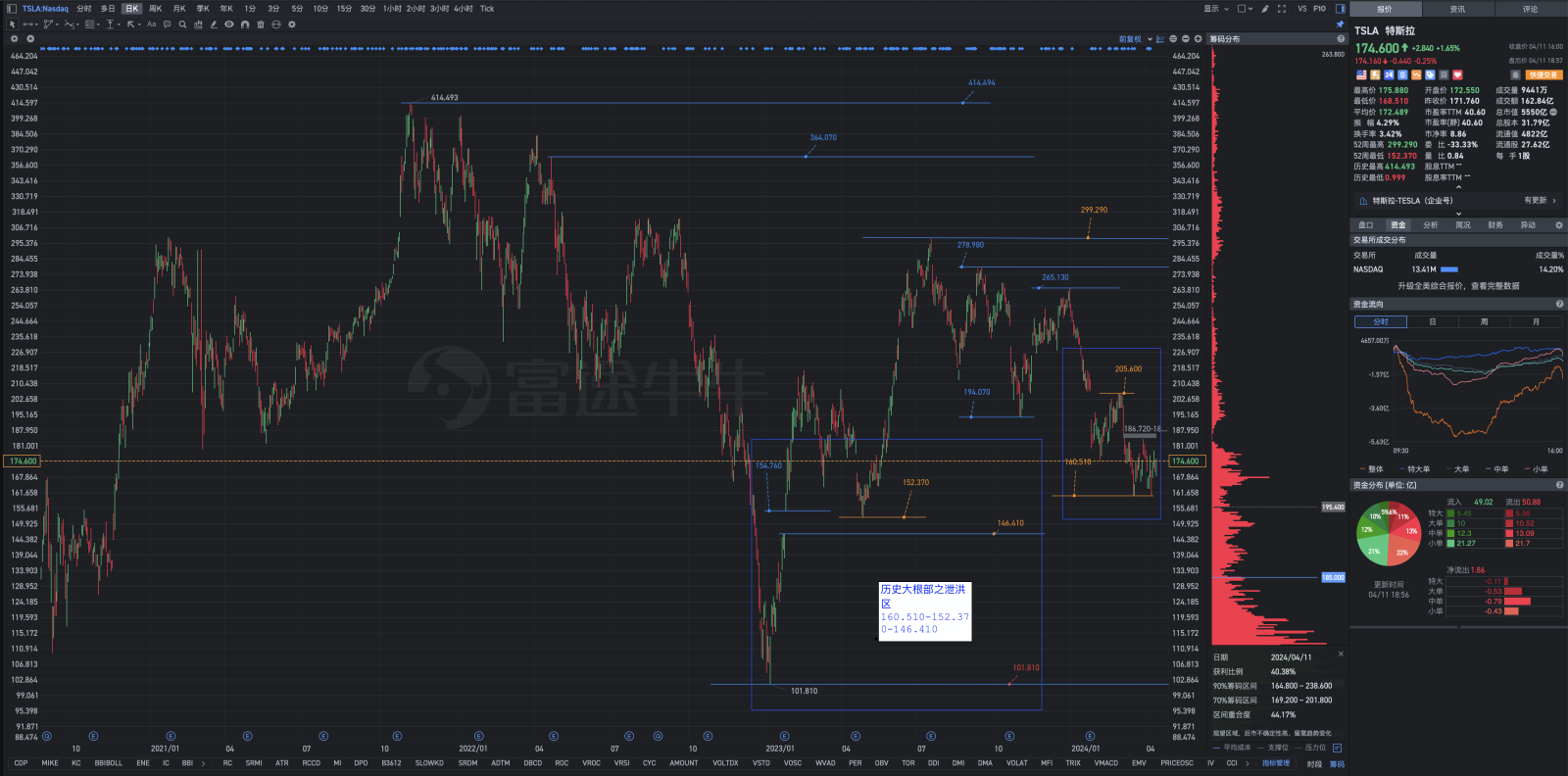

历史大数据显示:投机获利无法超越投资获利。

罗纳德·斯蒂芬·巴伦(Ronald Stephen Baron,1943 年出生)(也称为罗恩·巴伦)是一位美国共同基金经理和投资者。 他是投资管理公司Baron Capital的创始人。 这家总部位于纽约的公司管理着他本人创立的 Baron Funds,管理着约 450 亿美元的资产。

截至 2022 年 11 月,Baron 的净资产为 50 亿美元。

巴伦 (Baron) 在新泽西州阿斯伯里帕克 (Asbury Park) 的一个犹太家庭长大,是工程师莫顿·巴伦 (Morton Baron) 和妻子玛丽安 (Marian) 的两个孩子之一。巴伦投资了 1,000 美元,省下了铲雪、服务员、救生员和卖冰的费用。 奶油,并通过投资股票将其变成 4,000 美元,促使人们称他为“伯爵”,这个绰号至今仍沿用至今。 他在巴克内尔大学学习化学,并凭借奖学金在晚上就读于乔治华盛顿大学法学院。他毕业后的第一份工作是在美国专利局。

1970 年至 1982 年间,巴伦曾在多家经纪公司工作。在此期间,他因投资小公司而享有盛誉。

他于 1982 年创立了 Baron Capital Management。Baron Capital 以其成长型股权投资的长期战略而闻名。 公司通常持有股票 4 至 5 年,有时长达 10 至 15 年。 该公司更喜欢投资由广泛的社会和人口趋势驱动的大趋势,包括婴儿潮一代对医疗保健的需求 - 这些趋势预计需求将保持稳定数年甚至数十年。该公司寻求投资于拥有强大管理能力的公司 团队,投资于人而不是资产。 他们寻找具有强劲增长机会、资金充足、具有竞争优势并且是所在领域领导者的公司。 巴伦资本特别关注其所投资公司的管理团队的实力,寻找可信、可靠、值得信赖的领导层。 2011年,Baron Capital管理的资产约为195亿美元。 为了感谢投资者,Baron 举办了一次年度股东大会,会议通常邀请埃尔顿·约翰 (Elton John)、海滩男孩 (Beach Boys) 和莱昂内尔·里奇 (Lionel Richie) 等摇滚歌手参加。 2012 年,Baron Capital 购买了曼联足球俱乐部 24% 的股票, 由格雷泽家族在纽约证券交易所上市。 Baron 的投资相当于俱乐部 5.8% 的所有权权益,而球队流通股仅占 10%。 2014 年 9 月,Baron Capital 将其在俱乐部的持股比例提高至整个俱乐部的 9.2%(相当于全部股份的 37.8%) 在纽约证券交易所上市)。

2014 年,该基金向特斯拉股票投资了 3.8 亿美元,平均每股成本为 43.07 美元。

1978 年,巴伦在和谐俱乐部举行的犹太仪式上与朱迪·伯纳德结婚。 2007 年,他以 1.03 亿美元的价格在纽约东汉普顿购买了一套住宅,这是当时购买住宅物业的最高价格,来自斯伦贝谢财富的女继承人阿德莱德·德梅尼尔 (Adelaide de Menil)。 德梅尼尔的房子是由东汉普顿历史悠久的建筑拼凑而成的,她将这些建筑搬到了这里,以防止它们被拆除。 在出售结束之前,德梅尼尔拆除了这些建筑物,并将它们转移到镇上的不同地点进行保护,其中六座被转移到了向北一英里的地方,在那里它们将成为东汉普顿镇政府的新校园。 建造了一座 28,000 平方英尺(2,600 平方米)的新房子,由纽约建筑公司 Hart Howerton 设计,汉普顿还有其他几个项目,专门从事大规模土地利用。 这座房子出现在 2008 年《名利场》杂志的一篇文章中。

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

FortuneStar : why not 3000?!

Elias ChenOP : One hundred thousand whys

盈利加仓Bull888888 : 60 times