Tesla Deliveries to Hit Record, But Fall Short of Musk's Aspirations

Despite TSLA shares are up about 110% in 2023, doubling after a lackluster 2022 when shares tumbled more than 60%, the growth story around the EV giant has come into question.

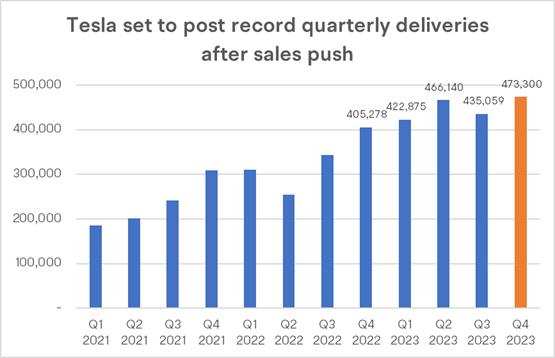

Tesla likely delivered 1.82 million vehicles globally in 2023, up 37% from 2022, with about 473,000 units in the fourth quarter, according to 14 analysts polled by LSEG. The EV maker is expected to report quarterly deliveries and production as early as next Tuesday.

"The fourth quarter is typically the strongest of the year in terms of deliveries for Tesla, we're expecting that to be the case again this year," said Garrett Nelson, senior analyst at CFRA Research.

Most analysts predict the company will reach its 1.8 million vehicle goal but will not achieve the 2 million units Elon Musk said might be possible during the Q1 2023 earnings call.

“These are volatile times from a production standpoint. If things go well, we’ve got a shot at 2 million vehicles this year, but that is the upside case. And we feel comfortable with 1.8, and we’ll see how this year unfolds,” Musk replied to a question from Goldman Sachs' Mark Delaney.

Note: Includes LSEG estimates for Q4 2023

Source: Reuters

The company, which made a year-end sales push by increasing discounts on its key models, has said it aims to achieve a 50% average annual growth rate over multiple years. However, the current growth rate falls far short of the target.

Jairam Nathan, an analyst at Daiwa Capital Markets, trimmed his estimate for Tesla's deliveries next year to 2.04 million from 2.14 million and said he was modeling for a 4% decline in average revenue per car from 2023.

Analysts polled by Visible Alpha forecast that Tesla will deliver 2.2 million units in 2024. Compared to the 37% growth between 2022 and 2023, Tesla’s growth in 2024 is expected to be slower.

“Tesla candidly admitted the company is now in an intermediate low-growth period,” Deutsche Bank analyst Emmanuel Rosner wrote in a note, citing a meeting with Investor Relations Chief Martin Viecha.

Is Tesla stock a buy or a sell in 2024?

Bears on Tesla are concerned that its core EV business is facing increased competition outside the US, potential demand woes, regulators' sights, falling margins, and the loss of tax credits for at least some models in the US, France, and Germany.

Tesla price cuts hit margins

To maintain sales momentum in 2023, Tesla aggressively cut vehicle prices in January. Auto gross margins, which peaked at 30% in Q4 2021 amid industry chip shortages, have plunged well below 20%.

Tesla EVs in regulators' sights

Entering 2024, Tesla faces mounting pressure from regulators. A recent Reuters investigation found the EV giant has known of faulty suspension and steering parts across its model lineup going back at least seven years, but often blamed drivers when those parts failed.

This comes after a National Highway Traffic Safety Administration investigation recently spurred Tesla to perform an over-the-air software "recall" on more than 2 million vehicles after determining that the Autopilot is prone to misuse after reviewing 1,000 accidents.

Competition in China

Musk has said China's EV companies are Tesla's main competition — with BYD, NIO, Li Auto and others all making inroads in the EV market.

BYD, already far above Tesla EV sales including plug-in hybrids (PHEVs), will likely overtake its US rival in global BEV deliveries in the fourth quarter of 2023. Warren Buffett-backed BYD has also decided to open a plant in Europe, moving onto Tesla's turf on another continent. BYD already is building plants in Thailand and Brazil.

Cybertruck face challenges

On Nov. 30, Tesla formally began Cybertruck deliveries. However, the new offering, the first since the Model Y in 2020, is unlikely to have much of a positive impact on Tesla's business in 2024.

Sacconaghi's view is that the "Cybertruck's addressable market is small" and that there will be an incremental, 100 bps headwind to gross margins in 2024.

Tom Narayan, an analyst at RBC Capital Markets, said in a report that Cybertruck would represent 3% of Tesla's volumes in 2024, calling it more of a "halo" product that could attract consumers to the brand.

However, Tesla stock bulls are still betting that a Cybertruck "halo effect," EVs’ longer-term potential, the full-self-driving (FSD) technology and the humanoid robot Optimus.

Tesla AI strategy

HSBC Analyst Michael Tyndall wrote that Tesla vehicles may well be the main driver of revenue and profits currently, but the future for Tesla is about robots, autonomous vehicles, energy storage and supercomputers.

Tesla's major AI investments involve:

Full self-driving (FSD) cars, trucks and autonomous vehicles.

Optimus robots.

Dojo, a supercomputer that went into production in August 2023.

Meanwhile, Musk has long touted Tesla's Full Self-Driving (FSD) technology and the potential value it brings to the brand.

“EVs have some big problems, but Tesla is way beyond just an EV company because of Elon Musk,” said Matthew Tuttle, chief investment officer and CEO at Tuttle Capital Management. “Elon allows for a higher multiple than you would have if Tesla was just an EV company.”

Source: Reuters, Investors, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment