What is your investment trading strategy?

1. Will there be new opportunities in May? What kind of new opportunities must we seize?

2. Conventional combat mentality and what are the current key points to focus on. Sharpen your investment and trading skills to become more professional and improve them a little more?

3. All important life investment stocks are currently low. Are you ready for life investment stocks? What is it? How are you going to invest?

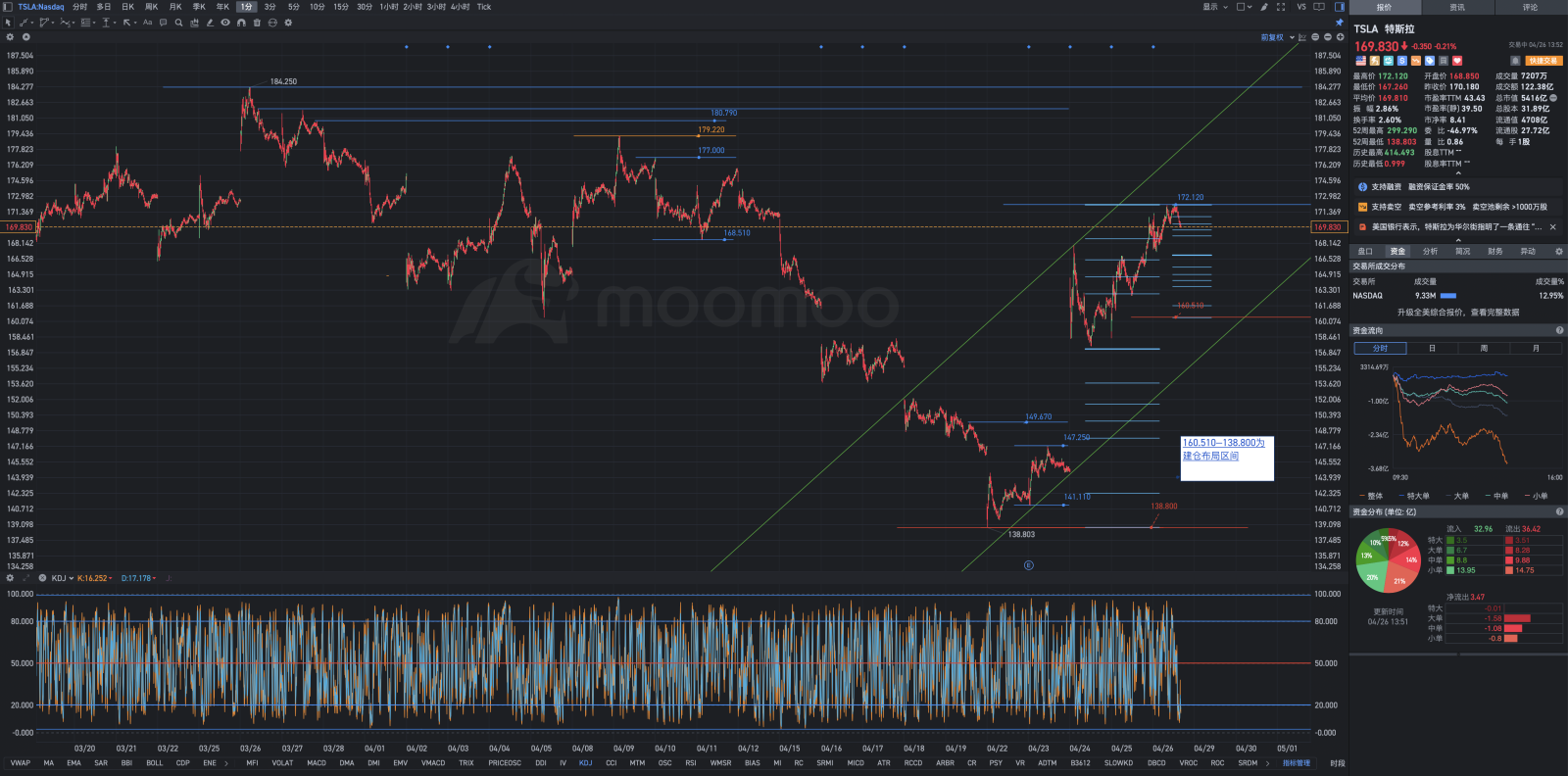

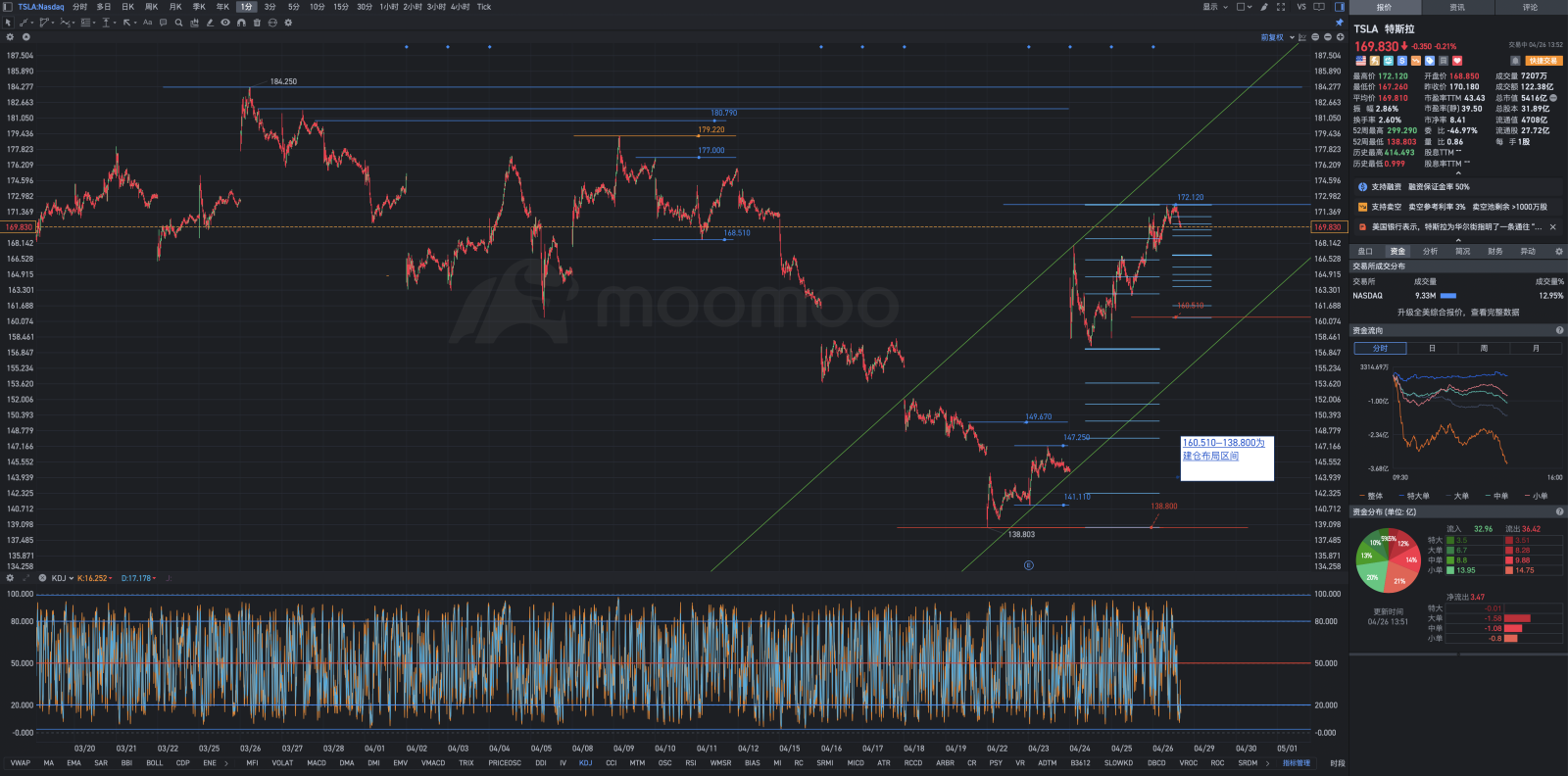

4. Tesla twists and turns from 265.130 to 220.280 (44.85 points); fell from 220.280 to 205.600 (14.68 points); fell from 205.600 to 160.510 (45.09 points); rebounded steadily at 160.510; a conventional view of poor earnings caused Tesla's stock price to plummet 138.800 (21.71 points) from 160.510. It was quickly boosted by bottoming out to 173.780 (34.98 points). The recent shock What does that mean? Should we be depressed and fearful, or should we cheer up and revive the mountains and rivers, not worth the “suffering” we have already experienced in the early stages?

5. Once a person's thinking is solidified, it is difficult to change it. Therefore, we must develop the habit of statistics; we must not have personal stubbornness; we must obey the rules of data statistics.

6. Decide how to make an investment transaction based on your own perception of Tesla, your own purpose, and your own financial nature and situation.

7. When technical graphics and technical indicator function curves and related function values are worst, it is also a relatively safe position for opening positions. When the ratio of profitable chips fluctuates in the single-digit percentage area; stock prices are infinitely close to the downside of the downward channel; most technical indicators are oversold or seriously oversold; some technical indicators intermittently show bottom divergence; that is, the so-called four-body resonance, then there is a high probability that a similar bottom area will occur.

8. At the end of the market decline, you can begin to consider gradient batches, discrete random variables, and position opening layout. Follow the trend, counter technology, and reverse humanity.

9. According to Elias, trends are divided into primary trends and secondary trends. Once Elias locks in 🔒 the subject of his own investment transaction, the main trend of locking in the object of 🔒 investment transaction is always upward; otherwise, he resolutely abandons. When the main trend is sharply opposed to the secondary trend, short-term trend, or even short-term trend, the position opening layout begins.

10. According to Elias, Tesla is a huge piece of jade that is being cut. It has only cut a small portion but has already revealed amazing natural fine jade. Currently, it is difficult to make a specific quantitative assessment. In the weekly chart, KD has formed a gold fork in the 20.000 to 0.000 area. Although the technical indicators of the weekly chart are lagging behind, the reliability is extremely high. The market is bullish after fixing short-term technical indicators, so take advantage of the decline to open positions.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

151628187 : downtrend

101891496 :

71601323 : I can't understand

欢跃的奥古斯特 : Yes, should we sell it?