TA Challenge: How to identify bearish trends with candlestick patterns?

Hi, mooers!

After learning to identify some useful bearish candlestick patterns, it's important to identify a real bearish trend to assist your trading. Don't worry, here are some basic skills you might need!

Basic Theory

Before diving into trading bearish candlestick patterns, it's important to keep in mind two principles:

1. A valid bearish reversal pattern should arise during an uptrend; otherwise, it might indicate a continuation pattern instead.

2. Most bearish reversal patterns require follow-up confirmation through a subsequent bearish price rise supported by high trading volume.

To help distinguish true bearish patterns from false signals, traders can use the following steps:

Confirm the Uptrend

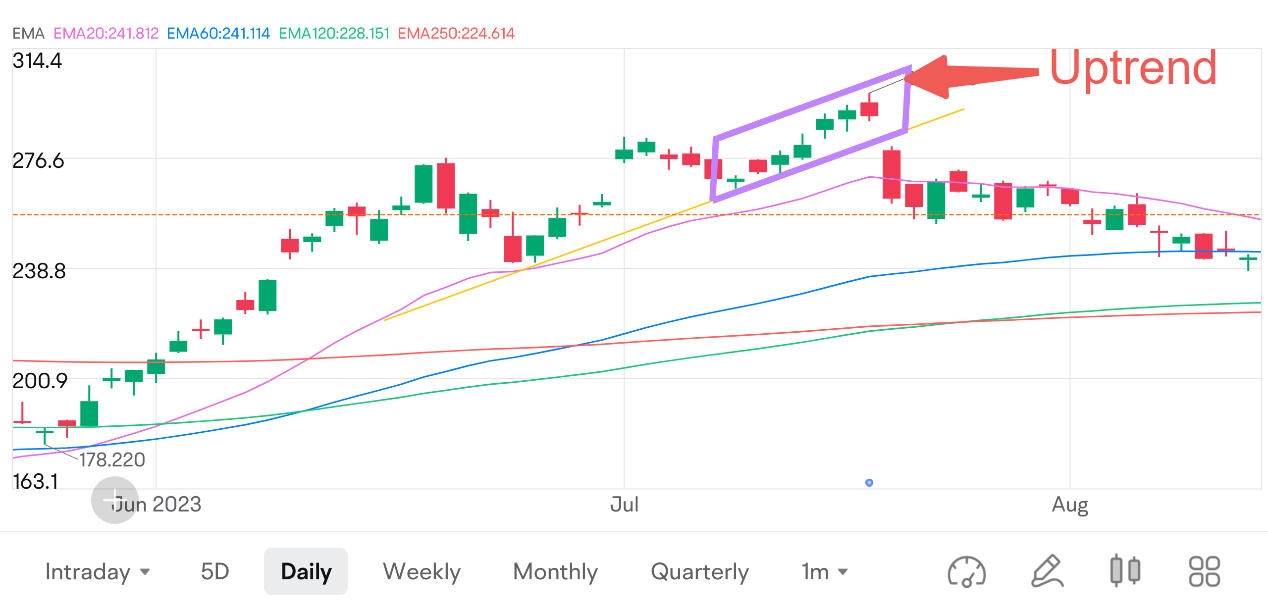

There are many methods available to determine the trend. An uptrend can be established using moving averages, peak/trough analysis, or trend lines. A security could be deemed in an uptrend based on one or more of the following:

1) The stock is trading above its 20-day exponential moving average (EMA).

2) Each reaction peak and trough is higher than the previous (higher highs and higher lows).

3) The stock is trading above a trend line.

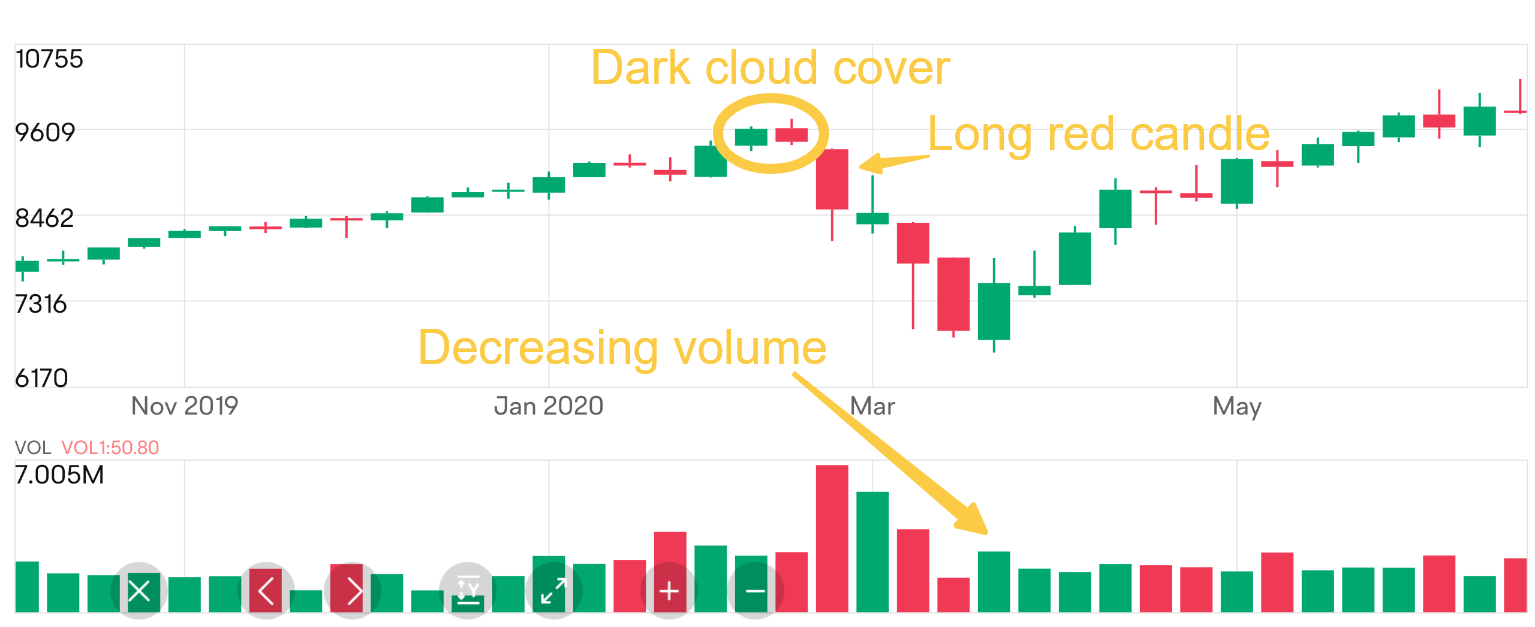

Confirm the bearish pattern

Bearish reversal patterns require bearish confirmation. Without confirmation, many of these patterns would be considered neutral and merely indicate a potential resistance level at best.

Bearish confirmation means further downside follow-through, such as a gap down, long red candlestick, or high volume decline.

You can employ a range of technical analysis tools to improve the robustness of bearish reversal patterns:

1) Lines: Determine if there is a bearish confirmation of price by drawing resistance levels and trend lines.

2) Momentum indicators: Use oscillators to confirm weakening momentum with bearish reversals, such as negative divergences in MACD, RSI, etc.

3) Money flows: Use volume-based indicators to assess selling pressure and confirm reversals.

Let's discuss

Which bearish candlestick pattern do you consider the most valuable in trading and why? Share your thoughts with other traders and seize the opportunity to win a $1 cash reward!

*Cash rewards represent the value of a potential credit to your brokerage account and can only be redeemed on the moomoo app and be used to buy equities (like stocks, ETFs, etc.).*The above rewards will be issued within 10 working days after the event ends. Eligibility for rewards will be determined by Moomoo Technologies Inc., at its sole discretion, on the quality, originality, and user engagement of the posts.

Disclaimer:

This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve.

This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Chris Ivan Ang : 3 black crows…

Meme_Short_Queen : confirmation is key, always enter on the right side

godzilla329 : just figuring out all the tools but definitely more confident than before!

NIOmoo : Bearish Engulfing Pattern. It usually indicates the uptrend is reaching the top. This selling signal is confirmed if accompanied with high volumes.

102964851 y : Falling below support

Jia Yung : In my opinion, analysis should just assist the decision, but there is no sure win in trading